Thread by Julien Bittel, CFA

- Tweet

- Mar 17, 2023

- #CentralBank #Finance #Economics

Thread

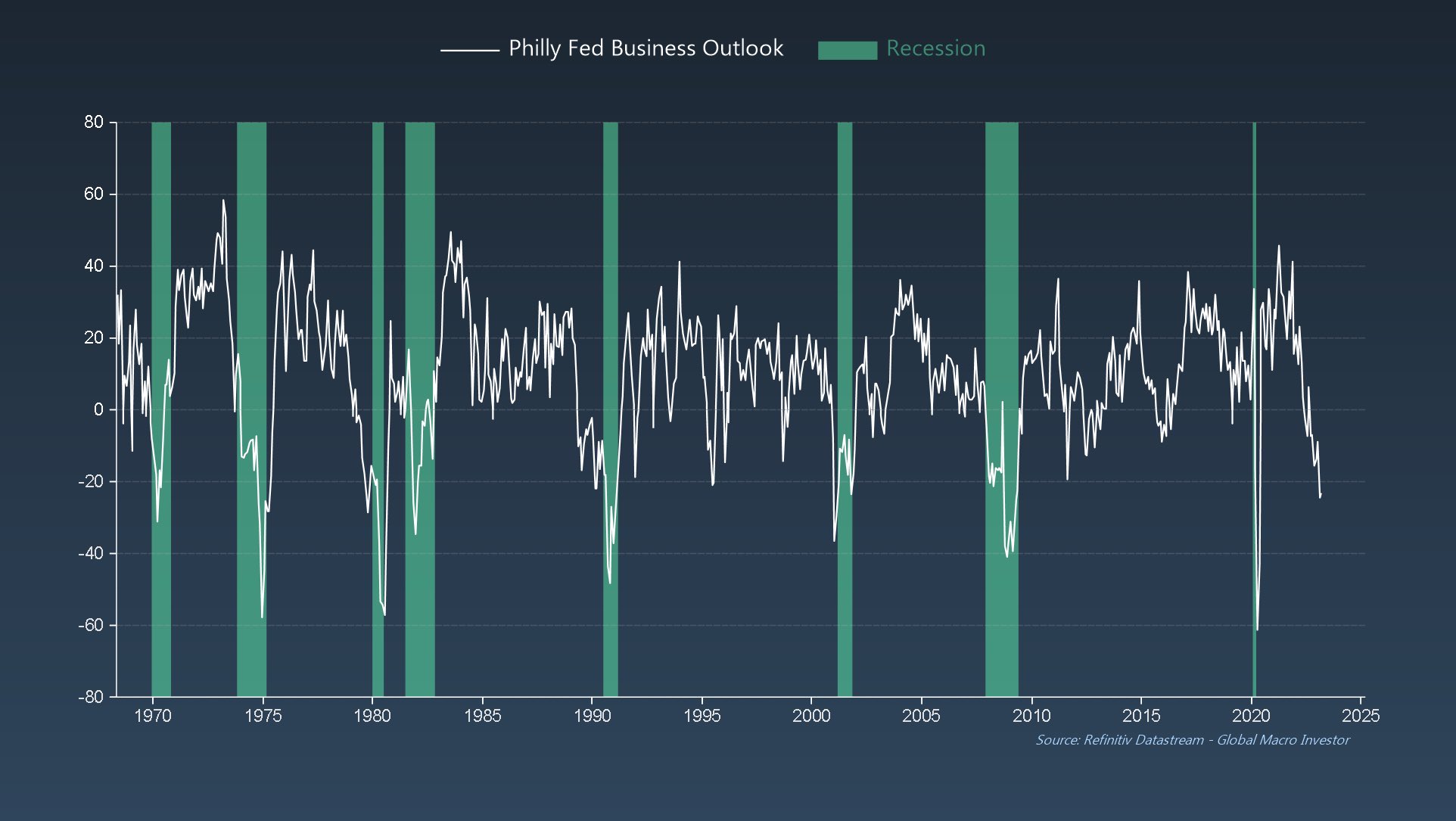

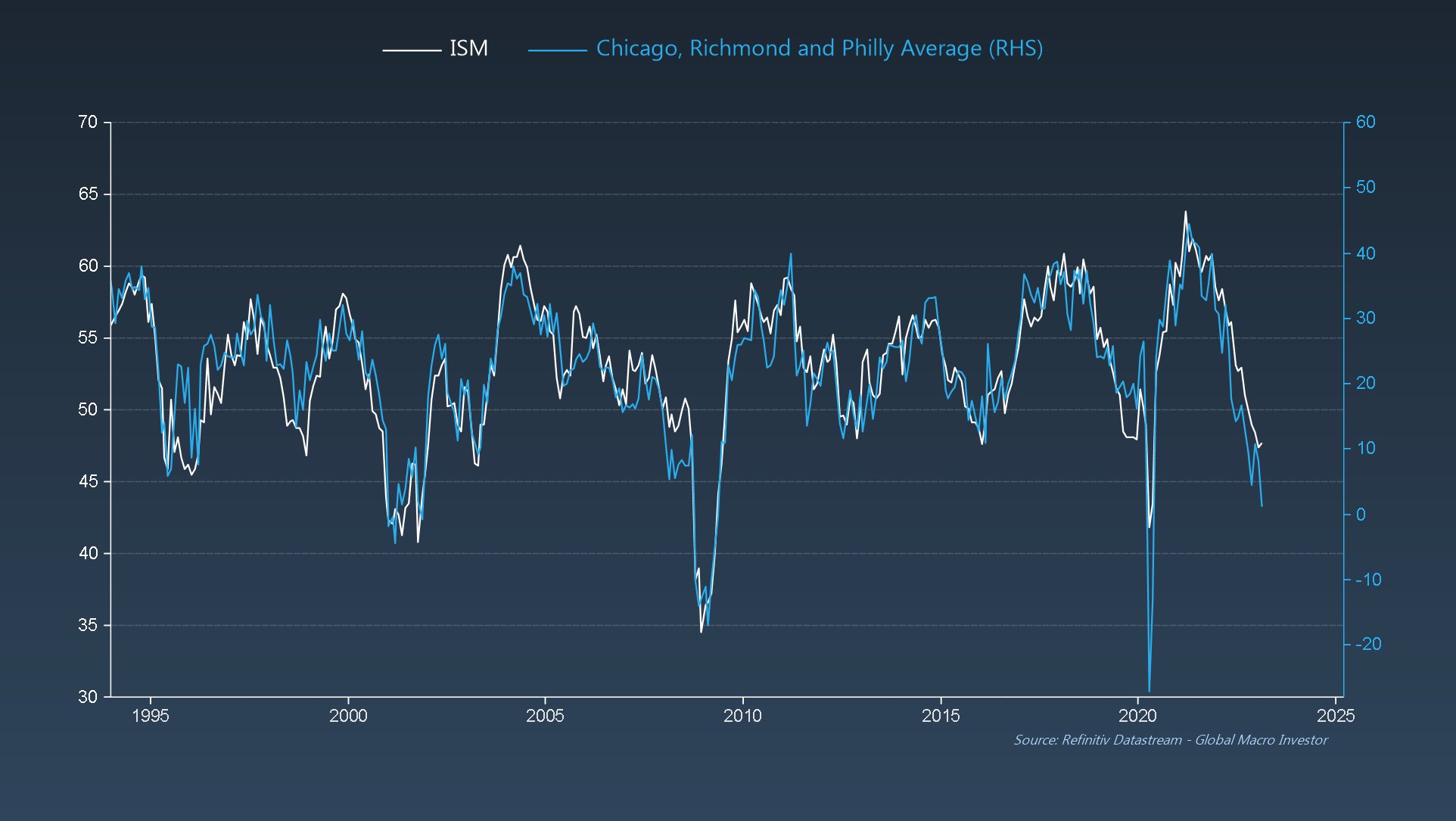

Bears really coming out of the woodwork on March Philly Fed data…

I think it’s the wrong take.

A lot of people are using the 1970s as the period most similar to today…

Some are using 2000 or 2008…

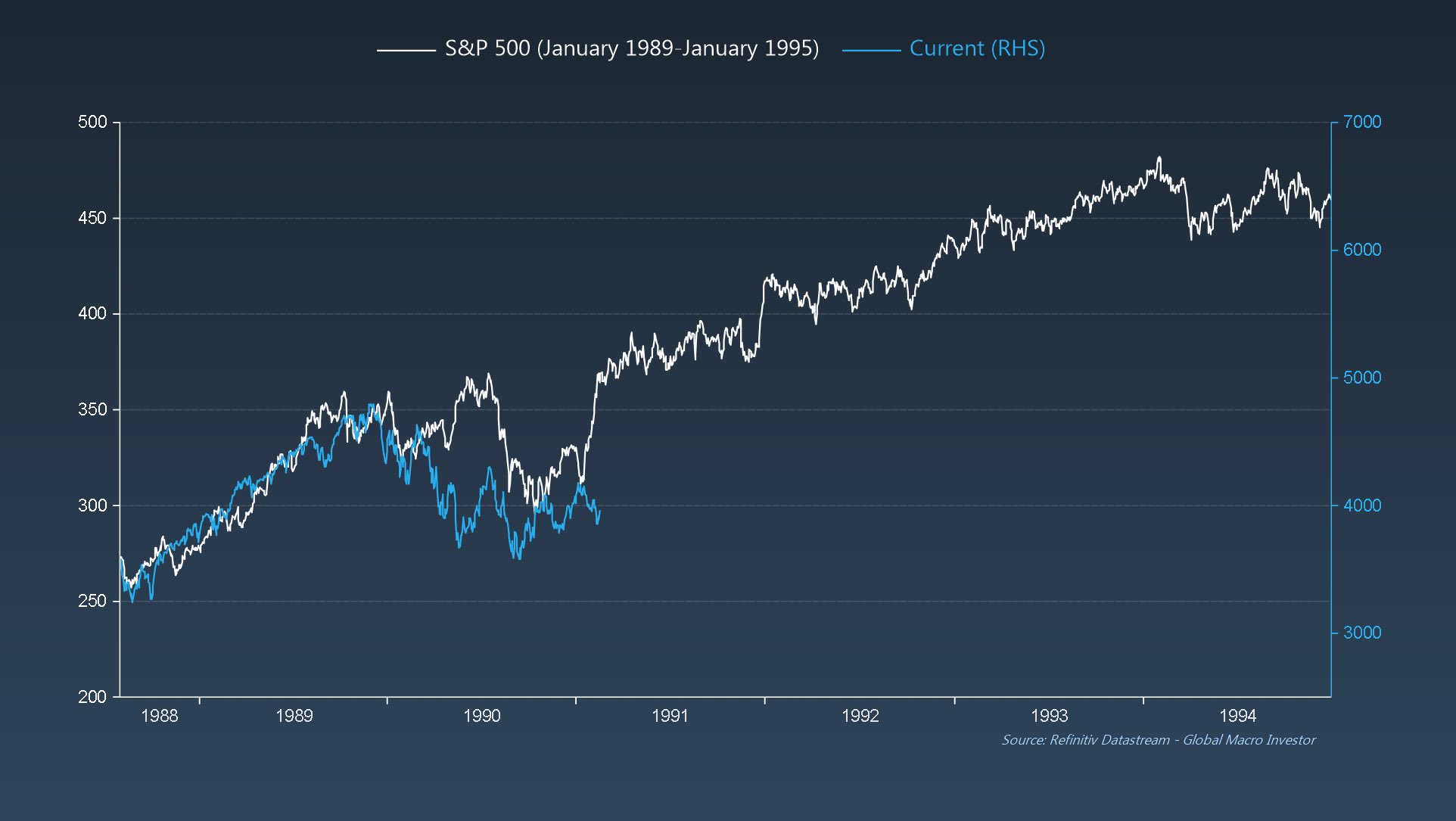

We’re using 1990.

It’s a near perfect fit. Let me show you…

A thread 🧵

I think it’s the wrong take.

A lot of people are using the 1970s as the period most similar to today…

Some are using 2000 or 2008…

We’re using 1990.

It’s a near perfect fit. Let me show you…

A thread 🧵

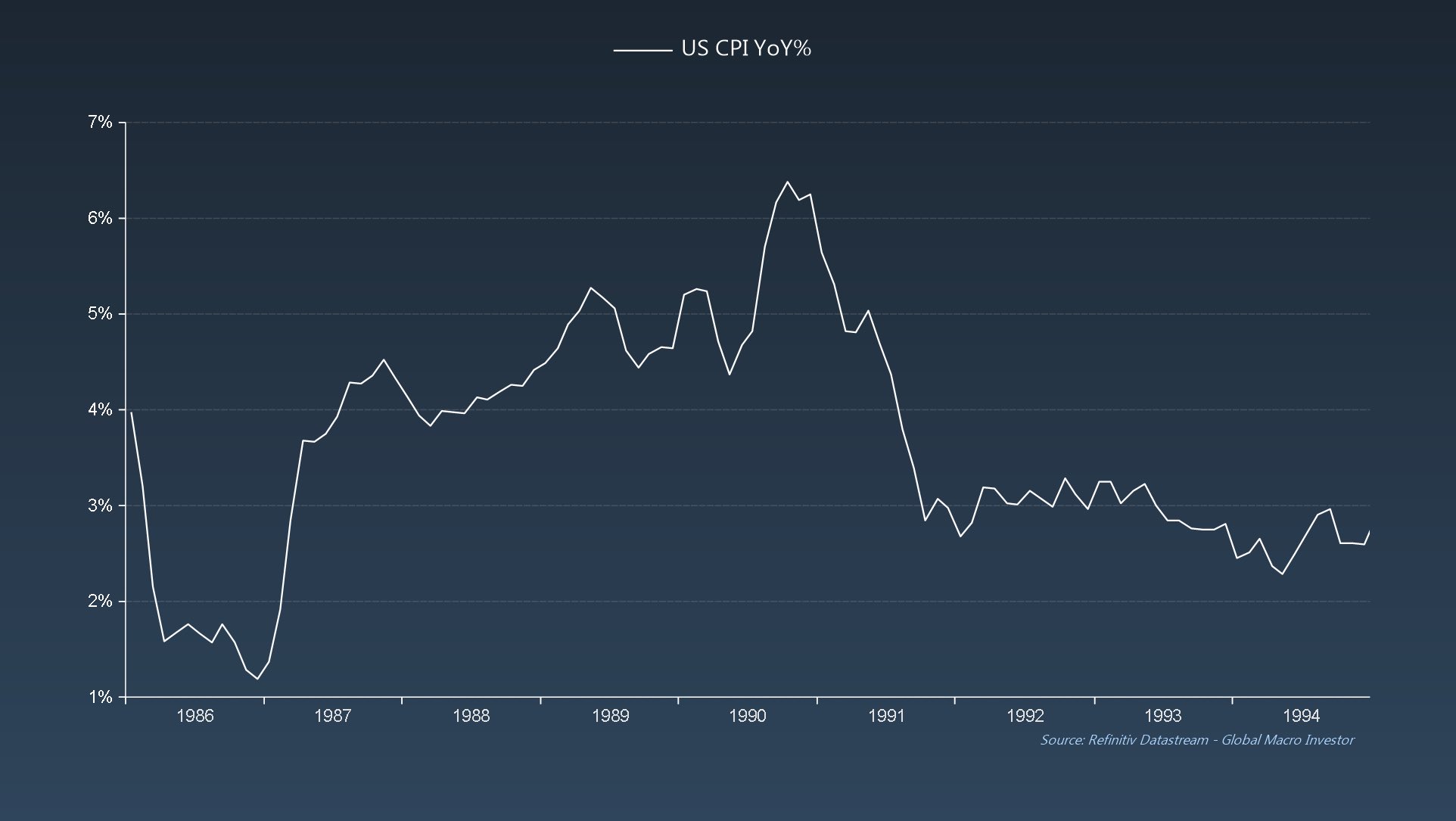

Back in 1990, CPI rose to 6.4% year-on-year (near ten year highs at the time), igniting fears that the 1970s were returning with a vengeance…

Sound familiar?

Sound familiar?

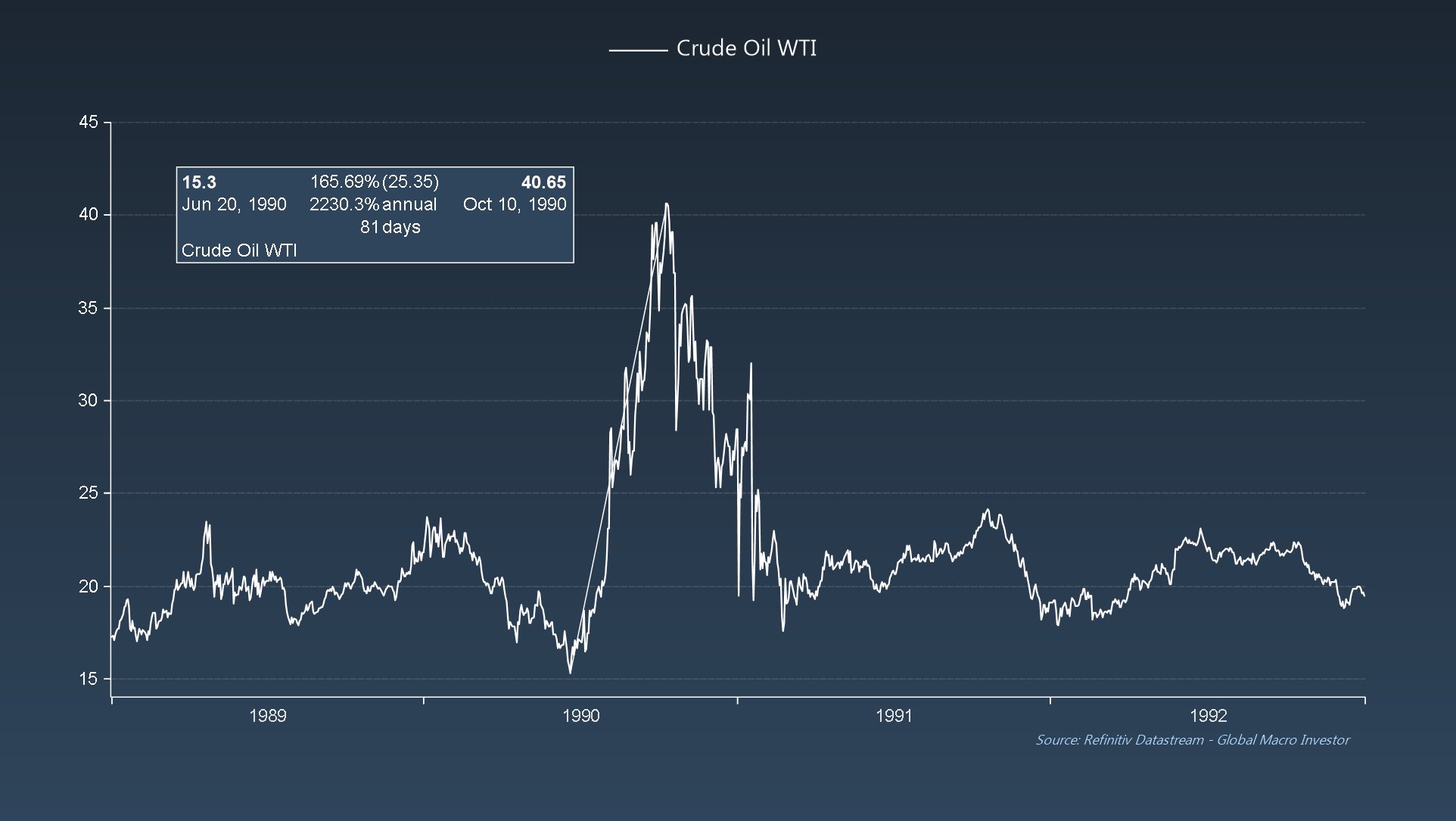

This was driven by a massive 166% spike in oil prices in response to the invasion of Kuwait by Iraq, with the subsequent embargo by the UN of Iraqi oil knocking out two of the world’s largest oil producers.

This resulted in a worldwide energy crisis…

This resulted in a worldwide energy crisis…

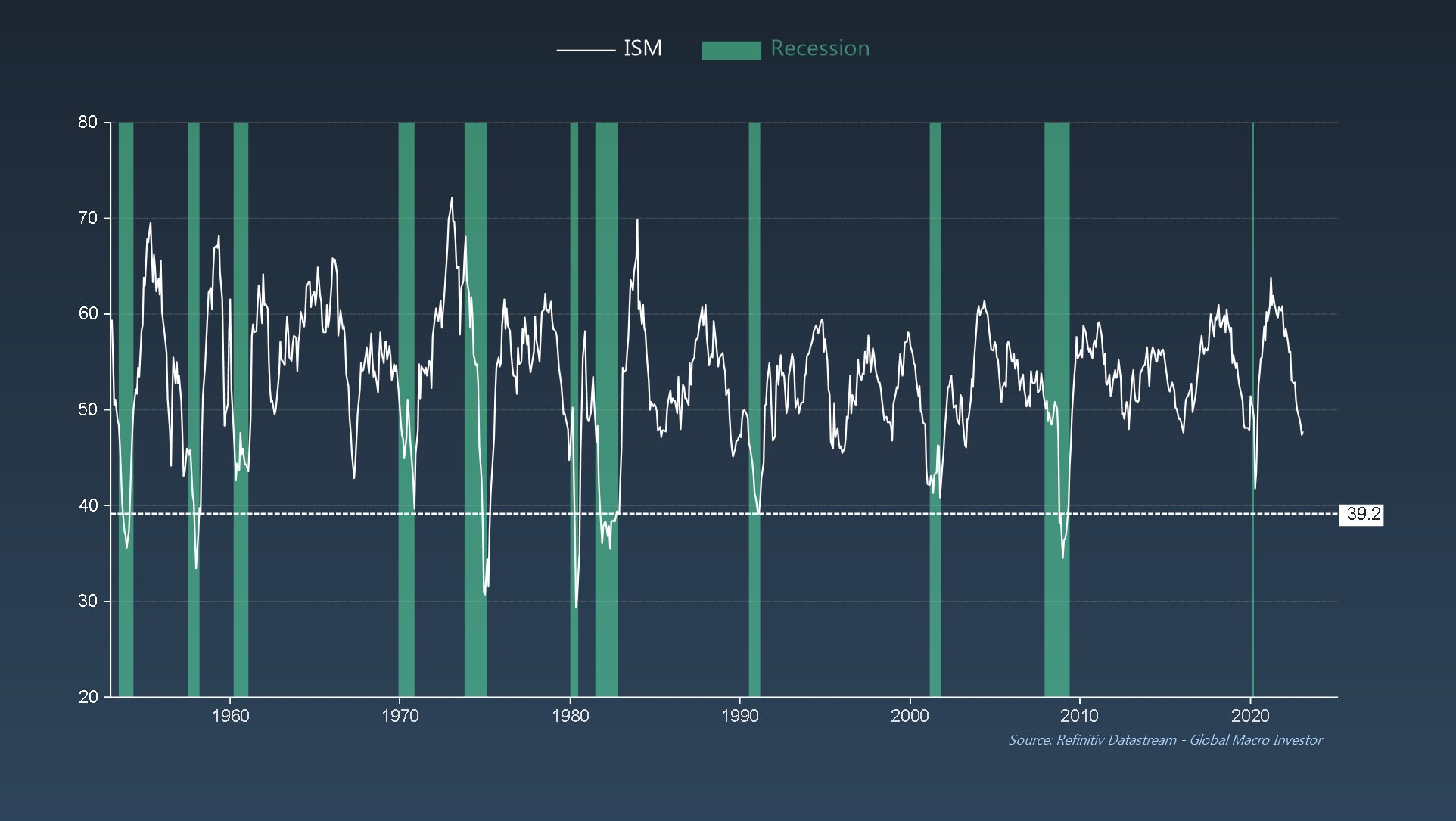

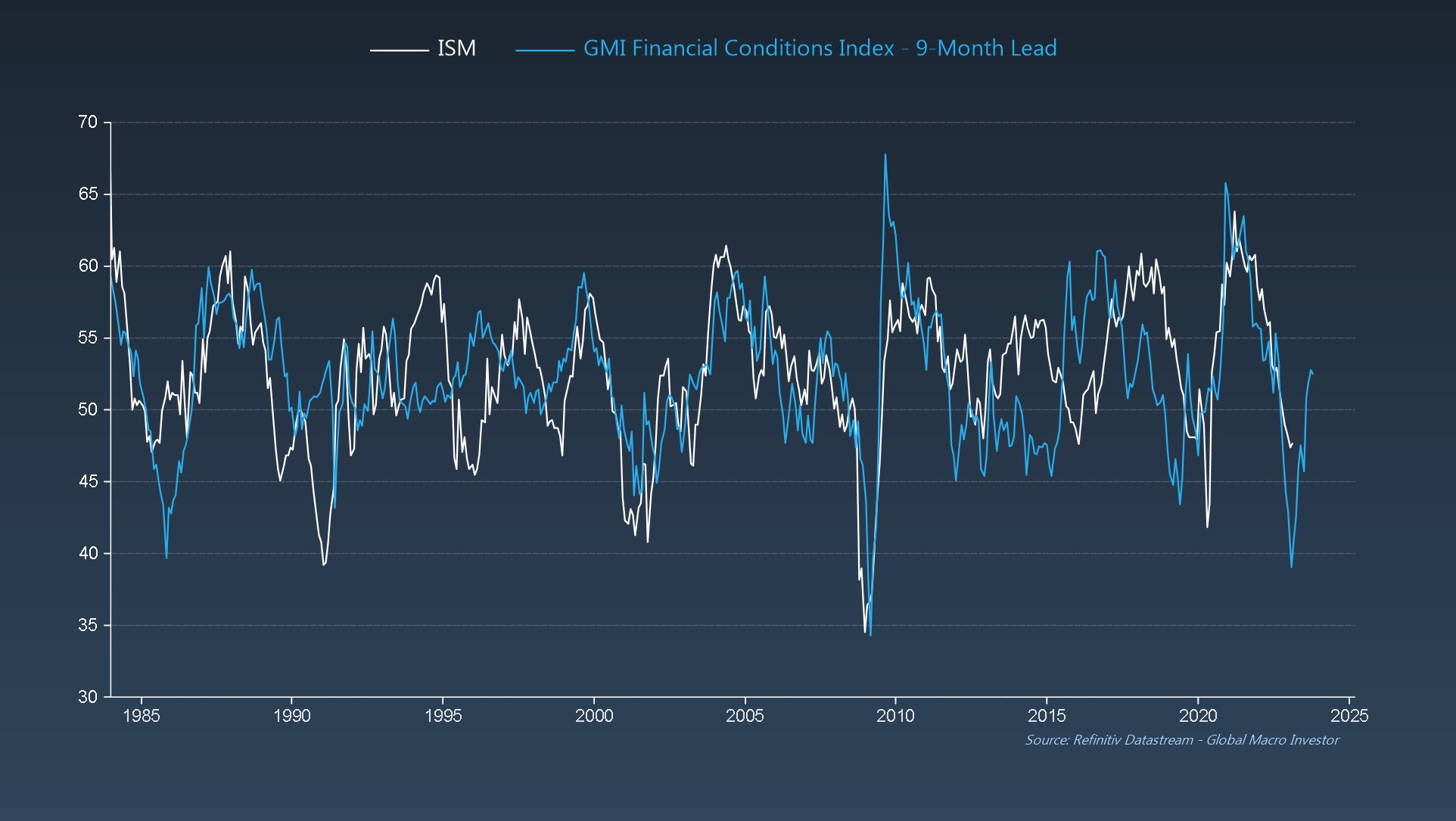

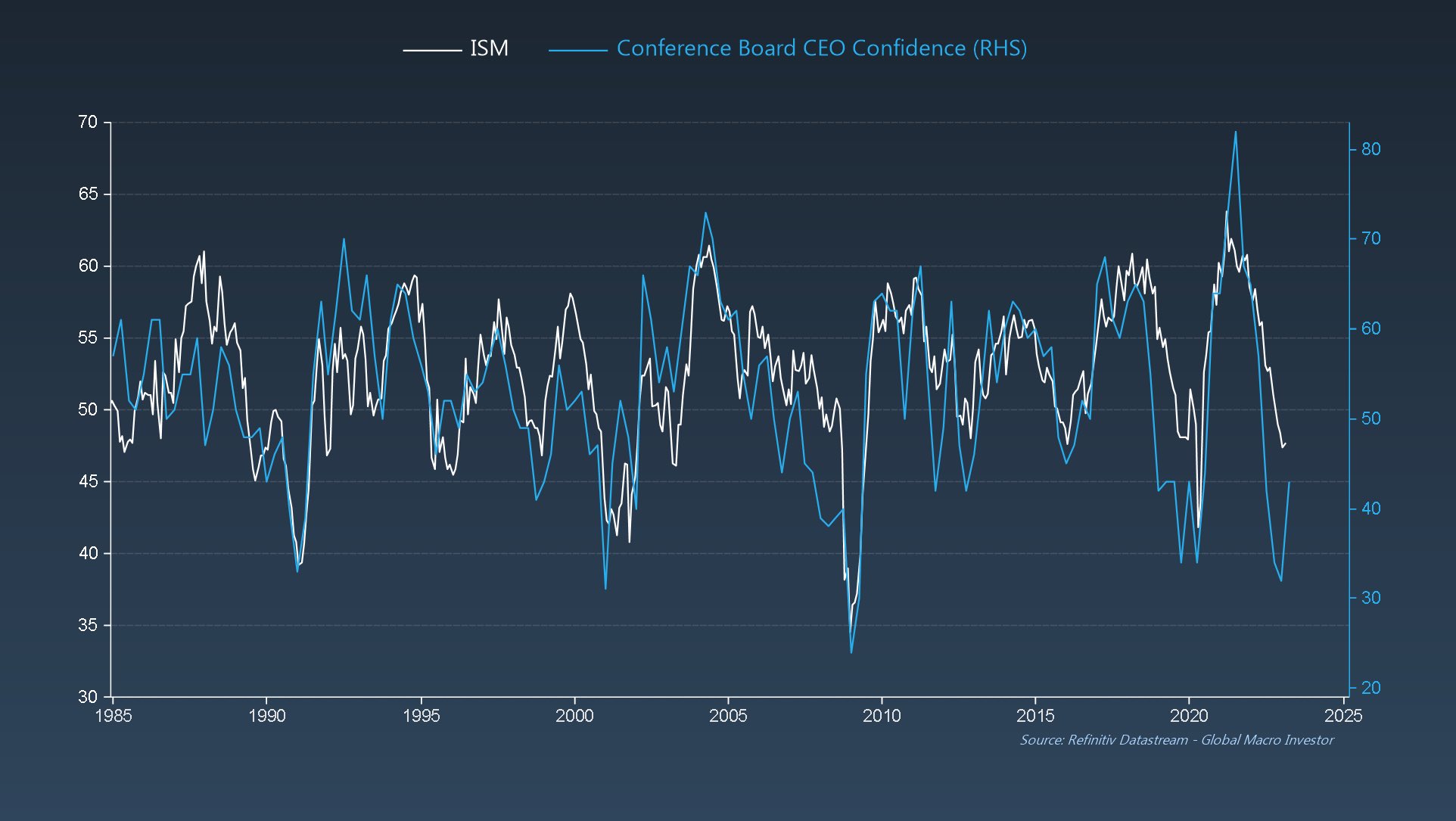

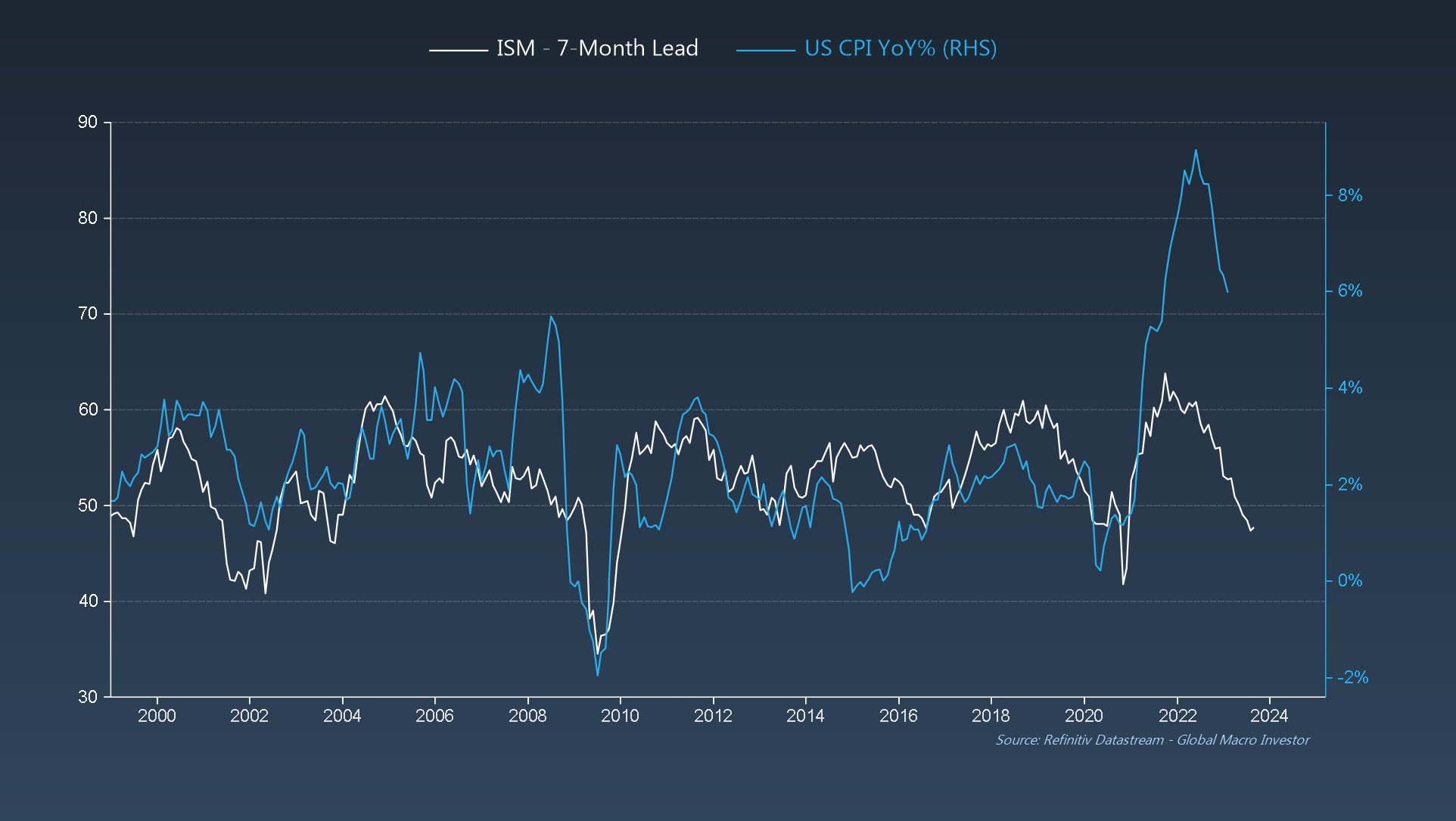

The Fed hiked rates from 5.75% to 10% to slay the inflation dragon which triggered a growth collapse and the ISM fell to 39.2 - 100% recession territory going back to the early 1950s…

Though, what’s important here is to be forward looking.

Our GMI Financial Conditions Index continues to suggest that the lows for ISM are now in sight…

Our GMI Financial Conditions Index continues to suggest that the lows for ISM are now in sight…

Sure, the ISM can still take a final dip lower based on recent Chicago, Philly and Richmond PMI data, say down to around 40…

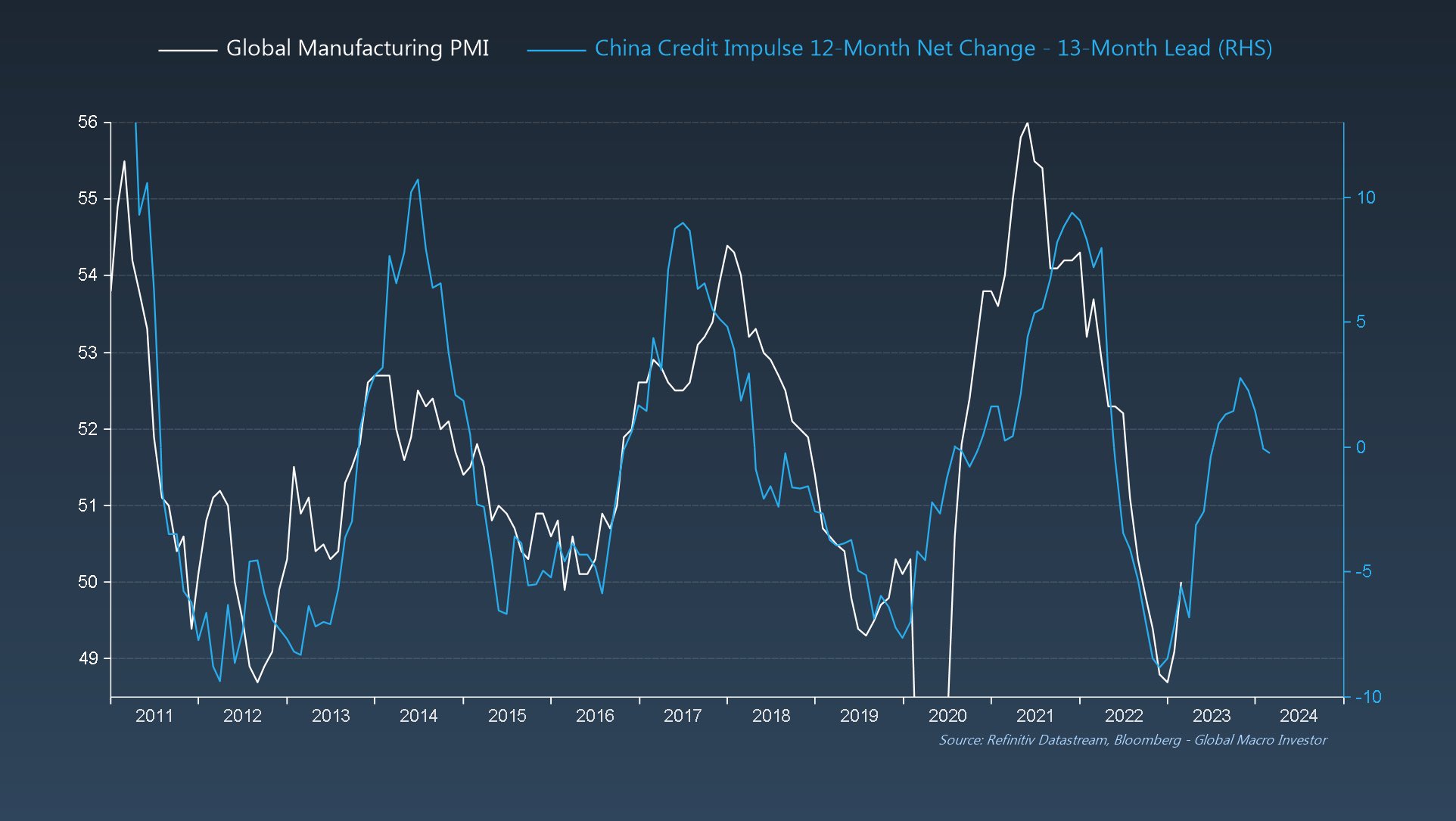

Additionally, similar to previous boom/bust cycles since 2008, China is driving the global growth cycle higher…

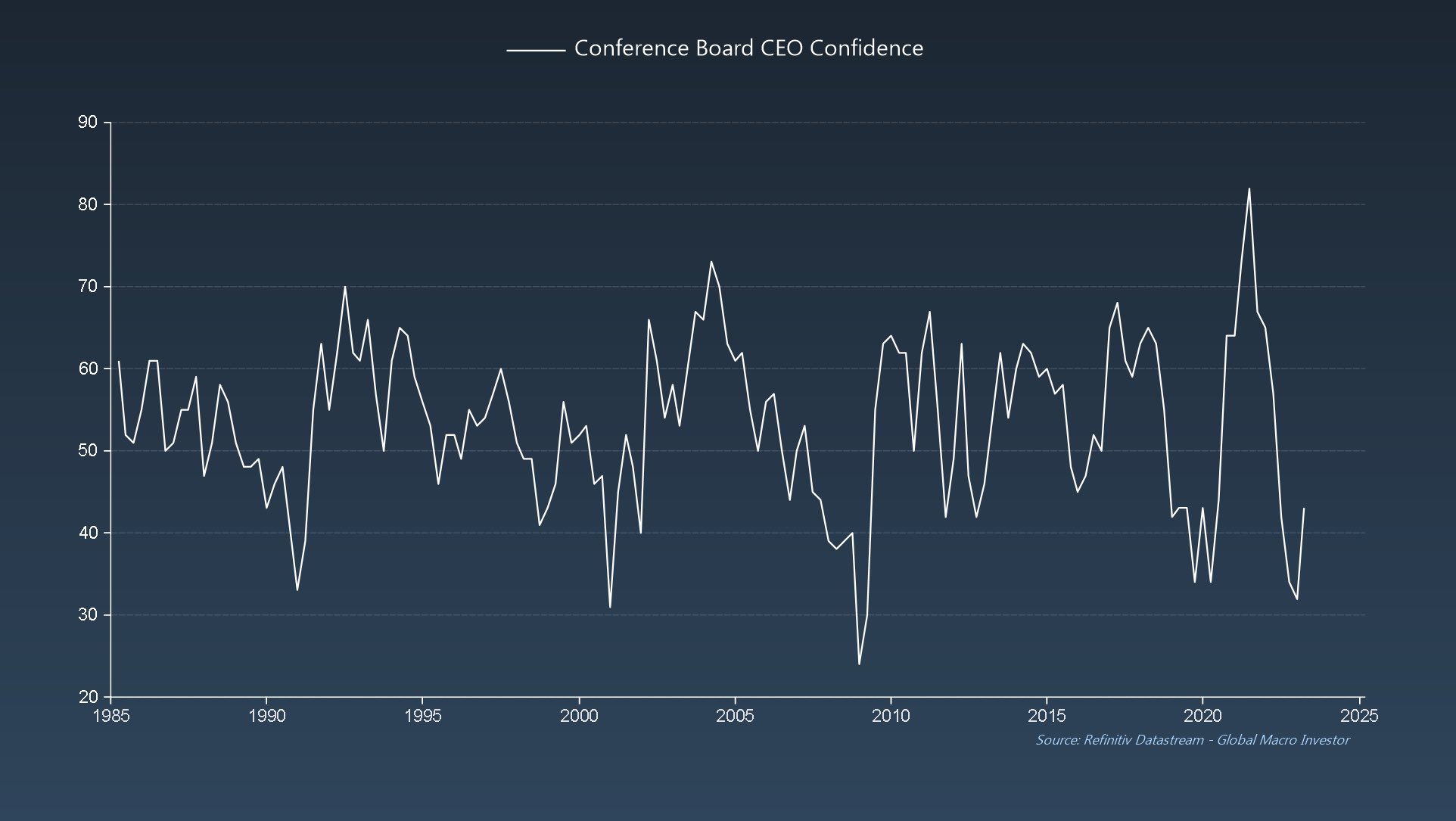

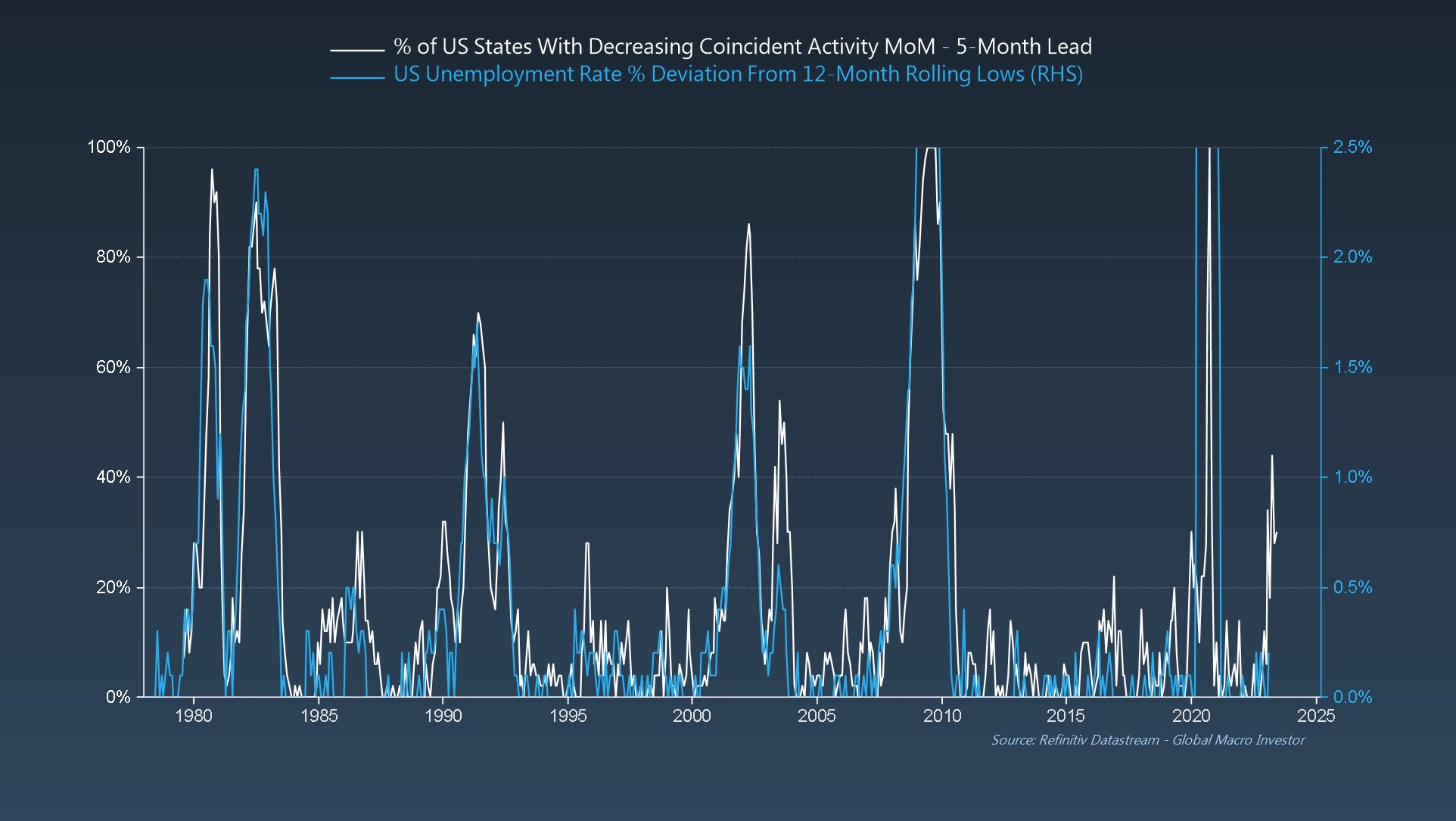

But, just like during the 1990 recession, the Fed will respond by cutting rates again, aggressively…

Remember, the Fed is not focused on lead indicators…

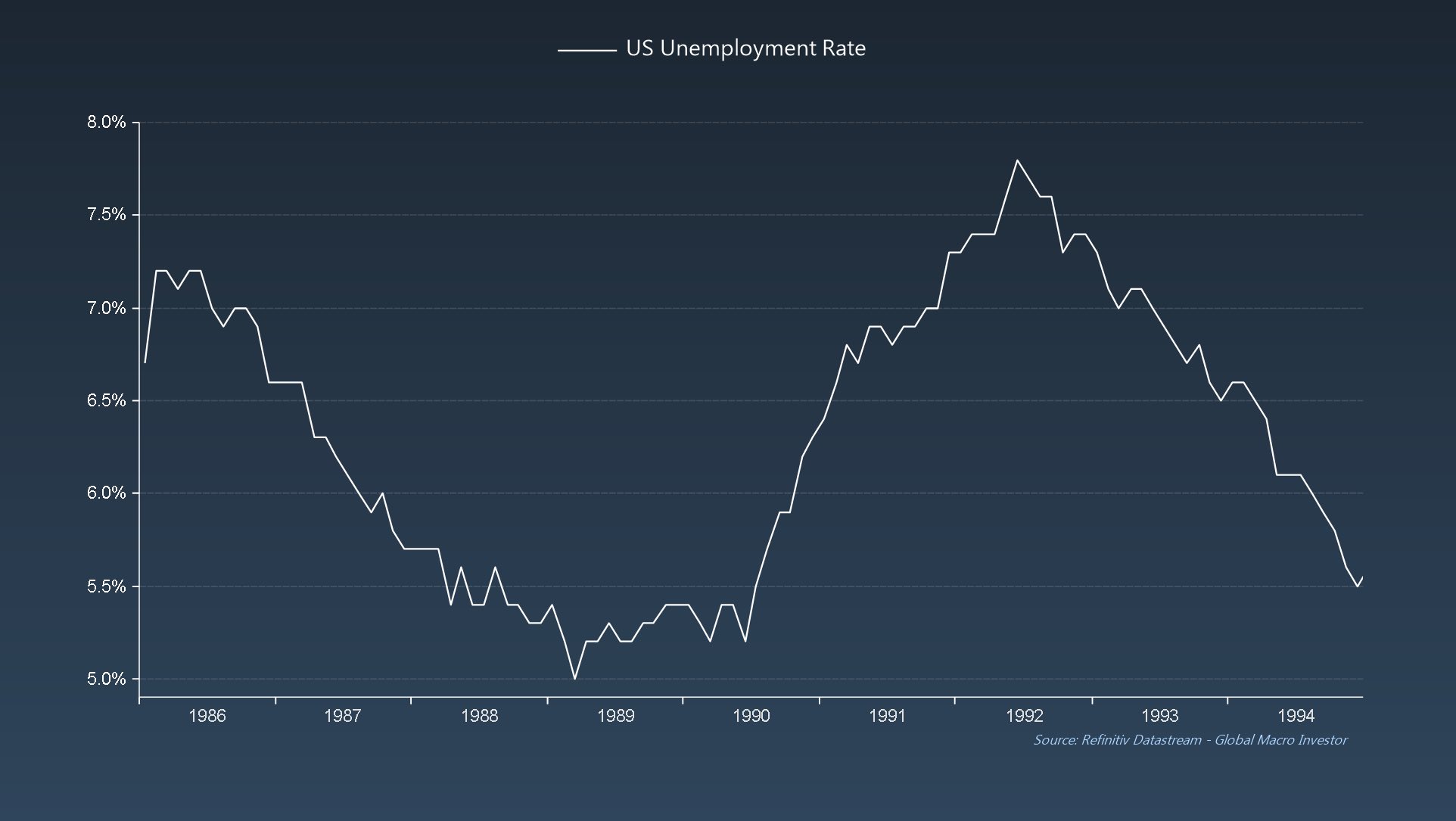

They’re focused on their mandate: employment and inflation, both of which are extremely lagging…

Remember, the Fed is not focused on lead indicators…

They’re focused on their mandate: employment and inflation, both of which are extremely lagging…

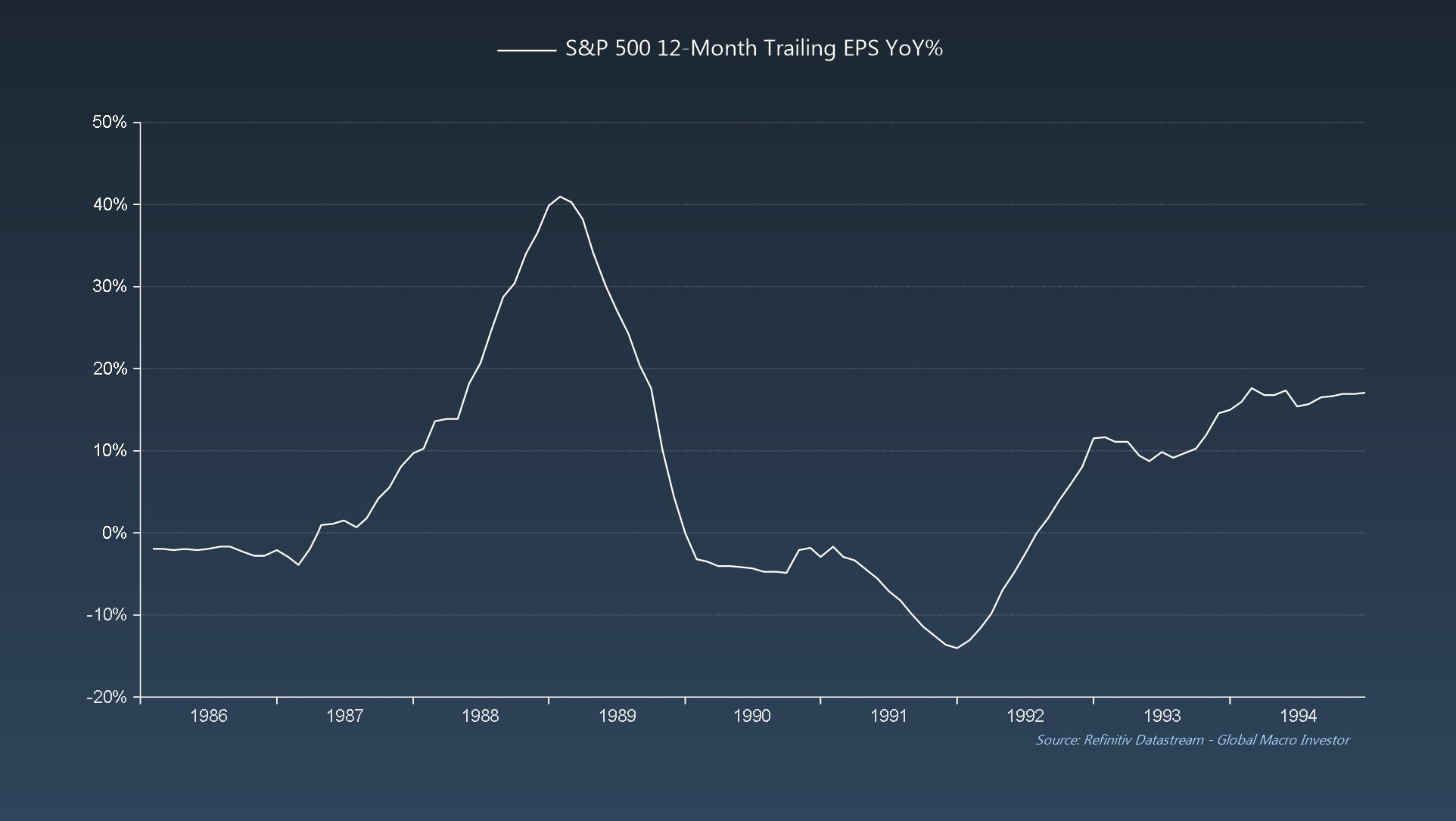

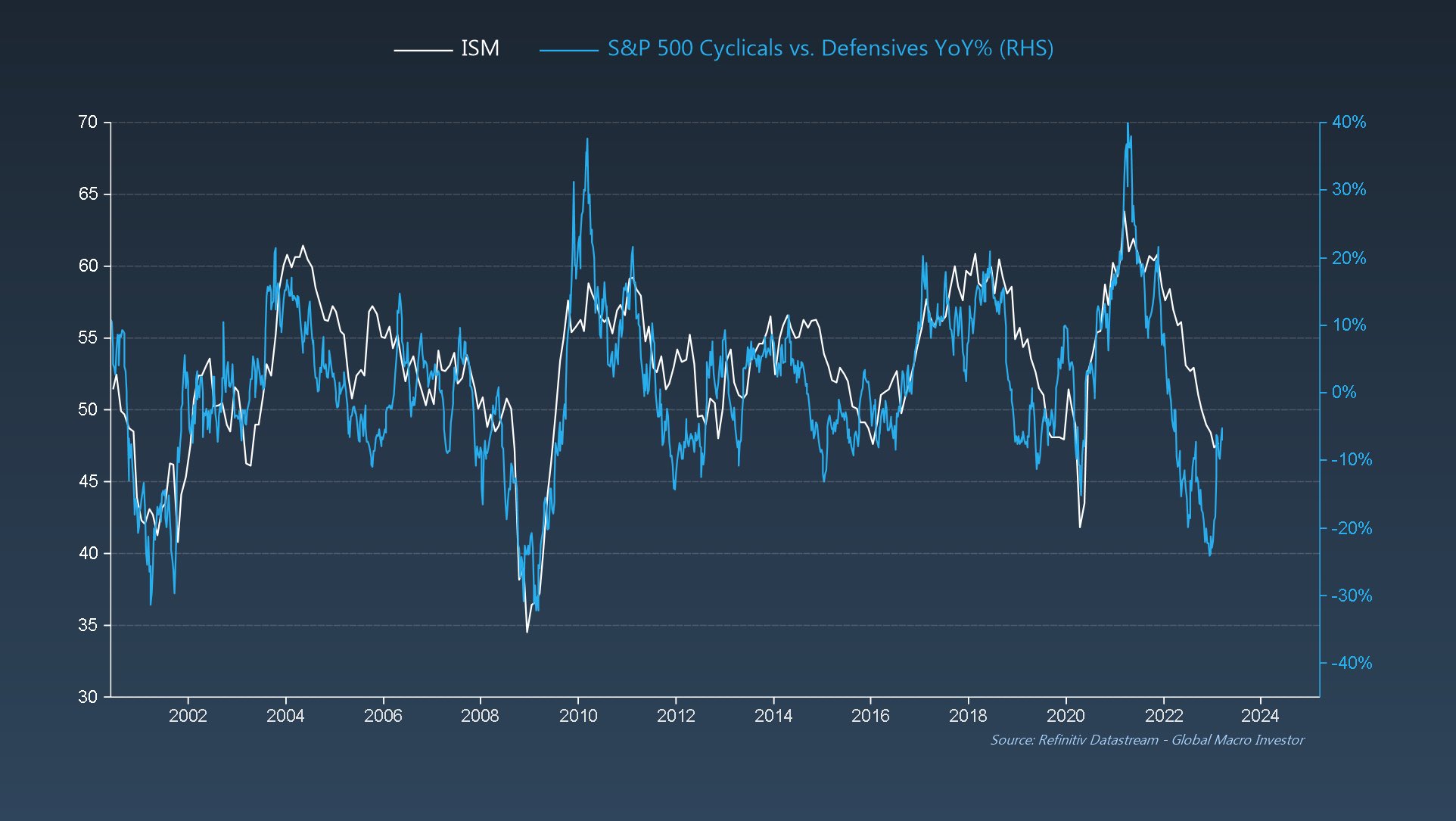

To conclude, today looks a lot like the 1990 recession:

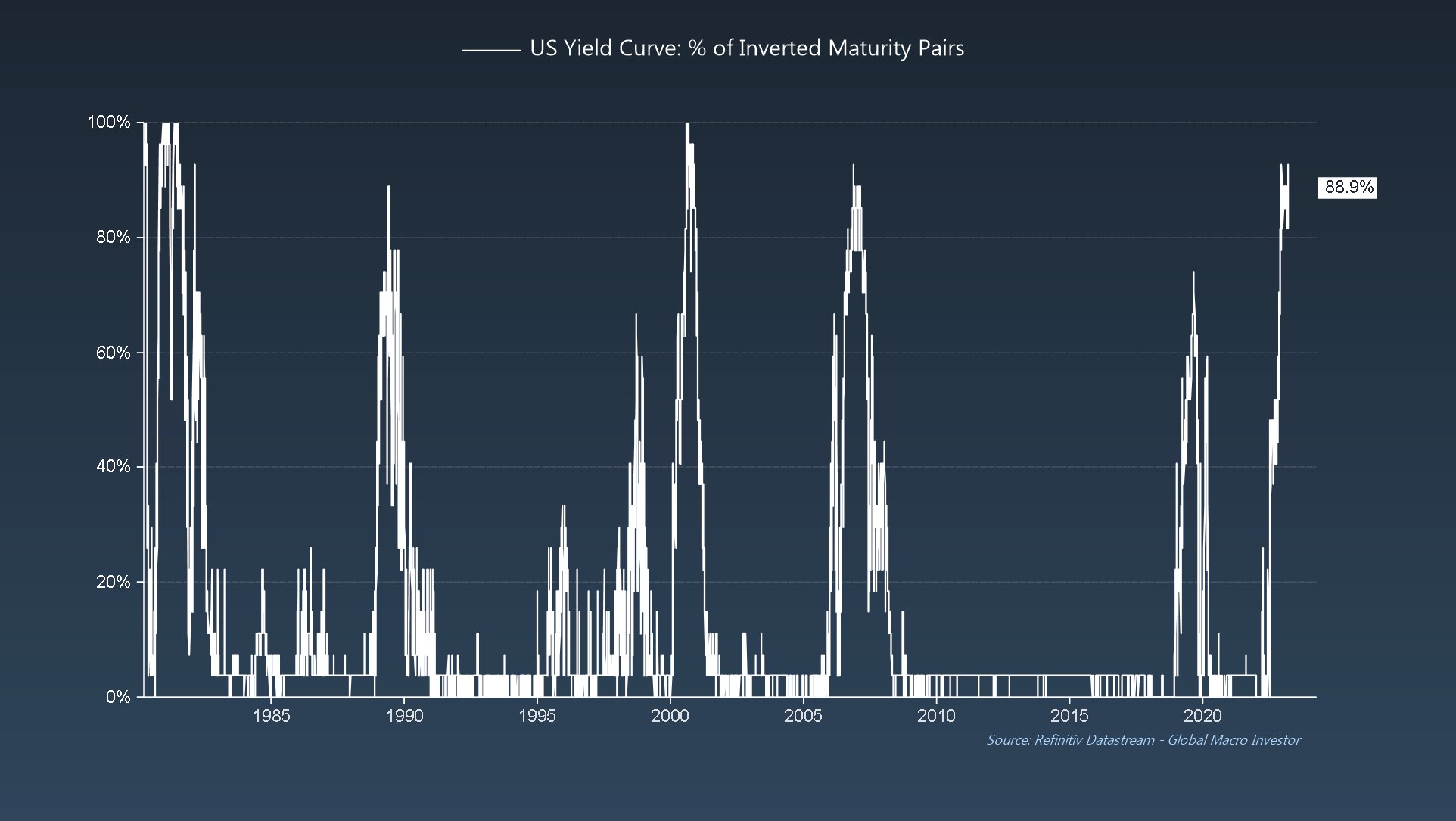

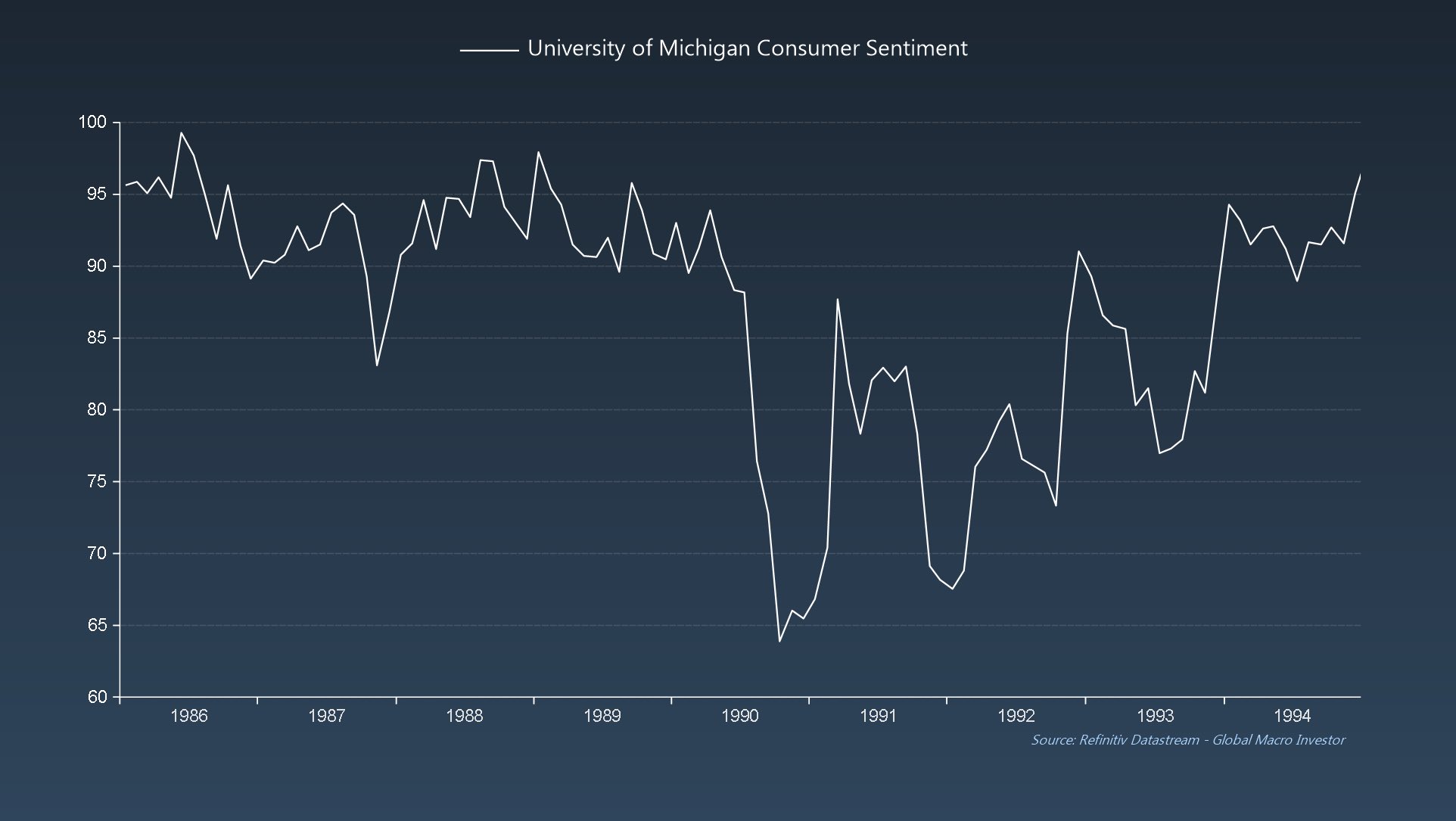

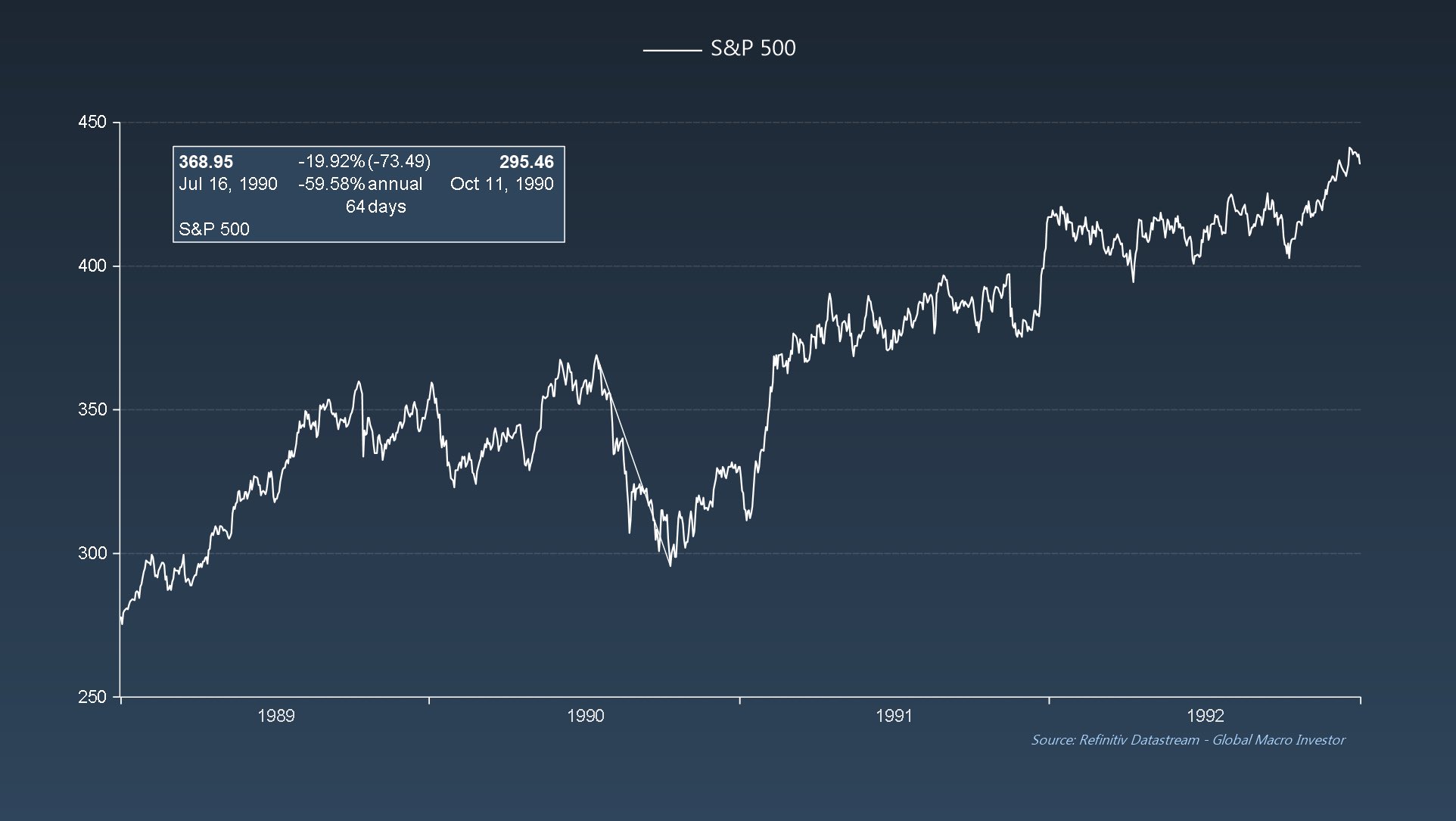

War, a massive spike in commodity prices, hot inflation, Fed hiking, inverted yield curve, growth collapse, rising unemployment, extreme bearish sentiment and a ~20% drop in SPX.

It’s also a pretty good fit contextually…

War, a massive spike in commodity prices, hot inflation, Fed hiking, inverted yield curve, growth collapse, rising unemployment, extreme bearish sentiment and a ~20% drop in SPX.

It’s also a pretty good fit contextually…

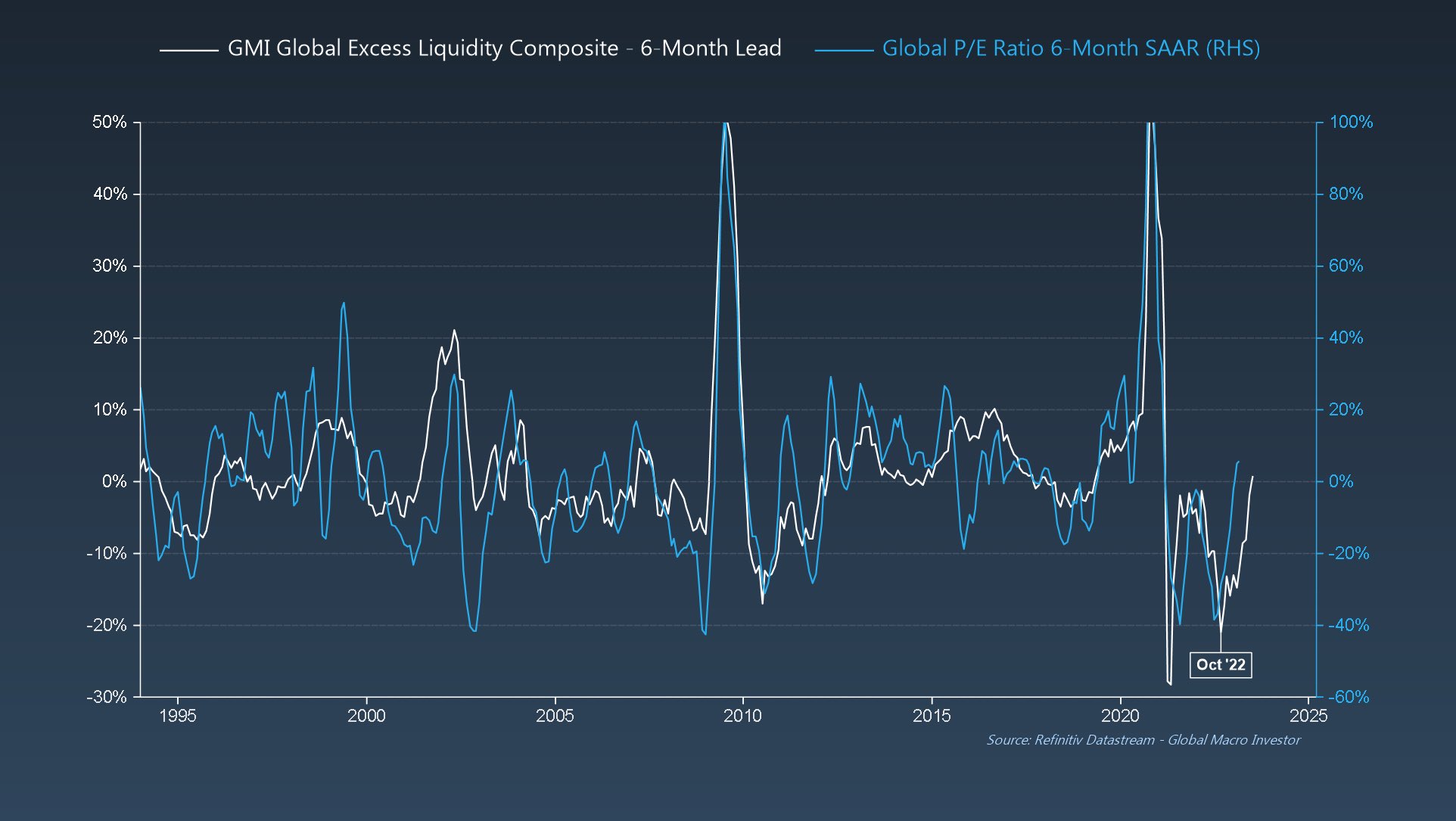

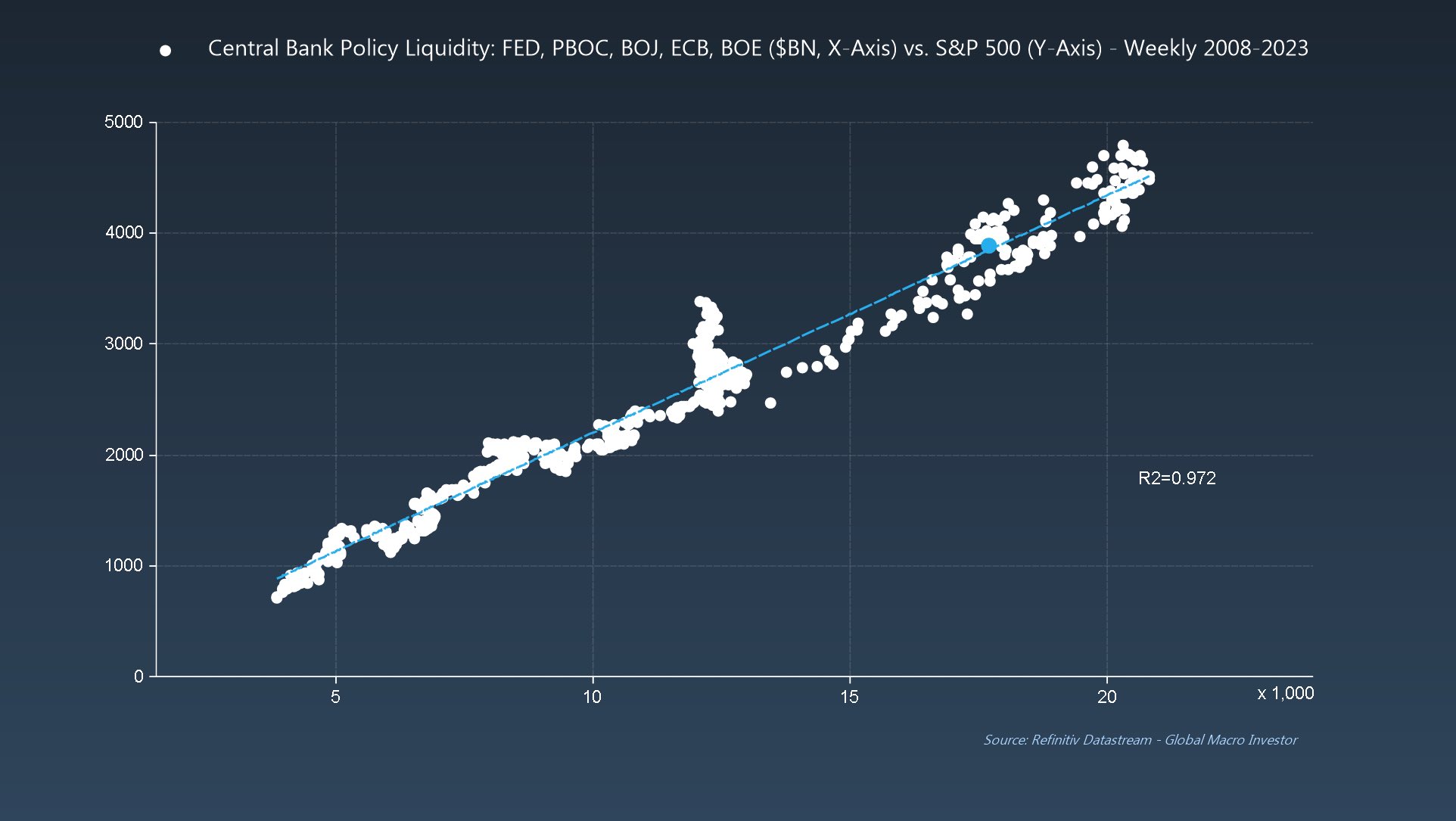

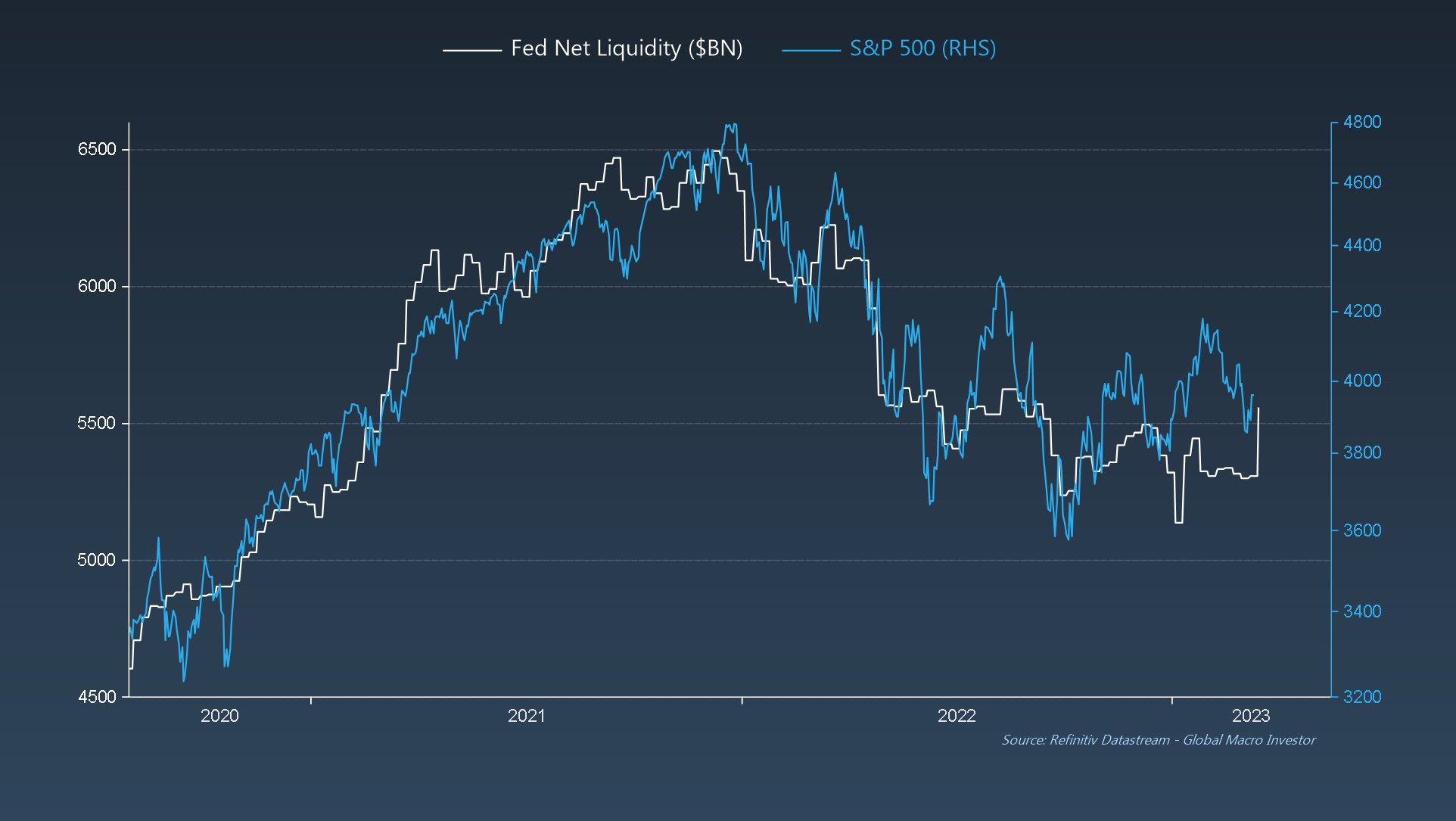

What’s been driving our more bullish take on equities since October is that we had been seeing liquidity turning higher and this has been a key driver behind the equity re-rating story so far this year…

Liquidity is extremely important for equities which are back to trading at fair value versus global liquidity conditions.

Prior to the sell-off, we had been trading at around an 8% premium but the gap has now closed…

Prior to the sell-off, we had been trading at around an 8% premium but the gap has now closed…