Thread by Brandon Beylo

- Tweet

- Feb 9, 2023

- #Economics #Investment

Thread

Capital Returns is a must-read for any investor that wants to up their game.

The book teaches you how changes in an industry's supply side can affect competitive positioning, economics, and more.

You can read it in a weekend!

Here are my 5 Favorite Lessons from the book ... 🧵

The book teaches you how changes in an industry's supply side can affect competitive positioning, economics, and more.

You can read it in a weekend!

Here are my 5 Favorite Lessons from the book ... 🧵

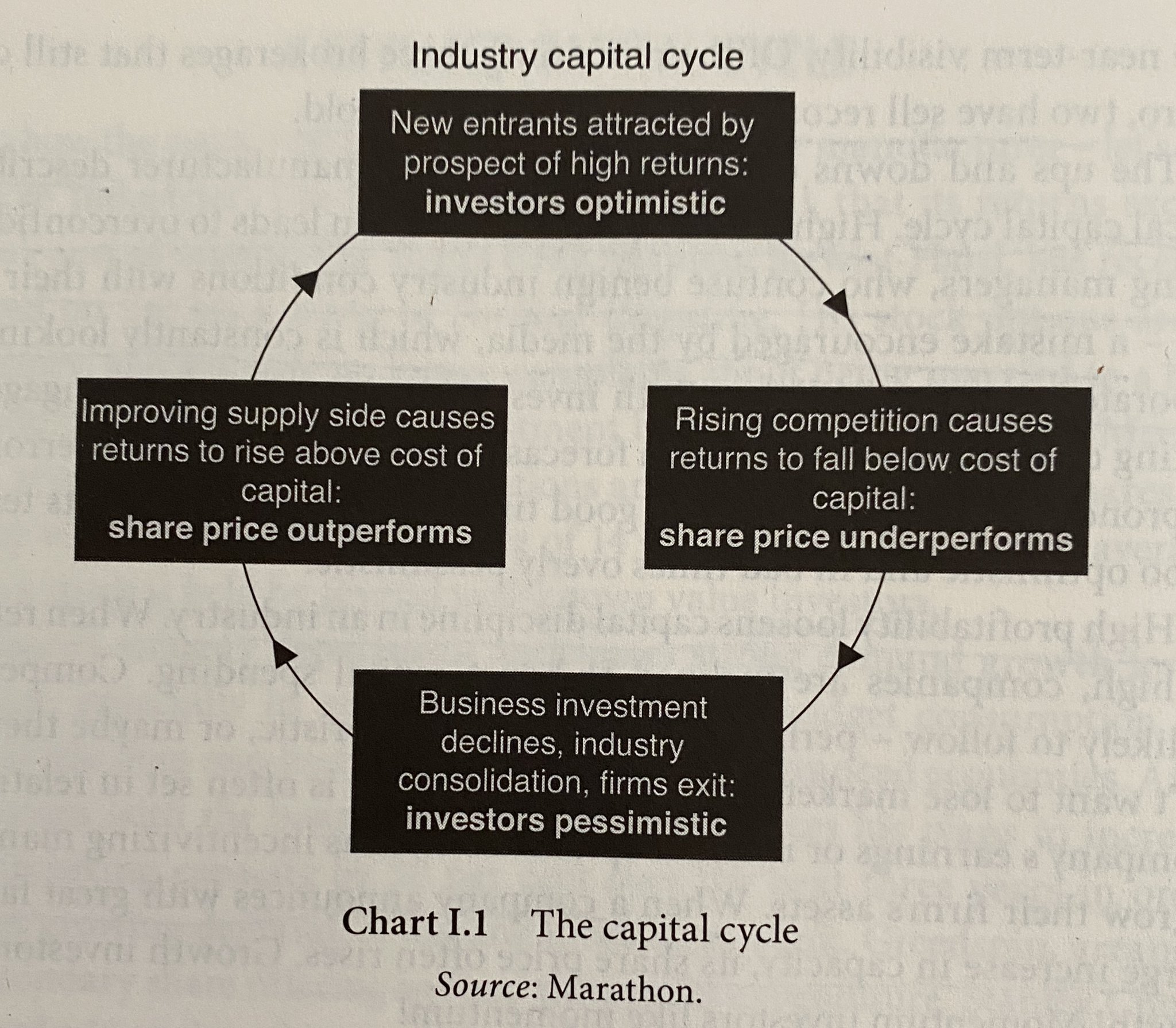

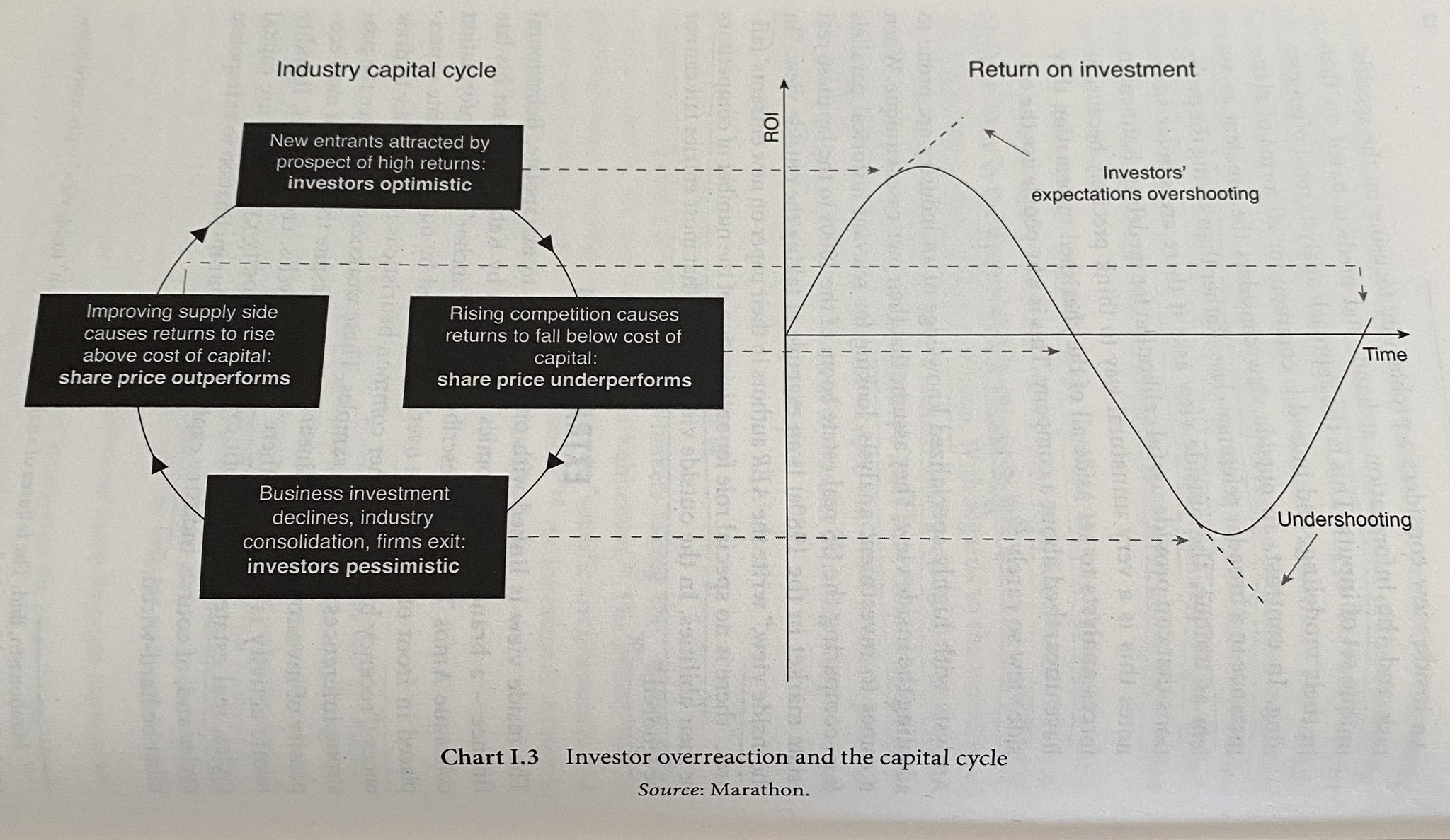

Lesson 1: Understand The Capital Cycle (CC)

There are four parts of the CC:

1) New entrants are attracted to industry by high returns

2) Rising competition causes returns to fall below CoC

3) Investment declines, consolidates, firms exit

4) Improving supply side = high rets

There are four parts of the CC:

1) New entrants are attracted to industry by high returns

2) Rising competition causes returns to fall below CoC

3) Investment declines, consolidates, firms exit

4) Improving supply side = high rets

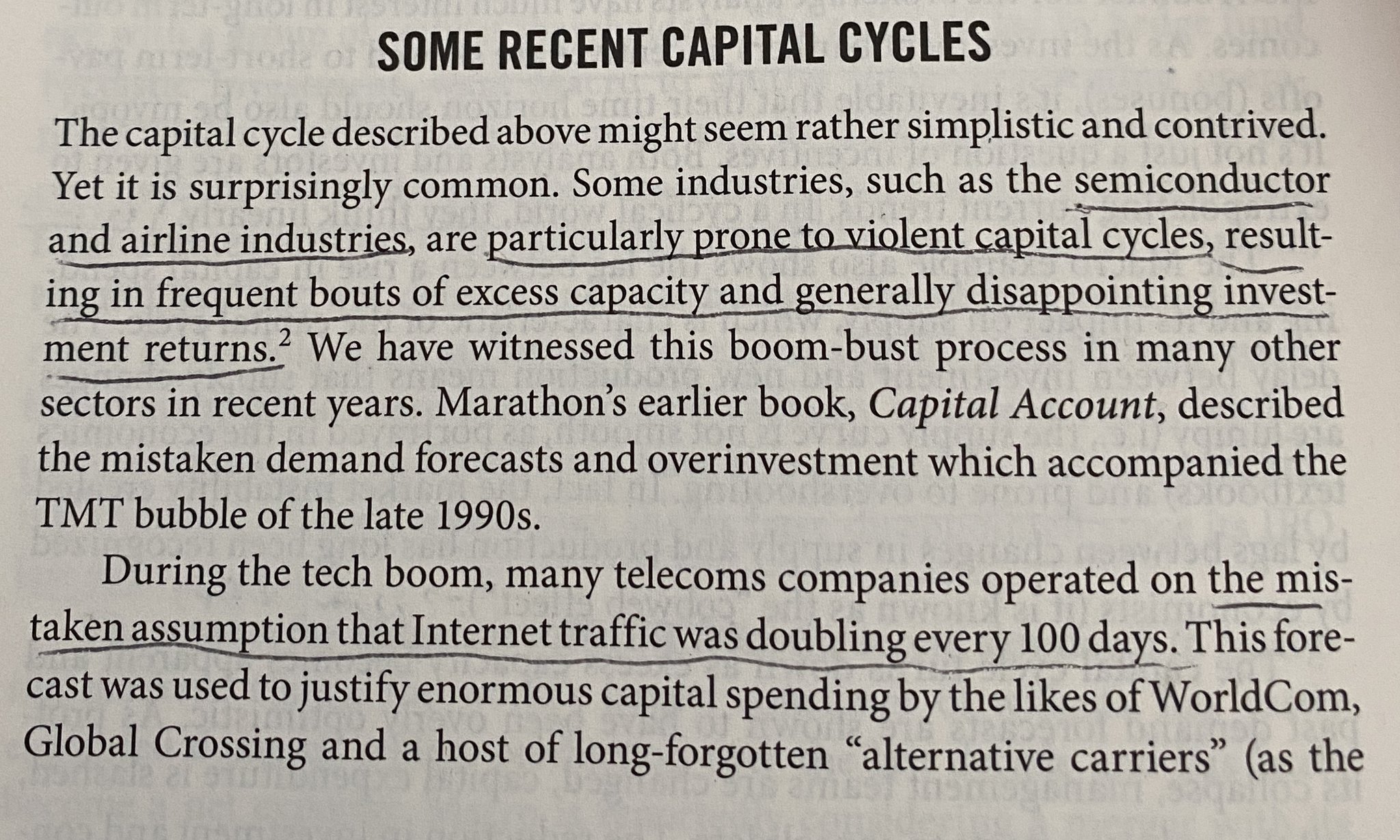

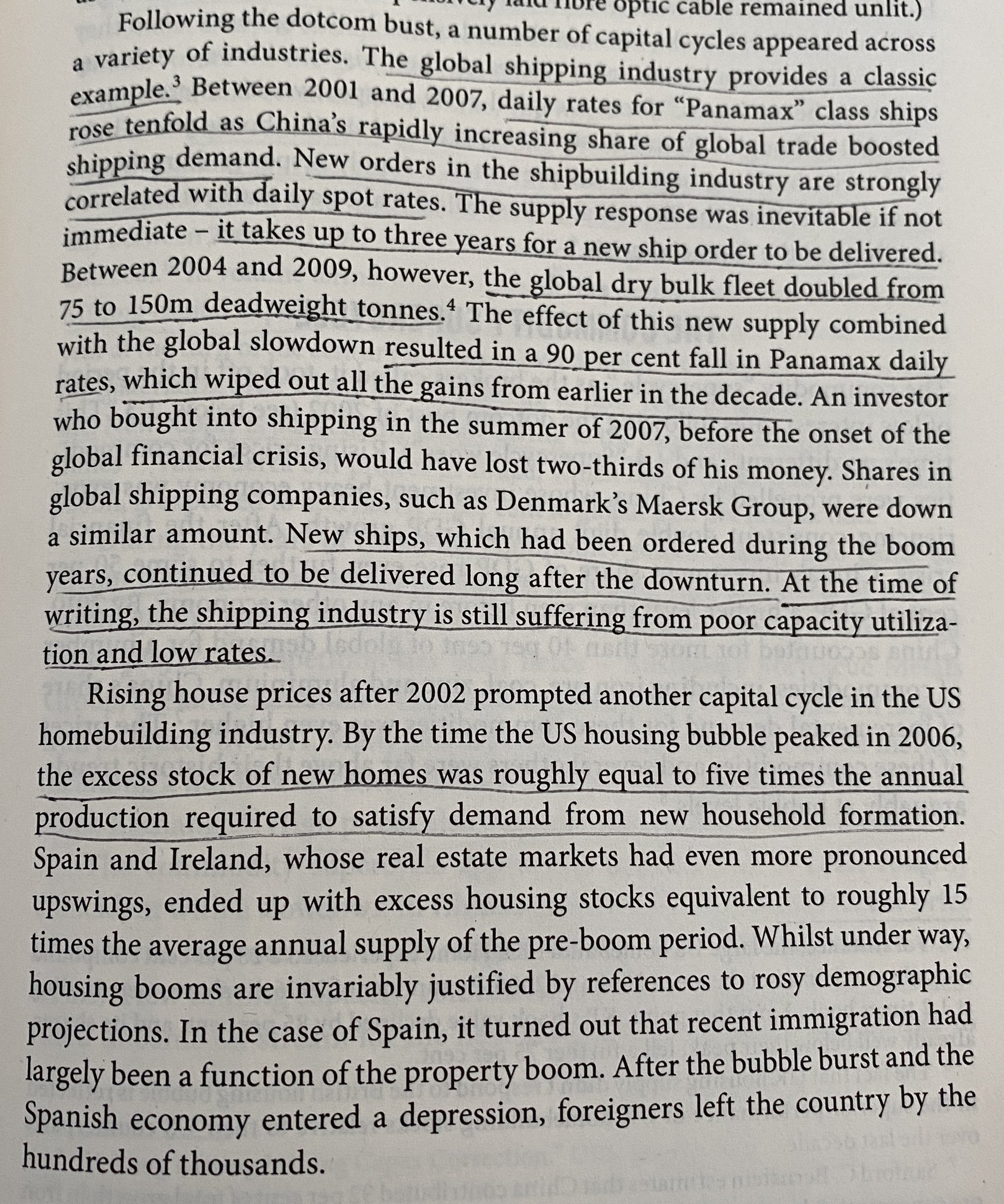

Examples of Capital Cycles in Industry

• Semiconductors

• Airlines

• Telecom

• Shipping

• Housing

• Commodities

Catching these industries at the bottom of a capital cycle (I.e., most pessimistic time) can be extremely profitable.

It's like @hkupppy "Inflection" thesis.

• Semiconductors

• Airlines

• Telecom

• Shipping

• Housing

• Commodities

Catching these industries at the bottom of a capital cycle (I.e., most pessimistic time) can be extremely profitable.

It's like @hkupppy "Inflection" thesis.

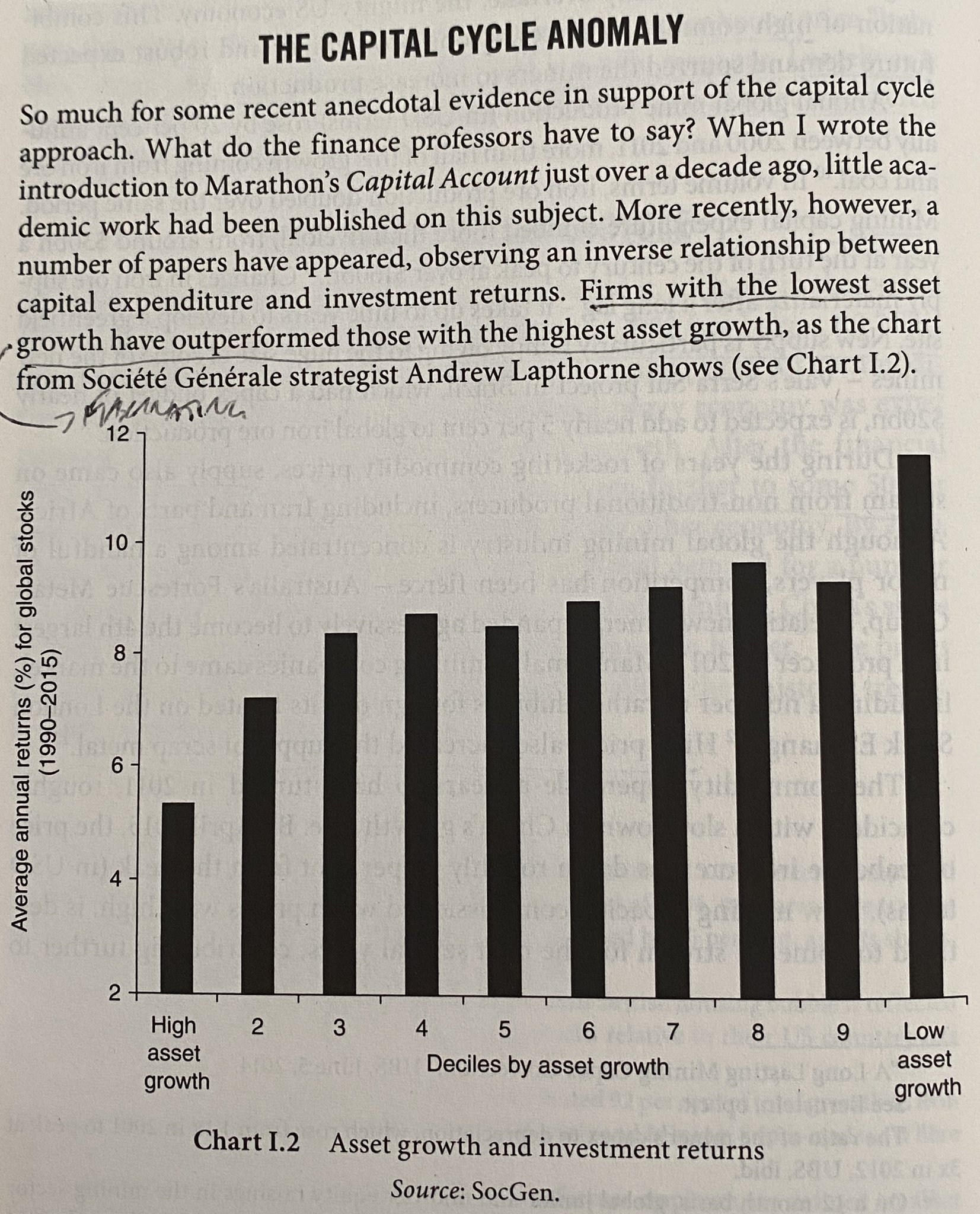

Lesson 2: Be Wary of High Asset Growth

The last two years have hypnotized investors into thinking that "Growth = Good."

Growth = competition

Which without a moat, is not good.

Firms w/ slower asset growth outperformed higher growth peers.

Focus on supply side folks!

The last two years have hypnotized investors into thinking that "Growth = Good."

Growth = competition

Which without a moat, is not good.

Firms w/ slower asset growth outperformed higher growth peers.

Focus on supply side folks!

Examples of Asset Contractions

There are a few tell-tale signs of asset contractions, like:

• Spin-offs

• Share repurchases

• Debt prepayments

• Dividend initiations/increases

These are great places to look for bargain stocks at capital cycle inflection points.

There are a few tell-tale signs of asset contractions, like:

• Spin-offs

• Share repurchases

• Debt prepayments

• Dividend initiations/increases

These are great places to look for bargain stocks at capital cycle inflection points.

Lesson 3: Avoid Extrapolation Extravaganza

I'm very much speaking to myself here.

Investors tend to anchor on recent info while ignoring decades of industry data.

Further, we linearly extrapolate the cyclicality of things like:

• Credit

• Liquidity

• Profity

• Industry

I'm very much speaking to myself here.

Investors tend to anchor on recent info while ignoring decades of industry data.

Further, we linearly extrapolate the cyclicality of things like:

• Credit

• Liquidity

• Profity

• Industry

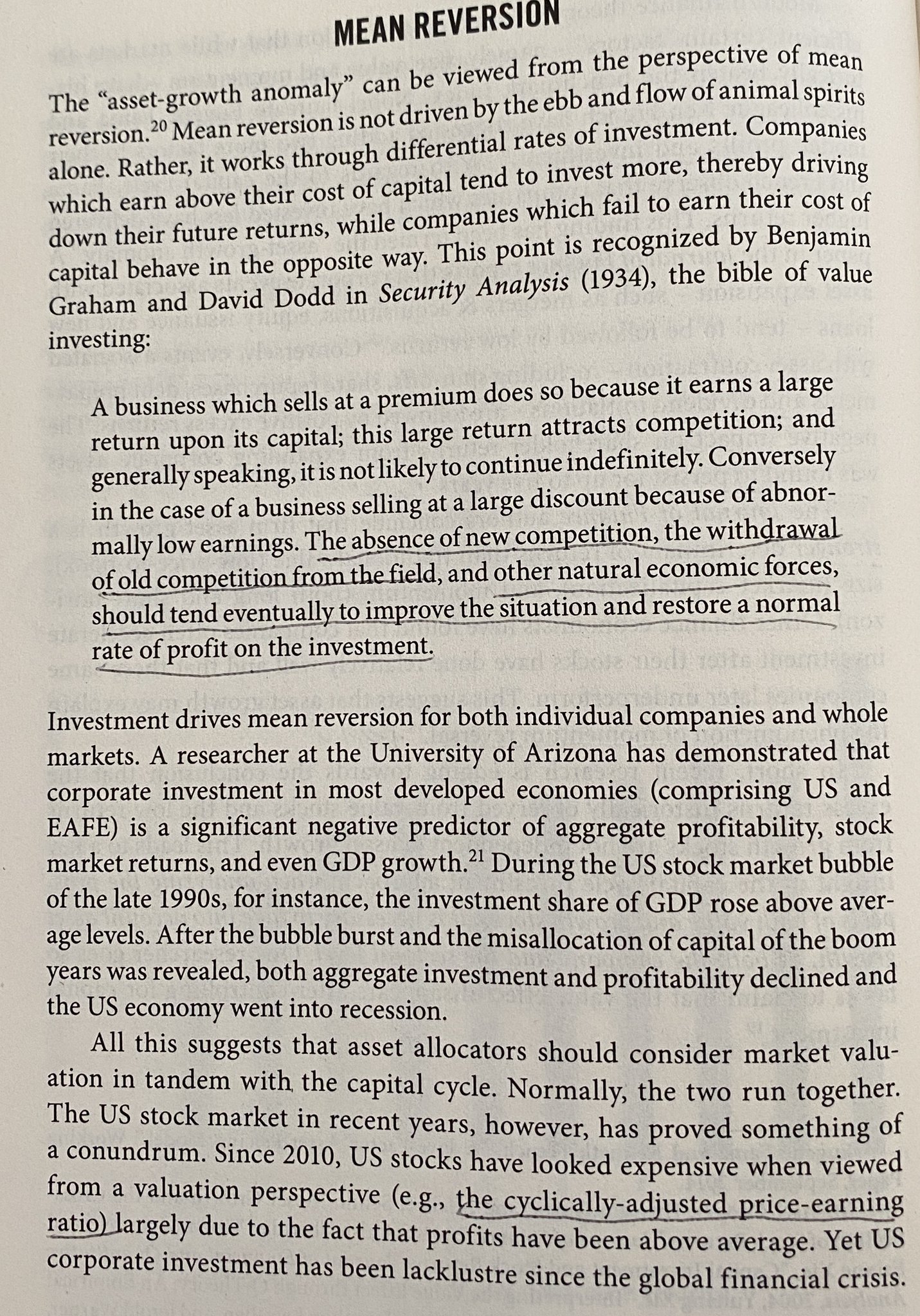

The Power of Mean Reversion

Here's my favorite quote from the book on Mean Reversion ...

"Mean reversion is driven by changes on the supply side which value ivnestors who consider only quantitative measures of valuation are inclined to overlook."

Which leads to lesson 4...

Here's my favorite quote from the book on Mean Reversion ...

"Mean reversion is driven by changes on the supply side which value ivnestors who consider only quantitative measures of valuation are inclined to overlook."

Which leads to lesson 4...

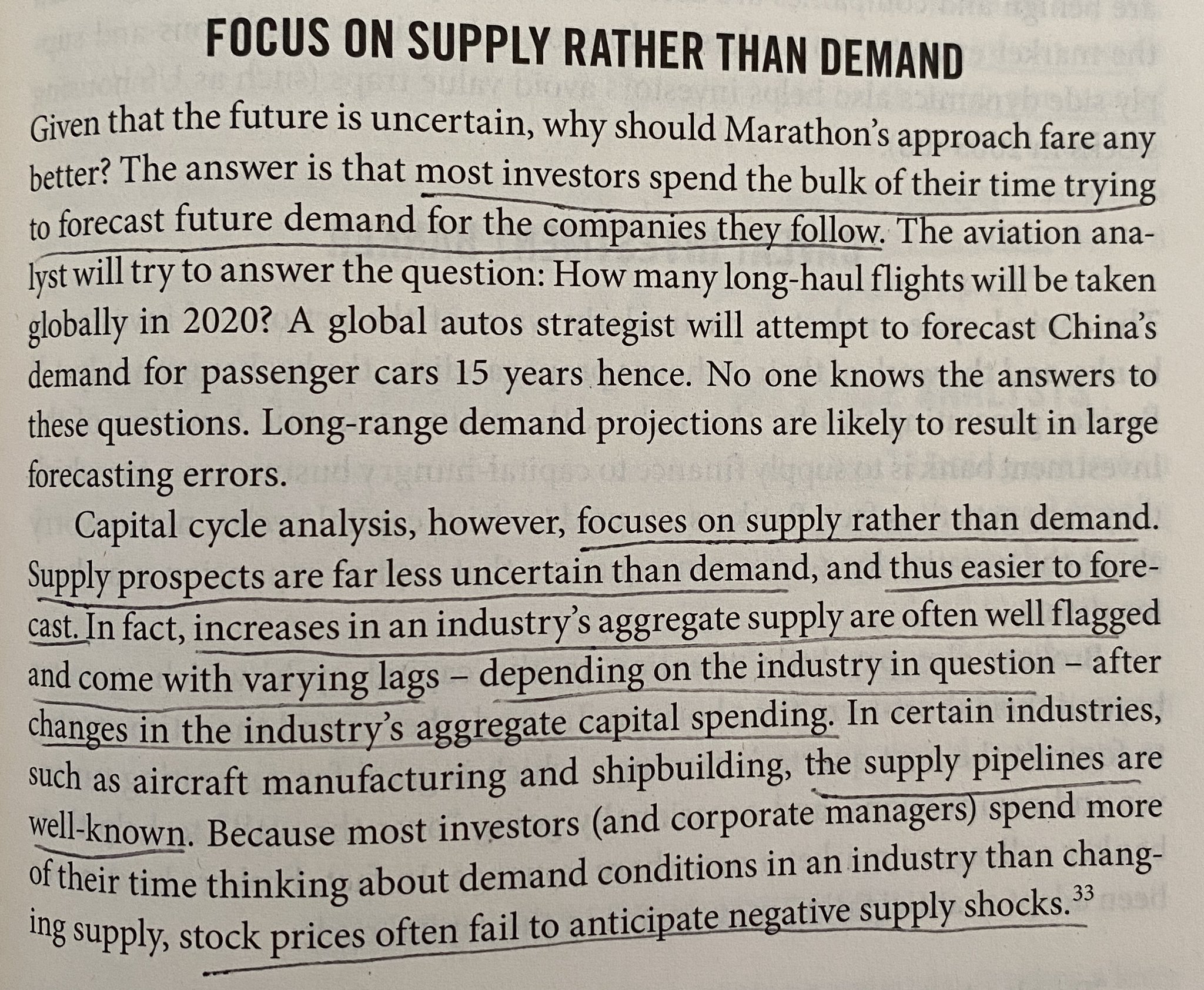

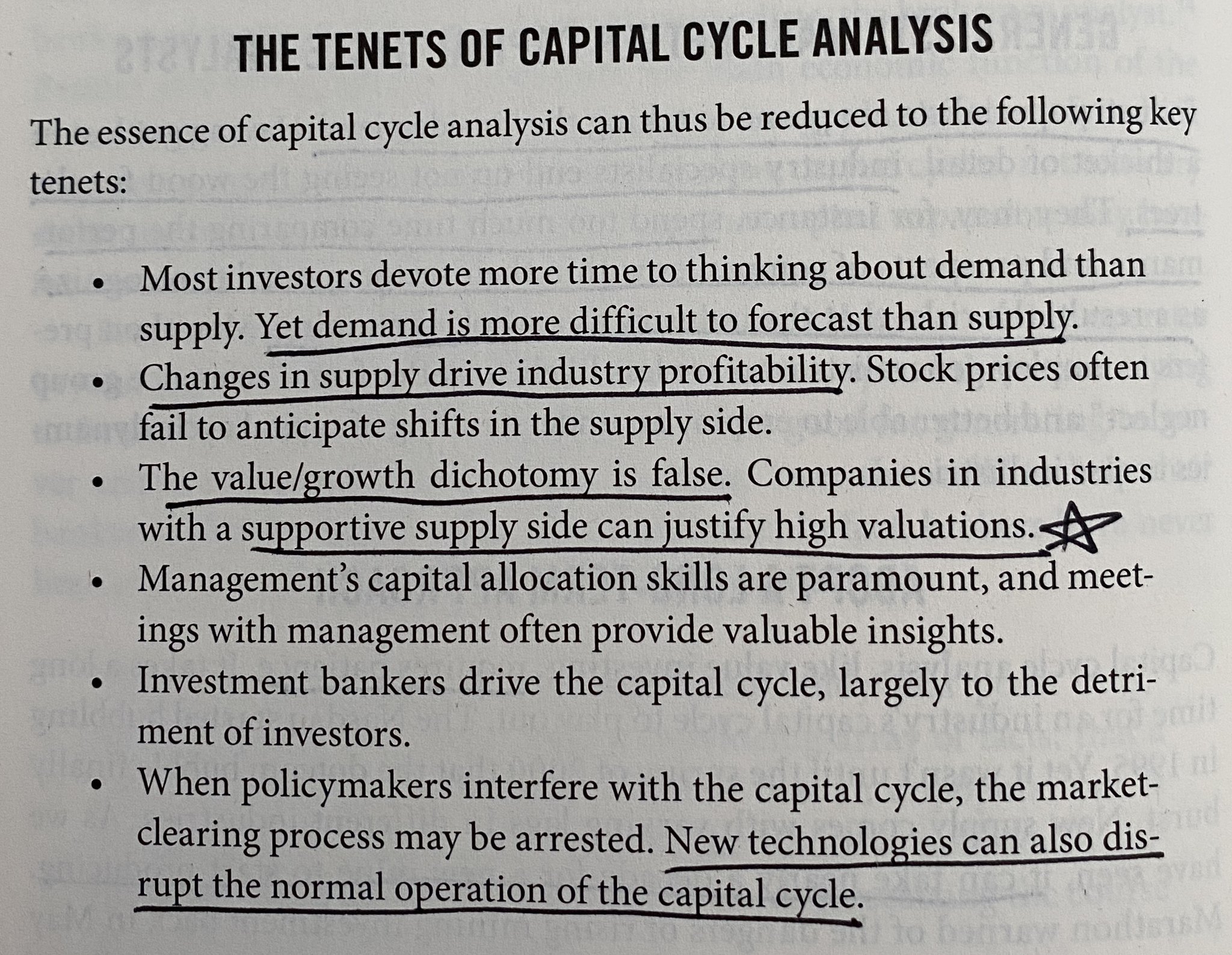

Lesson 4: Focus on The Supply Side

There are a few reasons to focus on the supply side:

• It's easier to forecast than demand

• Changes in supply side drive profitability

• Supportive supply sides drive higher valuations

• Most focus on demand

📚 Competition Demystified

There are a few reasons to focus on the supply side:

• It's easier to forecast than demand

• Changes in supply side drive profitability

• Supportive supply sides drive higher valuations

• Most focus on demand

📚 Competition Demystified

Lesson 5: Be Patient

Capital Cycle Analysis requres long-term patience.

It takes decades for cycles to churn in industries, credit, liquidity, etc.

Especially in energy/commodities where it can take 10+ yrs to build new supply.

Markets move faster than cycles (@agnostoxx)!

Capital Cycle Analysis requres long-term patience.

It takes decades for cycles to churn in industries, credit, liquidity, etc.

Especially in energy/commodities where it can take 10+ yrs to build new supply.

Markets move faster than cycles (@agnostoxx)!

Recap: My 5 Favorite Lessons From Captial Returns

1) Understand The Capital Cycle

2) Be Wary of High Asset Growth

3) Avoid Extrapolation Extravaganza

4) Focus on Supply Side

5) Be Patient

I hope you enjoyed this thread.

If you did, please like/RT and share with others!

1) Understand The Capital Cycle

2) Be Wary of High Asset Growth

3) Avoid Extrapolation Extravaganza

4) Focus on Supply Side

5) Be Patient

I hope you enjoyed this thread.

If you did, please like/RT and share with others!

Thanks for reading!

If you want more of this content in your inbox (for free), check us out at Macro Ops!

macro-ops.com/subscribe-newsletter/

If you want more of this content in your inbox (for free), check us out at Macro Ops!

macro-ops.com/subscribe-newsletter/