Thread

Some notes on the missing recession 🧵

I, like others, expected a recession for most of 2022, to occur around the turn of the year. I was pretty consistent with this call, having first made it in March/April

Hasn't happened yet, at least in the data currently available. Why?

I, like others, expected a recession for most of 2022, to occur around the turn of the year. I was pretty consistent with this call, having first made it in March/April

Hasn't happened yet, at least in the data currently available. Why?

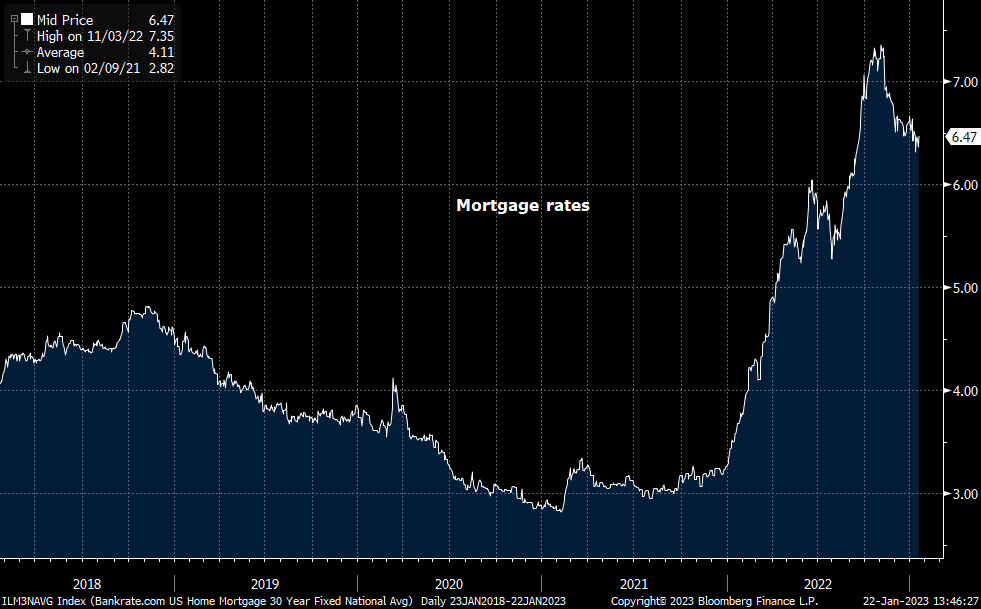

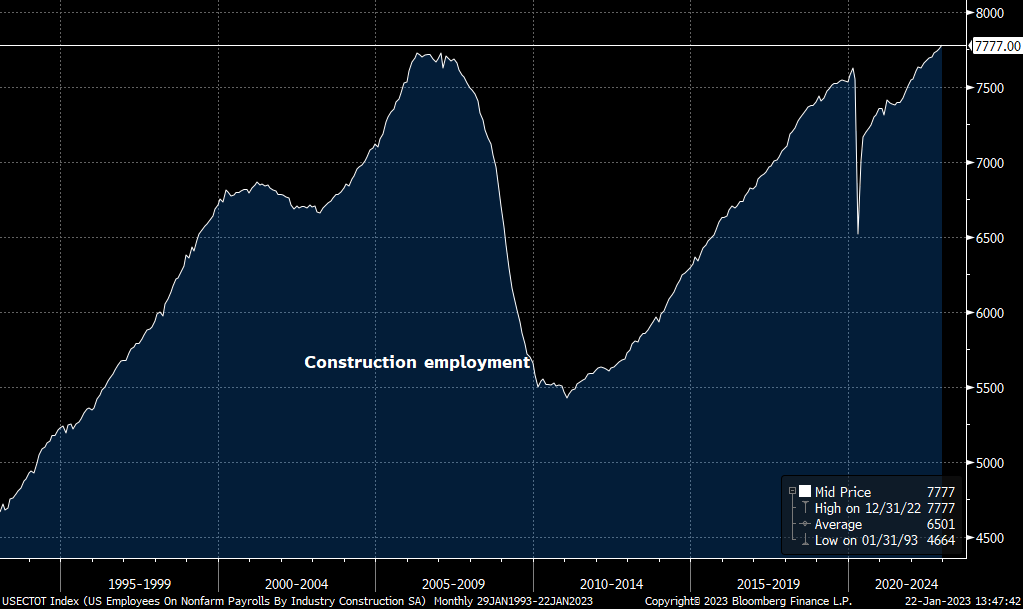

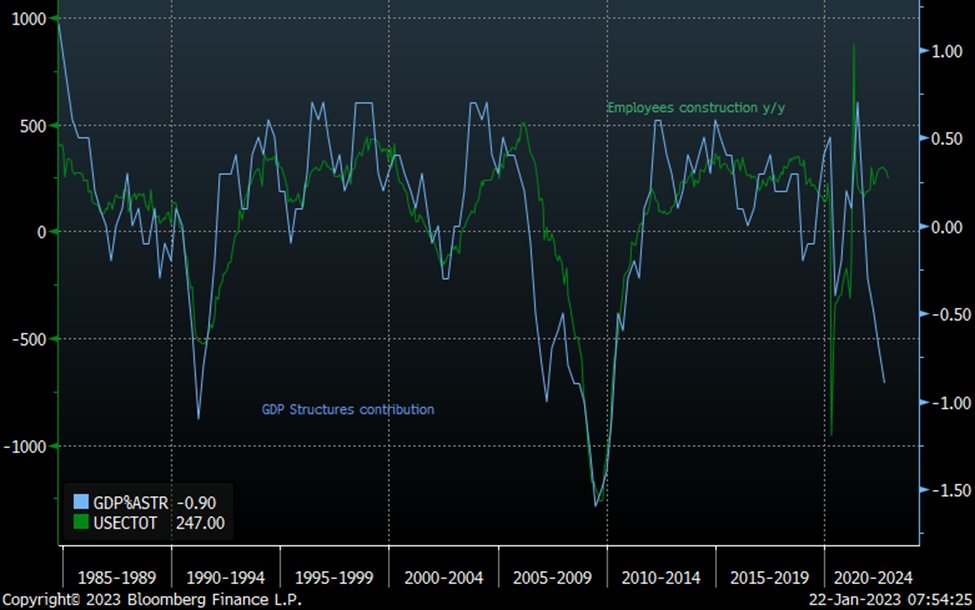

The principal reason is the missing construction layoffs. Mortgage rates shot up from 3% to 7%, making buying a home unaffordable for many folks. Normally, one expects a slowdown in construction activity and layoffs. But, construction employment is at all time highs!

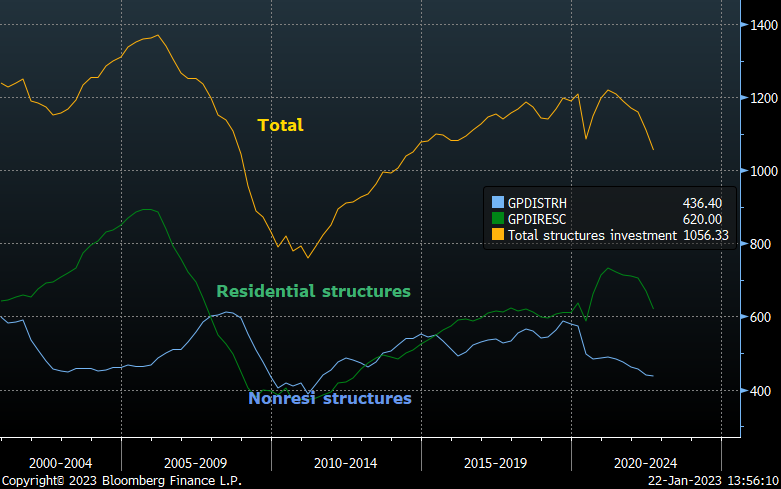

Meanwhile, construction activity *did* slow down. Total investment activity in structures is down by about $150 billion since its high in 2021.

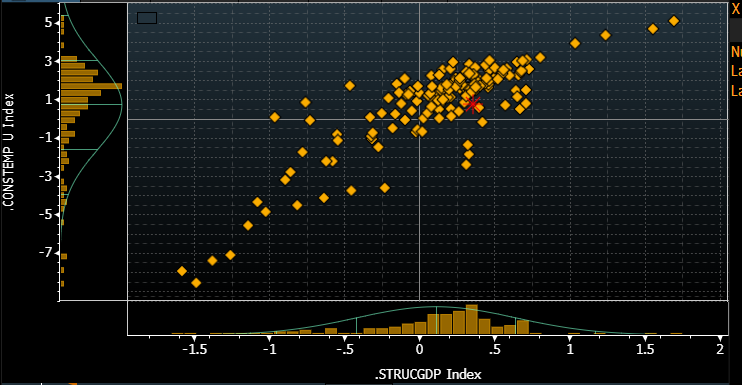

As @DomWh1te has flagged, we'd expect huge layoffs in the construction sector given this change. Some simple models for me indicate expected layoffs in the neighborhood of 500k to 800k jobs, and with multipliers, this would be 1 to 3 million total losses. That's a real recession.

Thus, the missing recession really boils down to the missing construction layoffs. Why haven't these occurred yet?

Some possibilities:

1. They will. (Maybe, but I don't see -any- sign of them in the data...yet.)

Some possibilities:

1. They will. (Maybe, but I don't see -any- sign of them in the data...yet.)

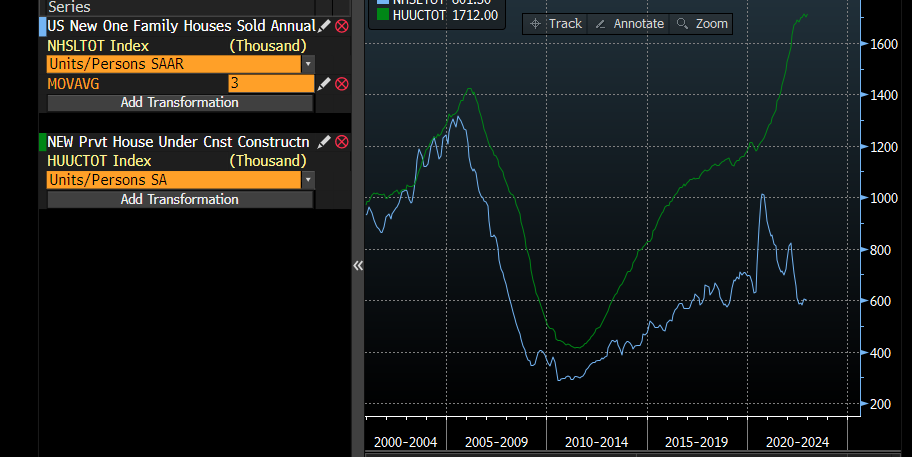

Still, there are some reasons for expecting the layoffs to eventually come. In particular, the huge divergence between the number of homes being sold and the number of homes currently under construction, which will presumably come down as homes are completed.

2. The extraordinary backlog of homes demand due to pandemic changes in the economy like wfh. This is a possible explanation, but presumably at some point runs out?

3. Labor hoarding by builders, i.e. holding onto employees for fear of being able to replace them if necessary in a tight labor market. I'm generally dismissive of labor hoarding for the economy as a whole, but more sympathetic in the building sector. Why?

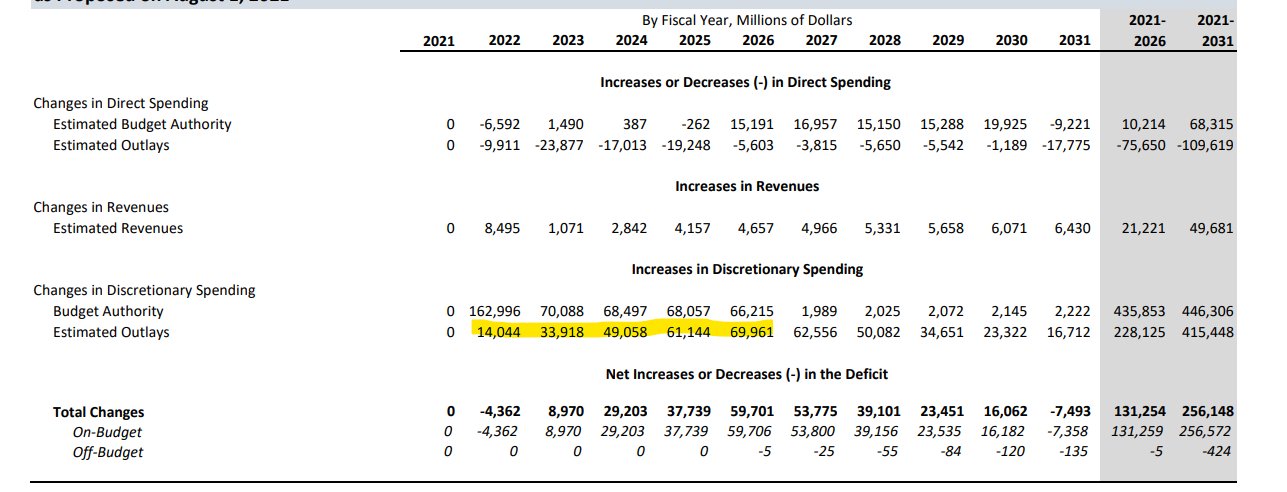

The principal reason is the Infrastructure Investment and Jobs Act, passed in 2021. As I pointed out at the time in @WSJopinion , the IIJA is going to further fuel inflation. www.wsj.com/articles/bipartisan-infrastructure-bill-inflation-stimulus-biden-automobile-regulations-a...

Going into CY2023, there's going to be ~$38 billion of Federal spending on construction and other projects kicking in. In CY24, it'll be closer to $54 billion. Assuming some multipliers, these go a long way to offsetting a big chunk of the decline in private structures spending.

(Ignore the decline in direct spending here, that's largely the offsets from reduced spending on phrama or subsidies to GSEs)

In other words, I suspect builders are holding onto employees because the $$$ being spent by Uncle Sam on construction are going to start kicking in this year. Given a historically tight labor market where employees seem to have all the power, they'd rather hold onto the workers

Why lay off your workers now if you expect real difficulty in hiring them back if building starts to pick back up, particularly for nonresidential construction?

3. Financial conditions have eased significantly since September: stocks, mortgage rates, the dollar.

3. Financial conditions have eased significantly since September: stocks, mortgage rates, the dollar.

It's not difficult to imagine a world in which home prices fall by 10% or so, but given strong wages, resilient stocks, and falling mortgage rates, final demand stays robust. Given the historic run up in home prices, builders are still very profitable at those levels.

In other words, maybe builders expect a surge of private demand in the near future and are therefore holding onto their employees.

CONCLUSION: The missing construction layoffs ARE the missing recession. If they come, we'll have a recession. There's a reason for expecting them to come (homes under construction lagging sales), and reasons for expecting them not to (future demand picking up, private & public)

Watching this sector will give us a clue as to whether we'll see a recession or not. In the meantime, as @darioperkins has pointed out, real incomes are accelerating on lower inflation, and as I've stressed 100x, financial conditions easing ought to induce a pickup in GDP growth

There is thus some chance the economy reaccelerates before those layoffs come, and the recession is avoided. However, in that case, the Fed will be goaded into a new hiking cycle, as inflation will pick back up, and the recession will be delayed and not avoided.

Afternote: there's a race between the exhaustion of the backlog & the coming construction layoffs, vs. a reacceleration of the economy on easing financial conditions & IIJA boosting construction demand

Which of these forces wins the race determines whether we have:

-recession, or

-burst of growth, followed by new hiking cycle, followed by recession

-recession, or

-burst of growth, followed by new hiking cycle, followed by recession