Thread

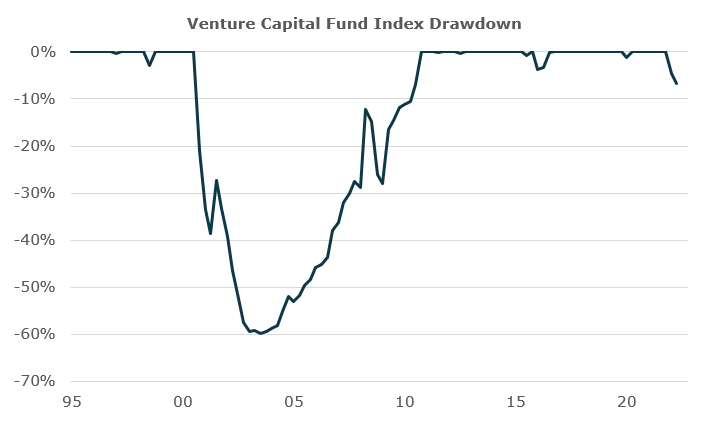

While it may be difficult to predict the public markets in '23, it is pretty easy to figure out that Venture Funds are on track to lose $1 trillion in value from peak.

The vast majority of these losses have yet to be recognized. '23 will bring more realistic marks. A thread.

The vast majority of these losses have yet to be recognized. '23 will bring more realistic marks. A thread.

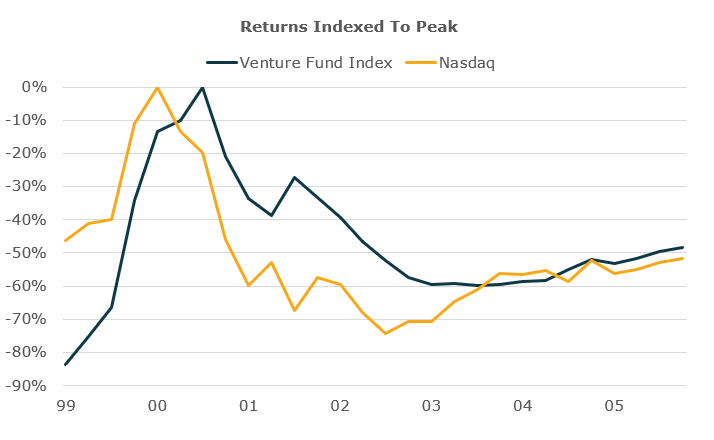

Venture funds are always behind the public markets in marking their books. Eventually the reality of company valuations is recognized. The 00 cycle provides some nice perspective. Venture funds took much longer to recognize losses than did public mkts, but eventually it happened.

In downcycles funds give many reasons why their portfolio will perform better than folks expect or the public markets. Some funds will outperform. Privates may incrementally do better.

But from any macro perspective the reality of the public markets eventually is realized.

But from any macro perspective the reality of the public markets eventually is realized.

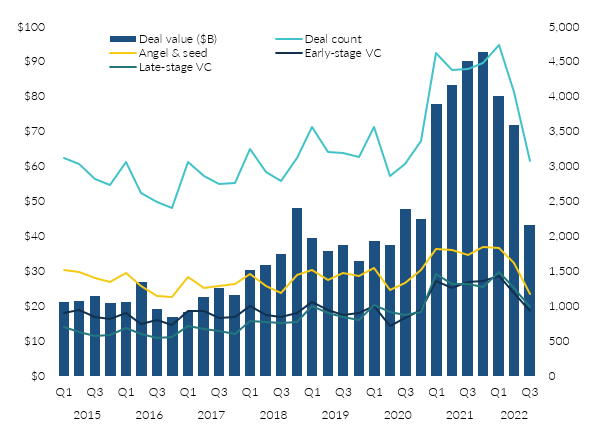

Just like any bubble-like cycle the peak in the cycle coincided with a substantial rise in incremental new investment. The result is that a lot of the money deployed by these funds was at peak valuations.

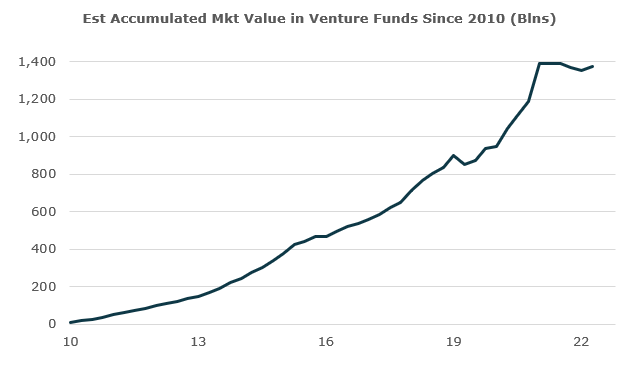

Figuring out the total value deployed in venture funds at a point in time is an estimation exercise.

If we take new incremental investment, valuation, and estimated exits from this incremental investment it looks like about $1.4tln of 'value' is currently in these funds.

If we take new incremental investment, valuation, and estimated exits from this incremental investment it looks like about $1.4tln of 'value' is currently in these funds.

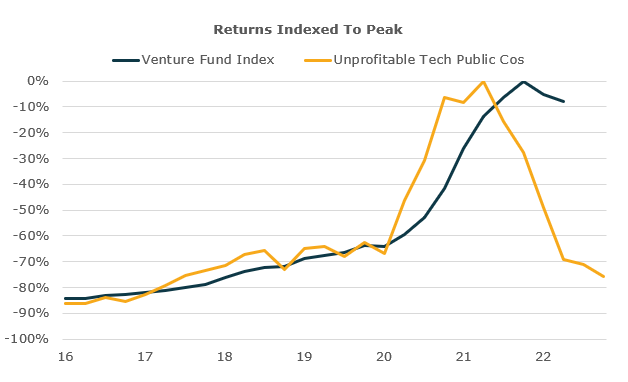

If we look at public market comps for these companies they are down close to 80% from peak. Worth noting how the rise on the upswing was also similar.

Just as in the 2000 cycle public markets peaked earlier than the venture fund marks. But now we are starting to see declines.

Just as in the 2000 cycle public markets peaked earlier than the venture fund marks. But now we are starting to see declines.

At just over 70% losses on the $1.4tln book from peak, total Venture Fund losses would $1tln in total.

Given public comps have tracked well in the cycle, and that they are down almost 80%, that seems like a pretty plausible outcome for the venture industry.

Given public comps have tracked well in the cycle, and that they are down almost 80%, that seems like a pretty plausible outcome for the venture industry.

So far, not much has been marked, but this will increasingly come to a head in '23.

Many companies raised during the good times looking for 12-18m of burn. They cut some expenses to extend that runway this year as it became clearer that the market was drying up.

Many companies raised during the good times looking for 12-18m of burn. They cut some expenses to extend that runway this year as it became clearer that the market was drying up.

Assuming most of that capital was raised across '21, then losses will start to become a problem through '23. And when they run out of money Venture Funds are going to be finally forced to mark losses.

Many will cease to be ongoing concerns and funds will have to book zeros.

Those that survive will need to raise money at depressed valuations which will also have to be marked once the transactions occur.

Those that survive will need to raise money at depressed valuations which will also have to be marked once the transactions occur.

In '22 some of the biggest themes have been the out-sized losses in the public & crypto markets.

In '23 one of the biggest themes will be the recognition of losses in the private markets, with many investors surprised because few have ever seen the size of coming losses.

In '23 one of the biggest themes will be the recognition of losses in the private markets, with many investors surprised because few have ever seen the size of coming losses.