Thread

1/ Over the past few weeks, my team at @coinmetrics has been obsessed with answering one question:

How did Alameda manage to lose billions of dollars of FTX user funds?

I think we've found some answers 👇🧵

How did Alameda manage to lose billions of dollars of FTX user funds?

I think we've found some answers 👇🧵

2/ First, let's get something straight:

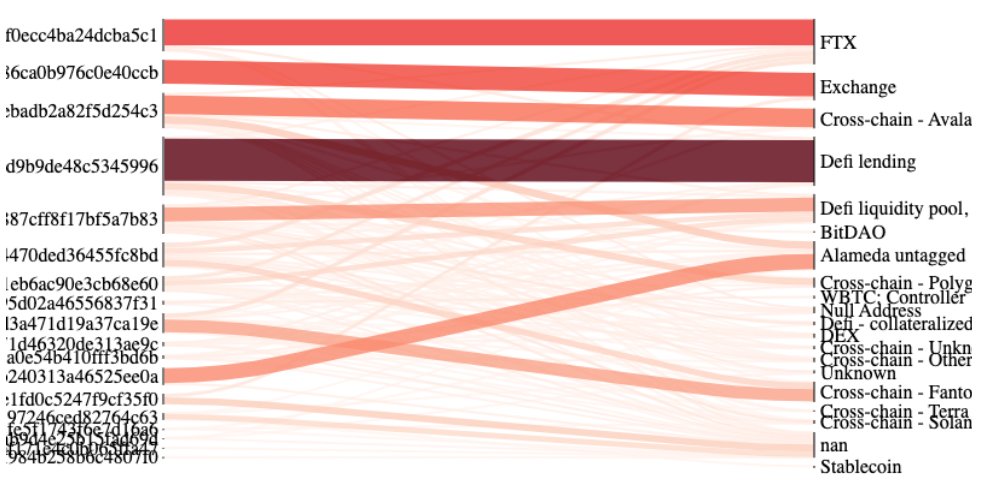

The line between Alameda and FTX was immensely blurred from the very beginning.

Our analysis showed thousands of large transactions from FTX to Alameda, so user funds were likely siphoned over the course of many months.

The line between Alameda and FTX was immensely blurred from the very beginning.

Our analysis showed thousands of large transactions from FTX to Alameda, so user funds were likely siphoned over the course of many months.

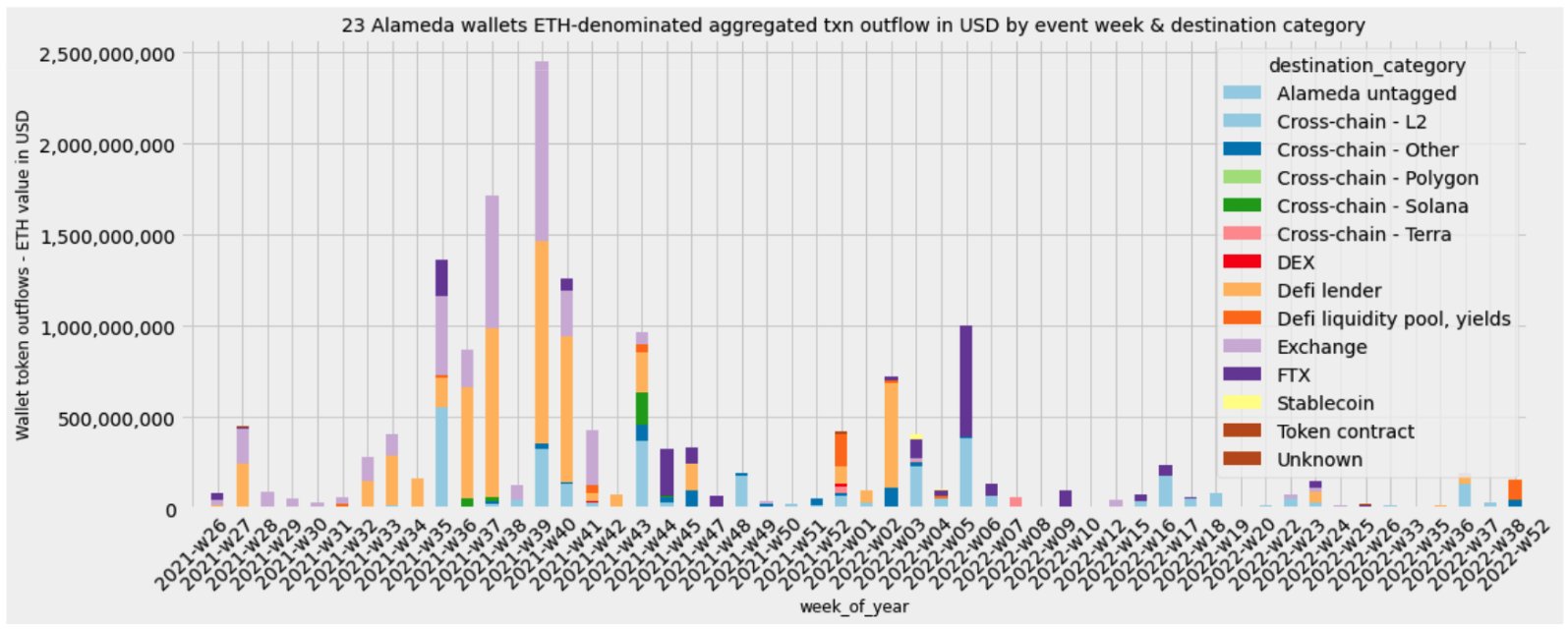

3/ The chart below shows the amount of ETH sent by Alameda in USD terms and the various applications they used.

It's truly astonishing: Alameda was involved in everything from DeFi borrowing and lending to cross-chain bridges across many different ecosystems.

It's truly astonishing: Alameda was involved in everything from DeFi borrowing and lending to cross-chain bridges across many different ecosystems.

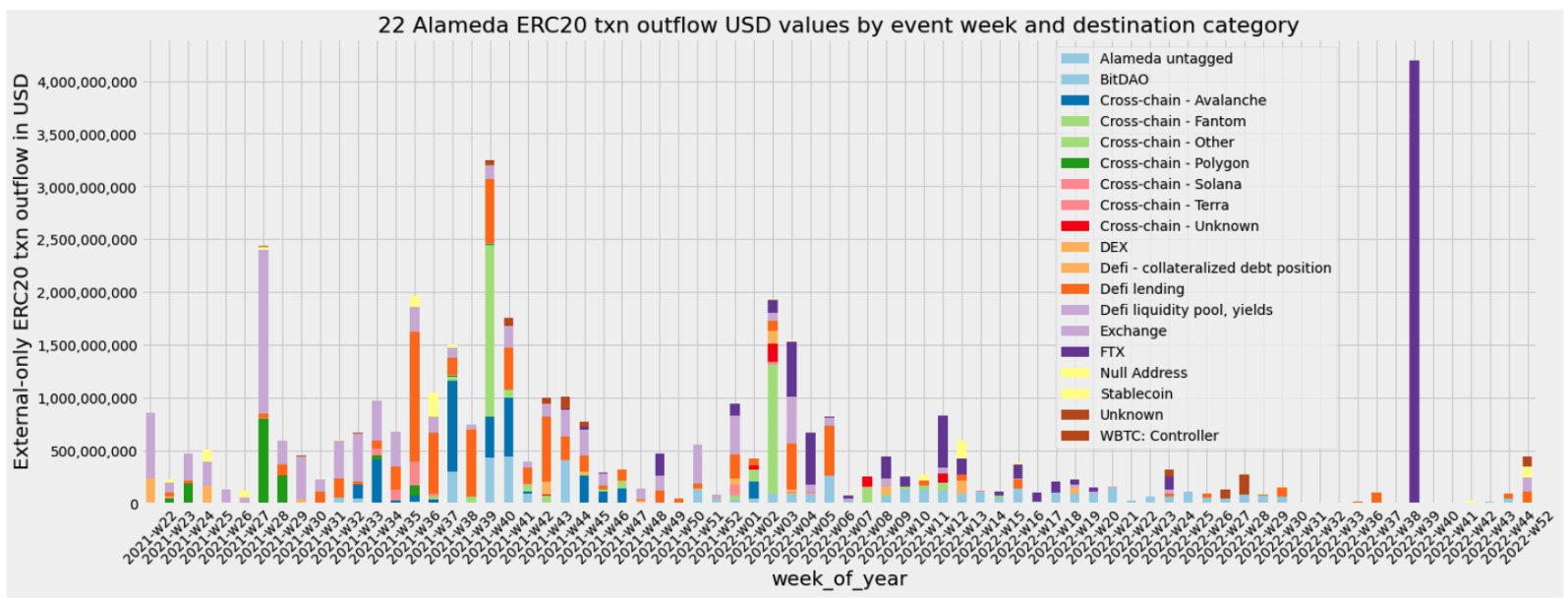

4/ Their approach was similar w.r.t ERC 20 tokens, which were also frequently sent cross-chain via bridges

They sent a total of $9.5 billion to bridges alone(!!!). We're still investigating the extent to which they might have lost user funds as a result of bridge hacks.

They sent a total of $9.5 billion to bridges alone(!!!). We're still investigating the extent to which they might have lost user funds as a result of bridge hacks.

5/ As you can see, the majority of the outflows happened in Q4 2021. Things noticeably cool down after that.

To us, this is a sign that they took a huge hit as markets contracted in Q4.

As mindblowing as this might be: it's possible by the time Terra happened, they were broke.

To us, this is a sign that they took a huge hit as markets contracted in Q4.

As mindblowing as this might be: it's possible by the time Terra happened, they were broke.

6/ So to recap where they might have lost considerable amounts of user funds by early 2022:

📉Directionally wrong trades, likely leveraged

📉DeFi lending markets, esp. stablecoin-denominated

📉Cross-chain bridges, either hacked or their native tokens becoming worthless

📉Directionally wrong trades, likely leveraged

📉DeFi lending markets, esp. stablecoin-denominated

📉Cross-chain bridges, either hacked or their native tokens becoming worthless

7/ At that point, the right thing to do would've been to come clean and return what was left of user funds.

However, as we now know, SBF is both narcissistic and delusional so instead they focused on 2 things:

1. Keeping the lights on and morale high

2. Pumping their FTT bag

However, as we now know, SBF is both narcissistic and delusional so instead they focused on 2 things:

1. Keeping the lights on and morale high

2. Pumping their FTT bag

8/ FTT became central to both Alameda and FTX's survival.

As long as FTT performed adequately, they could use it as collateral for loans and sell it in the open market.

So when the CoinDesk article revealed that FTT was FTX's largest position, they faced an existential threat.

As long as FTT performed adequately, they could use it as collateral for loans and sell it in the open market.

So when the CoinDesk article revealed that FTT was FTX's largest position, they faced an existential threat.

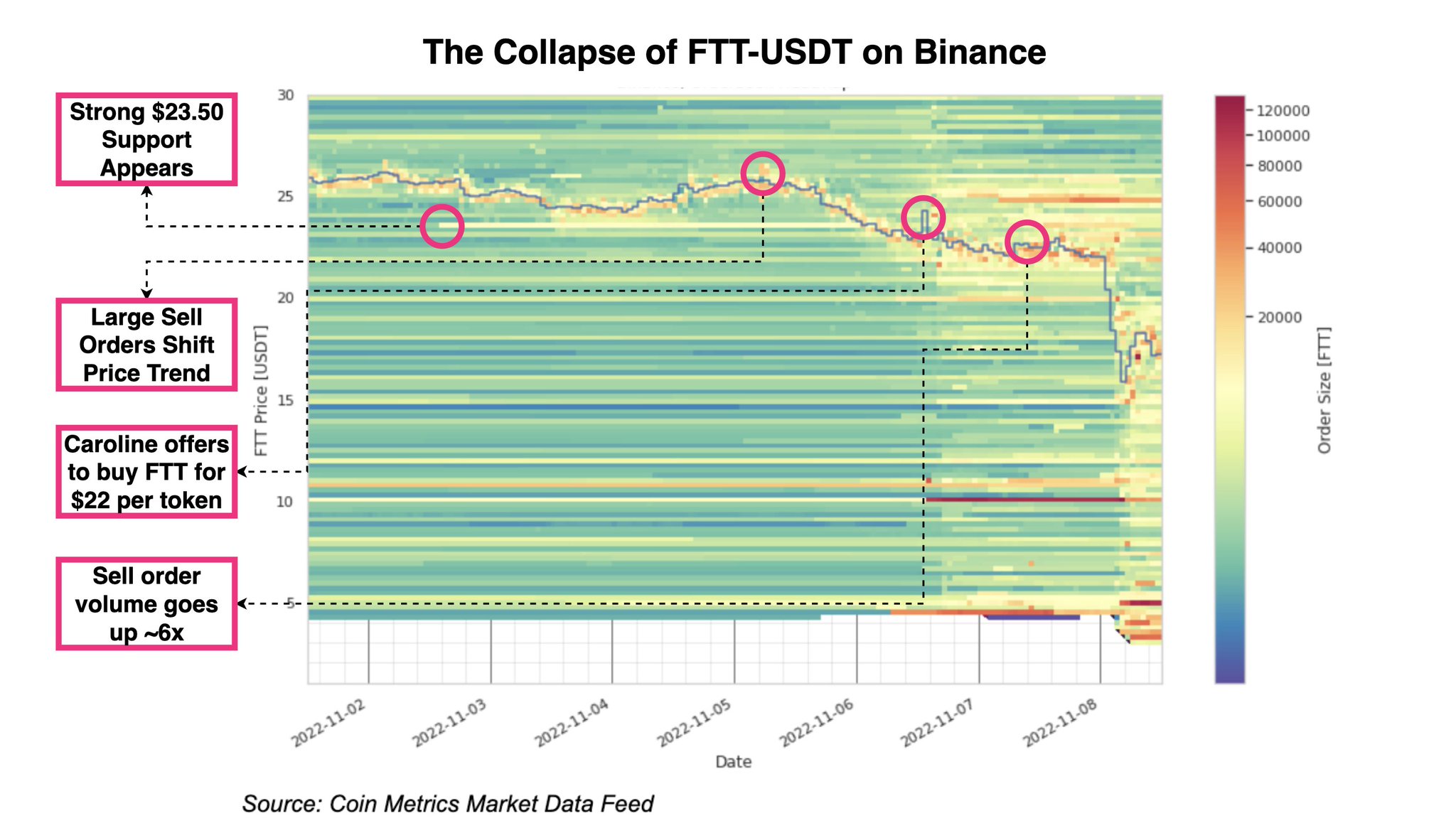

9/ It's clear looking at FTT markets on Binance that a large investor was allocating a considerable amount of USDT into protecting key price levels. First at $23.5, then at $10.

Our hypothesis is that Alameda was propping up that market, potentially with FTX user funds.

Our hypothesis is that Alameda was propping up that market, potentially with FTX user funds.

10/ This evidence adds a whole new dimension to the question of "where did user funds go?"

It's possible that funds were also used to prop up FTT's price starting in early 2022 when it outperformed several other similar tokens.

It's possible that funds were also used to prop up FTT's price starting in early 2022 when it outperformed several other similar tokens.

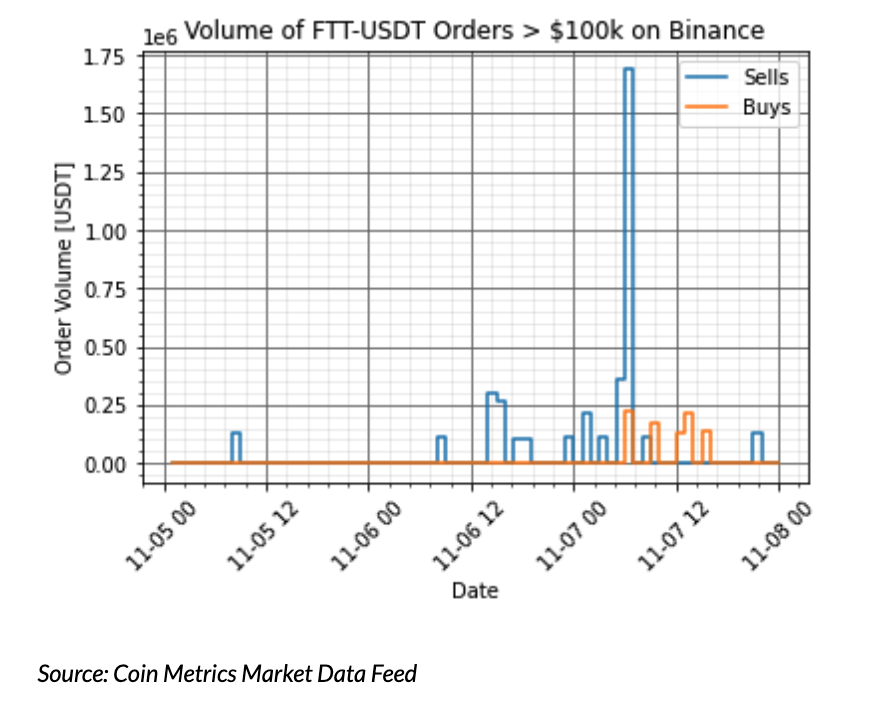

11/ For better or worse, the FTX bubble was popped on Binance's FTT-USDT market, potentially by Binance.

Binance was where price discovery was happening as FTT collapsed. This sharp increase in sell order volume on Nov 7 had something to do with it.

Binance was where price discovery was happening as FTT collapsed. This sharp increase in sell order volume on Nov 7 had something to do with it.

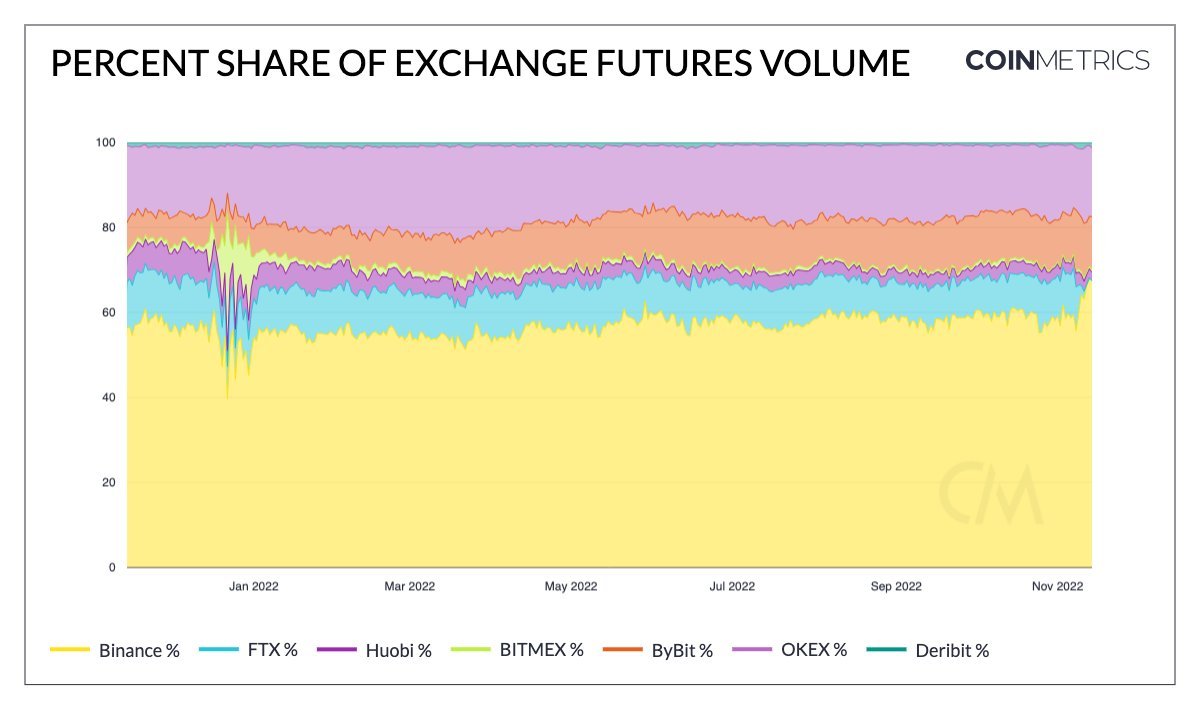

12/ Binance is a key player in this because, as I speculated previously, they might have seen this coming via similar on-chain analysis or by sensing Alameda's desperation.

Regardless, they positioned themselves favorably and walked out with FTX's entire share of futures volume:

Regardless, they positioned themselves favorably and walked out with FTX's entire share of futures volume:

13/ One thing I've realized is that the FTX/Alameda story is also a story about arrogance. Up until the very end they thought they could trade their way out of this mess.

On Nov 10 we caught them borrowing 1,000,000 USDT on Aave at a 52.9% interest rate:

etherscan.io/tx/0xC54FB48FBB62DEEBACFF5D32DE3CB9B9BBE475D82B1E3A49946314354E3F6FBB

On Nov 10 we caught them borrowing 1,000,000 USDT on Aave at a 52.9% interest rate:

etherscan.io/tx/0xC54FB48FBB62DEEBACFF5D32DE3CB9B9BBE475D82B1E3A49946314354E3F6FBB

14/ Make sure to check out the full report and subscribe to State of the Network, our free newsletter:

coinmetrics.substack.com/

coinmetrics.substack.com/

15/ Also, huge shoutout to the @coinmetrics team that contributed to this analysis @onchain_brewer, @ctbrazell, @matiasandroid_, @kylewaters_, @natemaddrey, @luyongxu, @Mudabir

Show them some love and give them a follow if you appreciated this thread.

Show them some love and give them a follow if you appreciated this thread.

Mentions

See All

Bruce Fenton @brucefenton

·

Nov 29, 2022

Yikes what a read