Thread by Genevieve Roch-Decter, CFA

- Tweet

- Mar 9, 2023

- #Finance #CentralBank #Investment

Thread

Silicon Valley Bank $SIVB is in trouble.

It sold off a $21 billion bond portfolio for a huge loss to shore up liquidity.

The market is worried and the stock is down 54% today.

Here’s what you should know 🧵

It sold off a $21 billion bond portfolio for a huge loss to shore up liquidity.

The market is worried and the stock is down 54% today.

Here’s what you should know 🧵

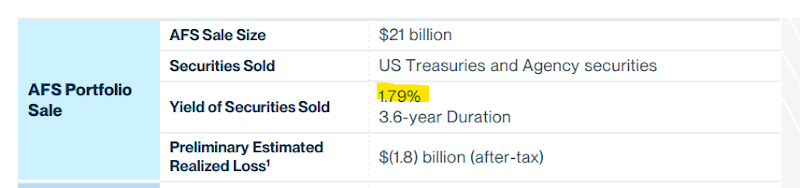

Silicon Valley Bank announced that it completed a firesale of its $21 billion AFS bond portfolio.

The bank took a massive $1.8 billion loss on the sale.

That’s more than the net income of the entire company in 2021 ($1.5 billion).

(AFS = Available-for-sale)

The bank took a massive $1.8 billion loss on the sale.

That’s more than the net income of the entire company in 2021 ($1.5 billion).

(AFS = Available-for-sale)

Now SVB is planning to sell $2.3 billion in shares to cover the bond losses.

The stock crashed 54% today, for many reasons.

Mainly, SVB is scrambling to shore up liquidity.

That’s worrisome.

And selling shares to potentially cover losses on investments is a huge red flag.

The stock crashed 54% today, for many reasons.

Mainly, SVB is scrambling to shore up liquidity.

That’s worrisome.

And selling shares to potentially cover losses on investments is a huge red flag.

It’s been a huge week in banking.

Just yesterday we heard that crypto bank Silvergate will wind down operations, due to many of the same issues SVB is facing, which I’ll get to.

Just yesterday we heard that crypto bank Silvergate will wind down operations, due to many of the same issues SVB is facing, which I’ll get to.

How is SVB’s liquidity?

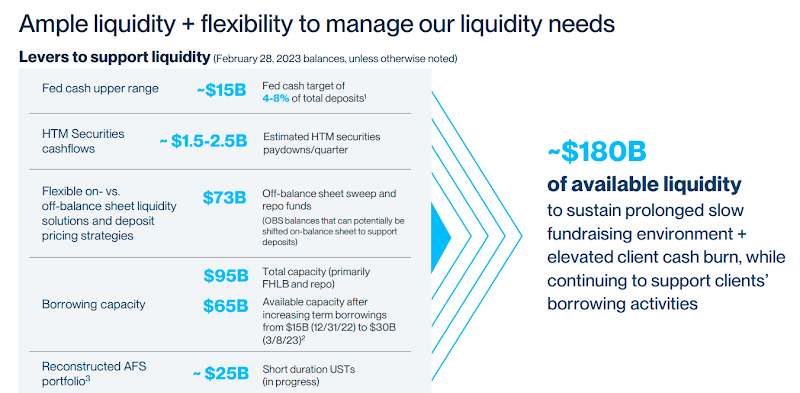

According to the company, they have $180 billion in available liquidity to cover $169 billion in deposits.

According to the company, they have $180 billion in available liquidity to cover $169 billion in deposits.

Dilution is another reason the stock is tanking. $2.3 billion in new shares would be about one-third of the company at today’s market cap.

The stock was already down 47% year-over-year before today’s sell-off.

The stock was already down 47% year-over-year before today’s sell-off.

Why is Silicon Valley Bank selling off bonds at huge losses?

The bank is facing 2 huge problems:

The first is interest rates.

The bank is facing 2 huge problems:

The first is interest rates.

SVB positioned itself horribly just before interest rates increased.

The company's $21 billion bond portfolio had a yield of 1.79% and a duration of 3.6 years.

Compare that to today’s 3-year Treasury yield of 4.71%.

The company's $21 billion bond portfolio had a yield of 1.79% and a duration of 3.6 years.

Compare that to today’s 3-year Treasury yield of 4.71%.

As rates rose over the last year, the value of SVB’s bonds fell dramatically.

And the bank had a choice: Ride out the ~3 year duration of its bonds with a yield far below the current Treasury rate, or sell at a loss and reposition the portfolio to maximize yield.

And the bank had a choice: Ride out the ~3 year duration of its bonds with a yield far below the current Treasury rate, or sell at a loss and reposition the portfolio to maximize yield.

Basically, SVB had to decide how quickly it thought rates would decrease.

And clearly, they don’t think rates are coming down anytime soon.

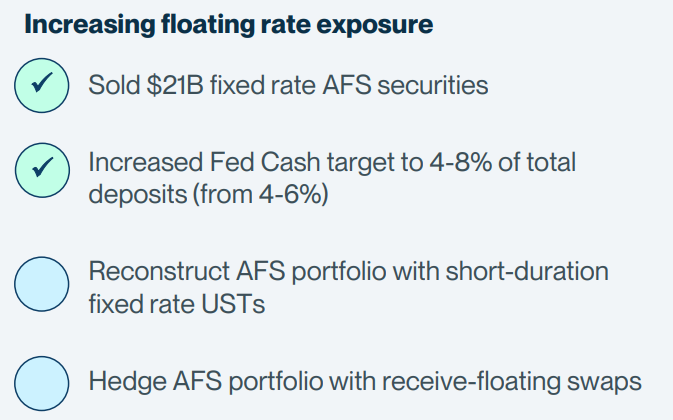

Here’s SVB’s plan to fix its yield problem:

And clearly, they don’t think rates are coming down anytime soon.

Here’s SVB’s plan to fix its yield problem:

The other crisis that SVB is facing: The lagging tech market.

SVB is the 15th-largest bank in the United States in terms of assets.

It’s especially popular with tech companies, as its name would suggest.

SVB is the 15th-largest bank in the United States in terms of assets.

It’s especially popular with tech companies, as its name would suggest.

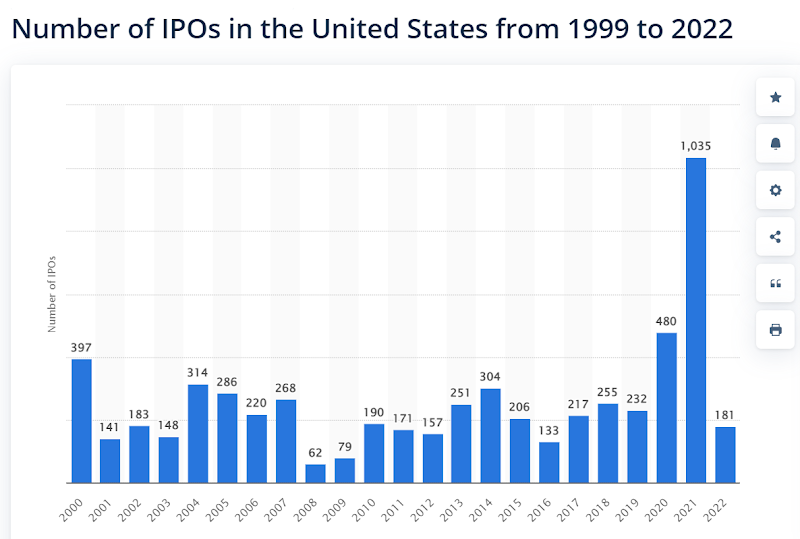

A struggling tech market means fewer deposits in SVB.

And the restricted IPO and capital markets mean that VC-backed tech companies have less money to deposit into banks.

And the restricted IPO and capital markets mean that VC-backed tech companies have less money to deposit into banks.

SVB is facing a slew of other problems today:

Moody’s cut the company’s credit rating and downgraded its credit outlook to negative.

And with tech in trouble, SVB can’t count on the massive growth it has seen in recent years.

Moody’s cut the company’s credit rating and downgraded its credit outlook to negative.

And with tech in trouble, SVB can’t count on the massive growth it has seen in recent years.

But SVB isn’t the only bank facing this situation.

Maybe it’s the first to proactively attempt to fix the problem, but the market expects more pain in the banking sector.

Silvergate already announced it was closing earlier this week.

Maybe it’s the first to proactively attempt to fix the problem, but the market expects more pain in the banking sector.

Silvergate already announced it was closing earlier this week.

Silvergate faced many of the same problems, but with crypto instead of tech.

Silvergate’s bond portfolio went sideways as well, and its customer base was hurt badly in the crypto crash of 2022.

Silvergate’s bond portfolio went sideways as well, and its customer base was hurt badly in the crypto crash of 2022.

I’ll be looking out for more financial institutions liquidating portfolios and shoring up liquidity.

Make sure you subscribe to my newsletter for the latest: gritcapital.substack.com/

Make sure you subscribe to my newsletter for the latest: gritcapital.substack.com/

Mentions

See All

Erik Voorhees @ErikVoorhees

·

Mar 10, 2023

Great thread as always 🙏

Auren 𝐇𝐨𝐟𝐟𝐦𝐚𝐧 @auren

·

Mar 9, 2023

great thread!