Thread by Frank Rotman

- Tweet

- Mar 18, 2023

- #Finance #Banking #Investment

Thread

SVB’s biggest mistake was creating a balance sheet that wasn’t resilient in a rising rate environment.

Correctly calculating the Beta of their deposits would have led them to construct a short duration investment portfolio.

A primer on Deposit Beta and Deposit Stability:🧵👇

Correctly calculating the Beta of their deposits would have led them to construct a short duration investment portfolio.

A primer on Deposit Beta and Deposit Stability:🧵👇

What is Deposit Beta?

Deposit Beta measures the change in the cost of a Bank’s interest-bearing deposits relative to the change in the benchmark interest rate.

In layman’s terms, it calculates how sticky deposits are when rates rise.

What Banks strive for is low Beta.

Deposit Beta measures the change in the cost of a Bank’s interest-bearing deposits relative to the change in the benchmark interest rate.

In layman’s terms, it calculates how sticky deposits are when rates rise.

What Banks strive for is low Beta.

Many factors drive Deposit Beta:

👉Avg loan size and duration of relationship

👉The speed at which rates are rising

👉The price sensitivity and uniformity of the depositor base.

The lower the Beta of the depositor base, the less a Bank has to worry when rates rise.

👉Avg loan size and duration of relationship

👉The speed at which rates are rising

👉The price sensitivity and uniformity of the depositor base.

The lower the Beta of the depositor base, the less a Bank has to worry when rates rise.

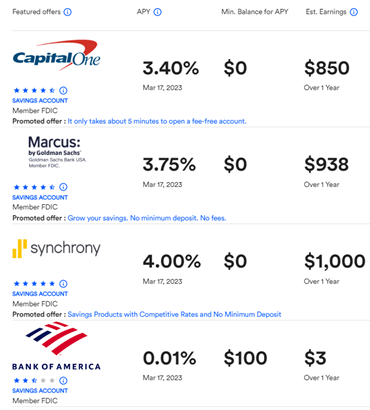

For instance, BofA has a very low Beta.

Their average customer has a low balance and been with them for a long time. They didn’t choose to bank with BofA based on their rates. They likely have a number of bills on autopay and the majority of their customers use online bill pay.

Their average customer has a low balance and been with them for a long time. They didn’t choose to bank with BofA based on their rates. They likely have a number of bills on autopay and the majority of their customers use online bill pay.

So it shouldn’t surprise you that BofA has just over $1 Trillion in deposits and was able to grow their deposit base throughout 2022 without increasing their interest rate.

They report a blended interest rate of 0.06% and aren’t using price to attract new depositors.

They report a blended interest rate of 0.06% and aren’t using price to attract new depositors.

All the big banks have low beta. It’s a competitive advantage in their business models. They can offer great rates on loans because they can count on their depositors to stick around. Their source of funds is sticky and isn’t rate sensitive.

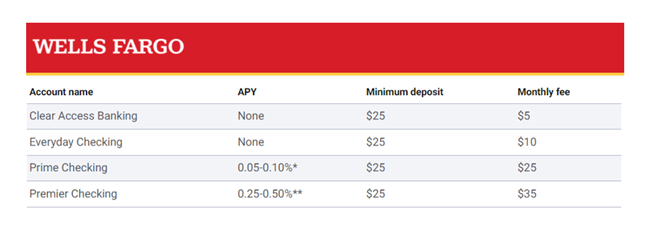

But SVB’s beta is much higher than that of a money center bank. The majority of their customers are venture backed startups. Many of these startups have a CFO whose job it is to actively manage cash. Seeking safe yield is one of their responsibilities.

SVB does their best to lock in their customers with ancillary products and services that their customers can’t get elsewhere (like Venture Debt), but many of their customers have the ability to move money off SVB’s balance sheet to seek safe yield.

Deposit Stability

Another critical characteristic of a Bank’s deposit base is the stability of their deposits.

Not all depositors will hold very predictable balances. Some depositors will maintain or slowly grow their balances while others will systematically shrink.

Another critical characteristic of a Bank’s deposit base is the stability of their deposits.

Not all depositors will hold very predictable balances. Some depositors will maintain or slowly grow their balances while others will systematically shrink.

As an example, a W2 worker has stable income with regular bills and expenses that draw down their balances. Twice a month they get paid and this money tops up their deposit balance. The average deposit amount over time is stable and predictable and grows as wages rise.

This is where SVB’s customer base was problematic.

They mostly banked money losing businesses which definitionally meant that their deposit balances were shrinking as their customers burned through cash.

Balances would go down until another round of capital was raised.

They mostly banked money losing businesses which definitionally meant that their deposit balances were shrinking as their customers burned through cash.

Balances would go down until another round of capital was raised.

Making matter worse, the ability for these startups to raise capital in a rising rate environment is challenging. LPs allocate less money to VCs and VCs in turn tighten their purse strings in investing in startups. Fewer startups survive and money is raised less frequently.

The combination of SVB’s high deposit beta and low deposit stability should have driven them to a strategy that only invested in highly liquid, incredibly safe, short-duration assets.

But this wasn’t the strategy they took. They bought long duration MBSs to chase yield.

But this wasn’t the strategy they took. They bought long duration MBSs to chase yield.

The TL;DR is that every Bank has to align its maturity transformation strategy with the underlying characteristics of their deposits.

The lower the beta and the higher the stability the more a Bank can invest in longer duration activities.

And SVB got this wrong.

The lower the beta and the higher the stability the more a Bank can invest in longer duration activities.

And SVB got this wrong.

Mentions

See All

Chris Hladczuk @chrishlad

·

Mar 19, 2023

very interesting thread