Thread

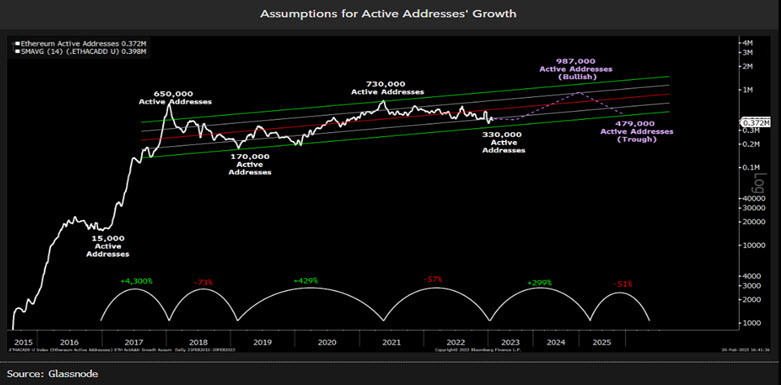

For Ethereum to hit new all-time highs it may require active addresses to hit a million. Our Metcalfe Law-driven valuation framework helps identify the key variables that can support better forecasting of asset prices. 🧵

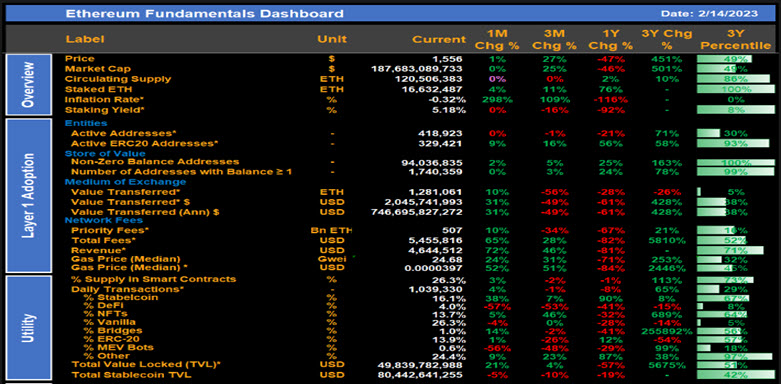

Are blockchains simple or complex systems? Our #Ethereum fundamentals dashboard tracks 70+ metrics (BTC 40+). Similar to traditional economic analysis, blockchain economies/networks are in constant flux, affected by internal as well as external factors.

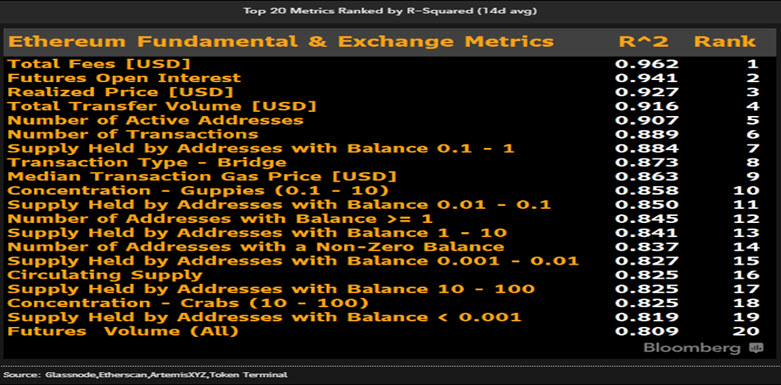

Metrics that evaluate utility and adoption should correlate with the price of the native currency. Findings are clear, some on-chain and exchange data strongly correlate, with active addresses, transactions, gas and supply ranking near the top.

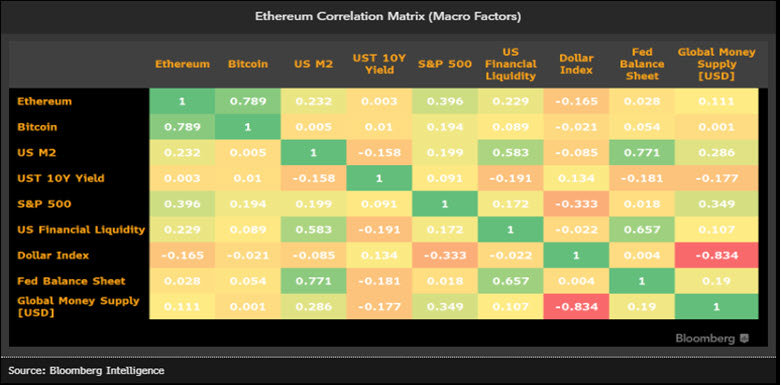

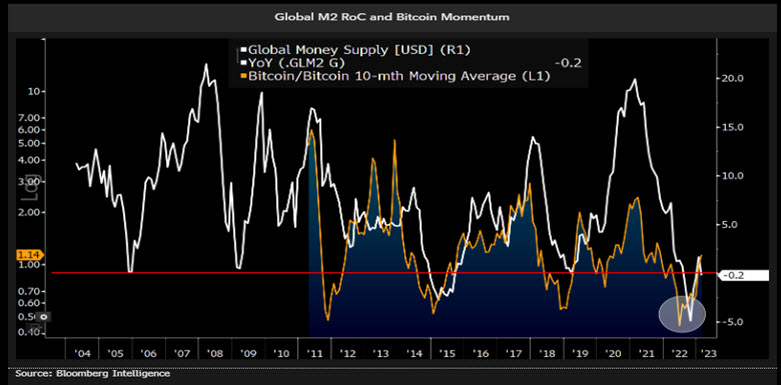

What about Macro factors? All assets, especially long-duration technology plays like crypto, are heavily impacted by the macro environment. However, our correlation matrix shows Ethereum has a low correlation with our crypto macro factors.

The relatively low statistical relationship with our macro factors suggests that we should skew our valuation model toward on-chain fundamentals while deploying macro factors for timing. Our macro timing indicators turned positive in Q4 2022

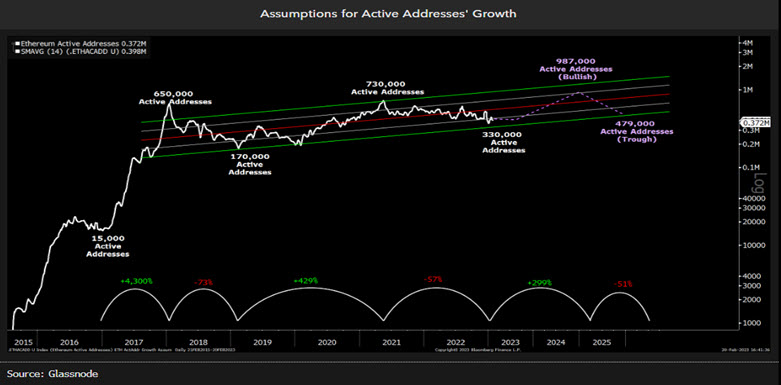

Returning to the fundamentals - let's use active addresses, which had a strong relationship with price changes. We applied some annual growth rates starting from Dec-22 of 10%, 20% & 40% and projecting 3 years to the future (assuming we are at the start of a new cycle)

Trough to Trough case of 10% pa by 2025/26 would be approx active addresses of 479k vs 360k in Dec-22 (glassnode). Under the Bullish case of 40% (much less than 100% growth in last cycle), it could hit close to a million.

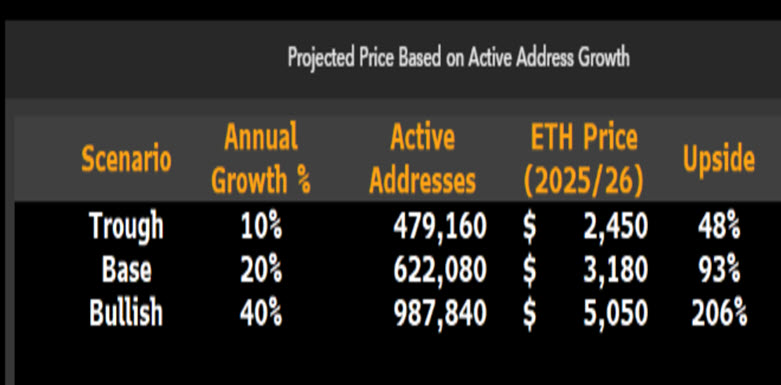

What could these levels mean for price?

What could these levels mean for price?

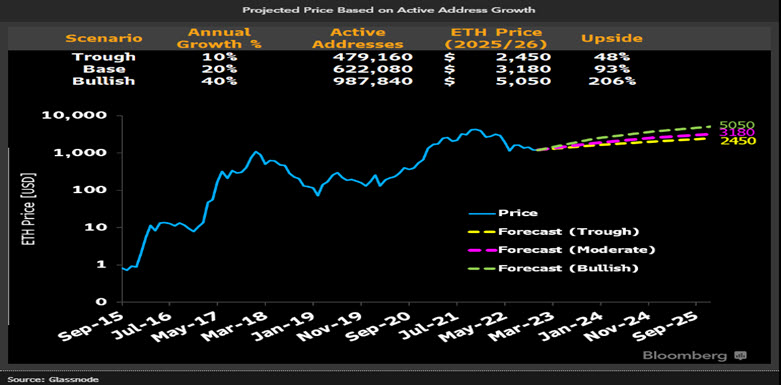

Forecasting the price of Ethereum, a complex system early in its life cycle, using one network metric is undoubtedly an oversimplification. And I am sure this correlation will change over time, especially as L2s cannibalise base activity.

However, under conservative assumptions, Ethereum should find support at $2,450 during the next activity recession expected in 2025/26. Under our bullish case of near 1m active addresses, Ethereum should break above the previous ATH.

⬇️ Risks to these scenarios include L2 cannibalization, hostile regulations and unresolved censorship issues, while ⬆️ risk remains from sharding the network and real-world asset tokenization, which will bring more activity to the base chain.

Mentions

See All

Raoul Pal @RaoulPal

·

Feb 22, 2023

Great thread