Thread

Ethereum is a trojan horse for tyranny.

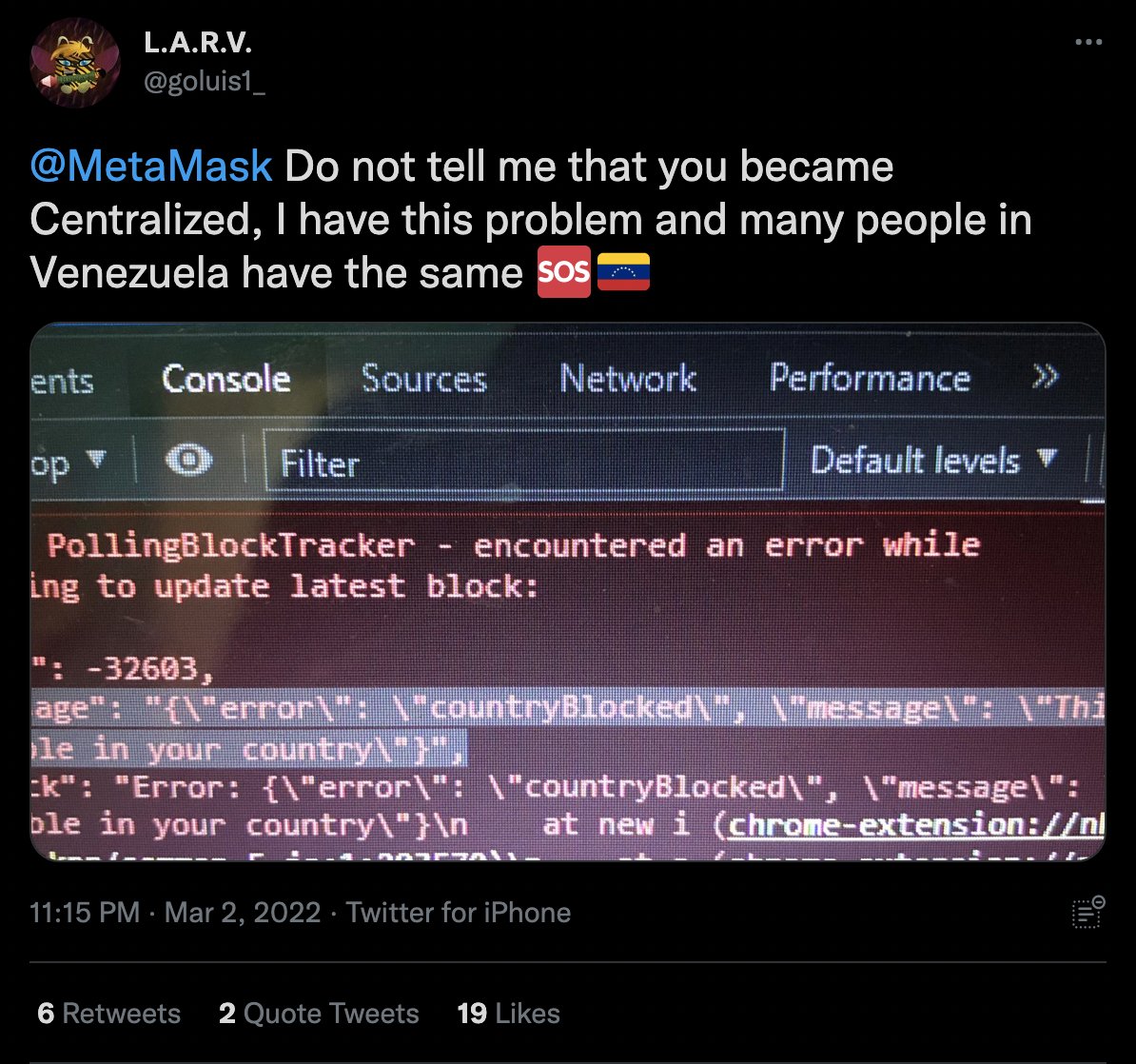

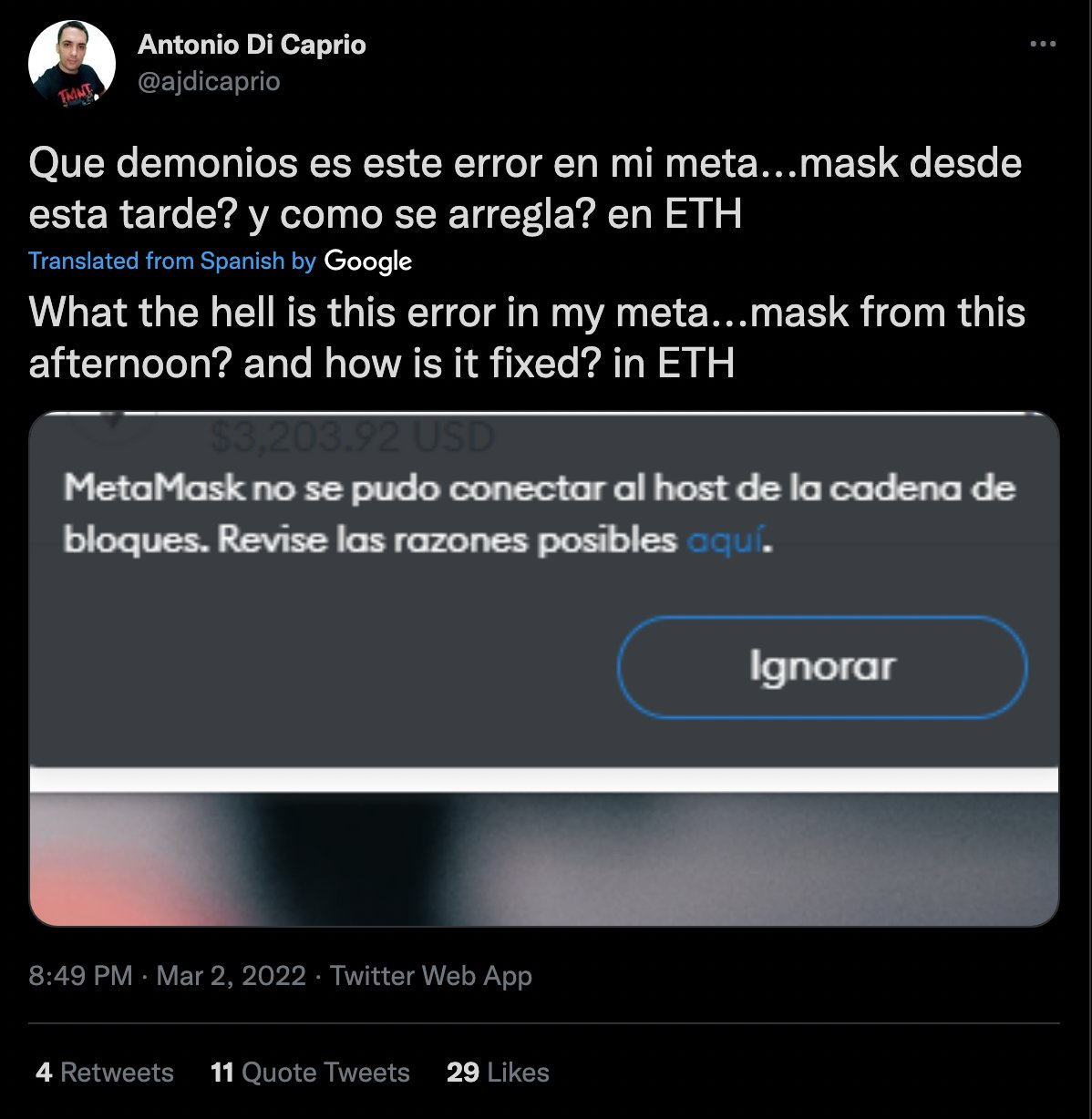

Consensys owns Infura & Metamask. JP Morgan, UBS, Mastercard own Consensys.

99% of EVM transactions go through Consensys.

DeFi is captured by VCs & banks.

Only #bitcoin is government-resistant. Ethereum is not even insider-resistant.

Consensys owns Infura & Metamask. JP Morgan, UBS, Mastercard own Consensys.

99% of EVM transactions go through Consensys.

DeFi is captured by VCs & banks.

Only #bitcoin is government-resistant. Ethereum is not even insider-resistant.

Source:

Looks like it was related to infura, even worse.

Disagreement by @Timccopeland over this. He’s suggesting tweets like mine are disinformation.

My response.

Throwback to December.

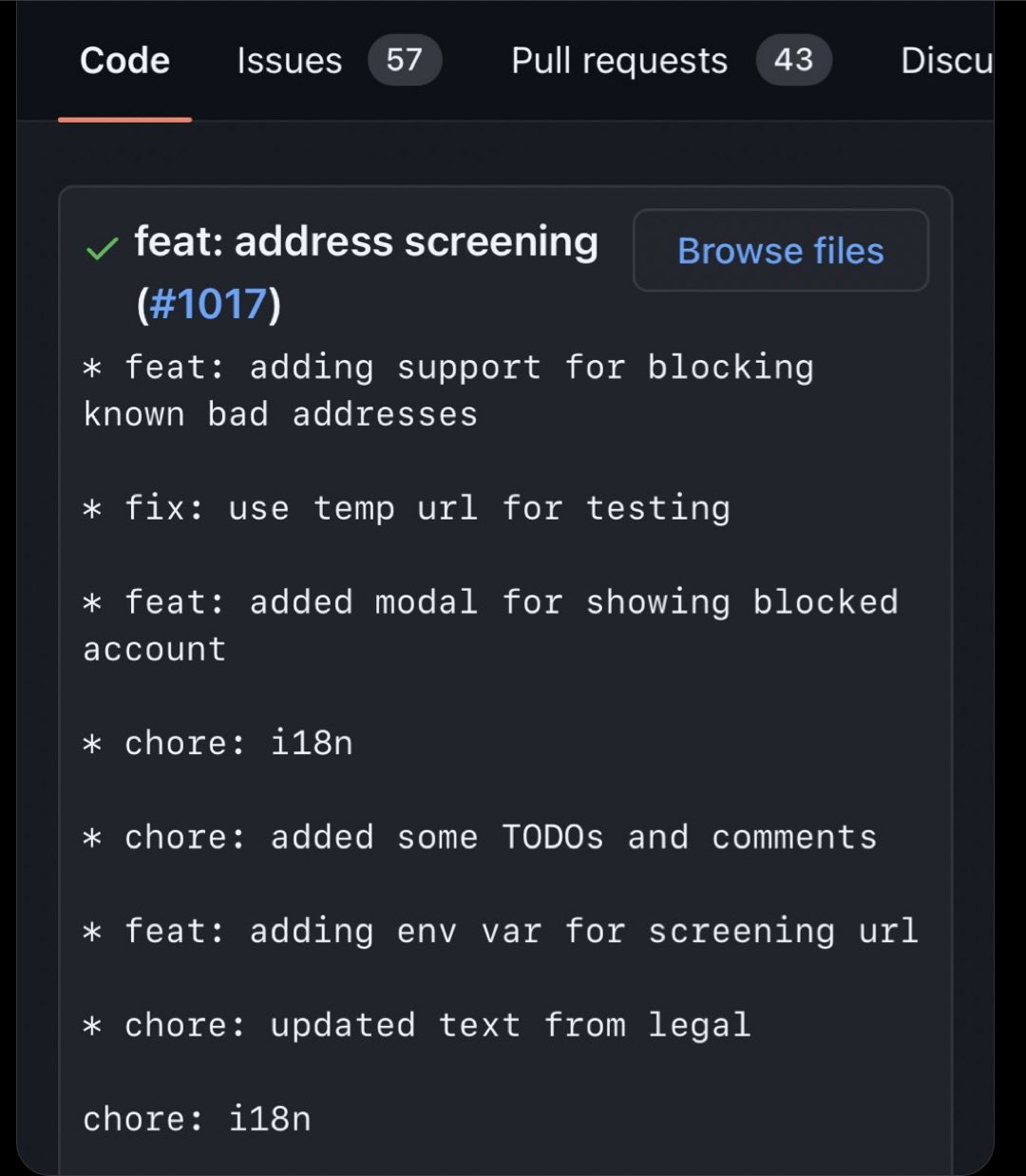

How does a DeFi protocol know you are American?

You are tracked across multiple vectors.

Why are DeFi protocols like 1inch and others making you sign compliance messages unless they are prepped for compliance not cypherpunk values?

Major defi protocols have business licenses. Decentralization theater.

To think you’re not being logged is naive.

To think you’re not being logged is naive.

Governance tokens are a joke. Governance voting is a LARP.

Many DeFi protocols have emergency keys or admin keys and often intervene. WBTC is custodied by BitGo, only a matter of time before they force aml / KYC on users who want to peg back out to real bitcoin.

Regulators are sending clear signals that DeFi is not in compliance.

Significant majority of DeFi companies are centralized & subject to US regulations.

Naive to think the US VCs & founders who got obscenely rich off their premines aren’t prepping to comply with policy changes.

Significant majority of DeFi companies are centralized & subject to US regulations.

Naive to think the US VCs & founders who got obscenely rich off their premines aren’t prepping to comply with policy changes.

Circle has been bending over backwards to comply with US regulators.

Biggest algo stablecoin DAI is pretty much wrapped USDC.

DeFi is infected with fake cypherpunks who *will* roll over - they can’t resist.

At this point, they can only hope to continue to capture the state.

Biggest algo stablecoin DAI is pretty much wrapped USDC.

DeFi is infected with fake cypherpunks who *will* roll over - they can’t resist.

At this point, they can only hope to continue to capture the state.

If you have not read @moxie’s impression of web3, you should - it’s eye opening for anyone who still thinks they have privacy in DeFi.

The difference between how a bitcoin company and an nft company respond to a government request to ban users should give you an idea of which one is more government resistant.

Another example of decentralization theater.

It’s all centralized, DAOs and governance votes are just a smoke screen.

They are changing the contract to force withdraw collateral from a whale that deposited $100M+ in SOL who is close to liquidation, so they can dump it OTC.

It’s all centralized, DAOs and governance votes are just a smoke screen.

They are changing the contract to force withdraw collateral from a whale that deposited $100M+ in SOL who is close to liquidation, so they can dump it OTC.

Still waiting for a reply from @jerallaire whether or not there’s a real risk that Circle can apply a global blacklist state to all addresses that have not KYC’d.

Can regulators order Circle to freeze all USDC that’s not whitelisted until the address does KYC.

Stablecoin 6102.

Can regulators order Circle to freeze all USDC that’s not whitelisted until the address does KYC.

Stablecoin 6102.

Not sure what the context of this tweet is, but I’m still waiting for an answer on the threat of global blacklist of USDC.

Who could have predicted this!?

When cypherpunks met Silicon Valley & Wall St.

As we bitcoin maxis predicted, VCs & developers who very publicly print billions of dollars for themselves via token bubble schemes do *not* want to go to jail.

Ethereum DeFi was a trojan horse for tyranny.

As we bitcoin maxis predicted, VCs & developers who very publicly print billions of dollars for themselves via token bubble schemes do *not* want to go to jail.

Ethereum DeFi was a trojan horse for tyranny.

Many reports of AAVE now engaging in censorship, as predicted.

The DeFi primitives are not that decentralized after all 😱

Justin Sun, who at one point had $4+ Billion in AAVE, was censored from AAVE over someone who sent 0.1 ETH to him from Tornado Cash.

The DeFi primitives are not that decentralized after all 😱

Justin Sun, who at one point had $4+ Billion in AAVE, was censored from AAVE over someone who sent 0.1 ETH to him from Tornado Cash.

Great thread from @_Checkmatey_ regarding the game theory fails piling up for Ethereum “DeFi” re: TC.

It’s turning out to be just a poor UX on top of traditional finance where instead of company equity you trade and buy worthless VC / quant dev circle jerk premined tokens.

It’s turning out to be just a poor UX on top of traditional finance where instead of company equity you trade and buy worthless VC / quant dev circle jerk premined tokens.

The temporary grey market window for pirate protocols is closing fast.

Get out of DeFi while you can.

It is probably too late to get out with your privacy.

You’ve been tracked and logged for a while now.

Get out of DeFi while you can.

It is probably too late to get out with your privacy.

You’ve been tracked and logged for a while now.

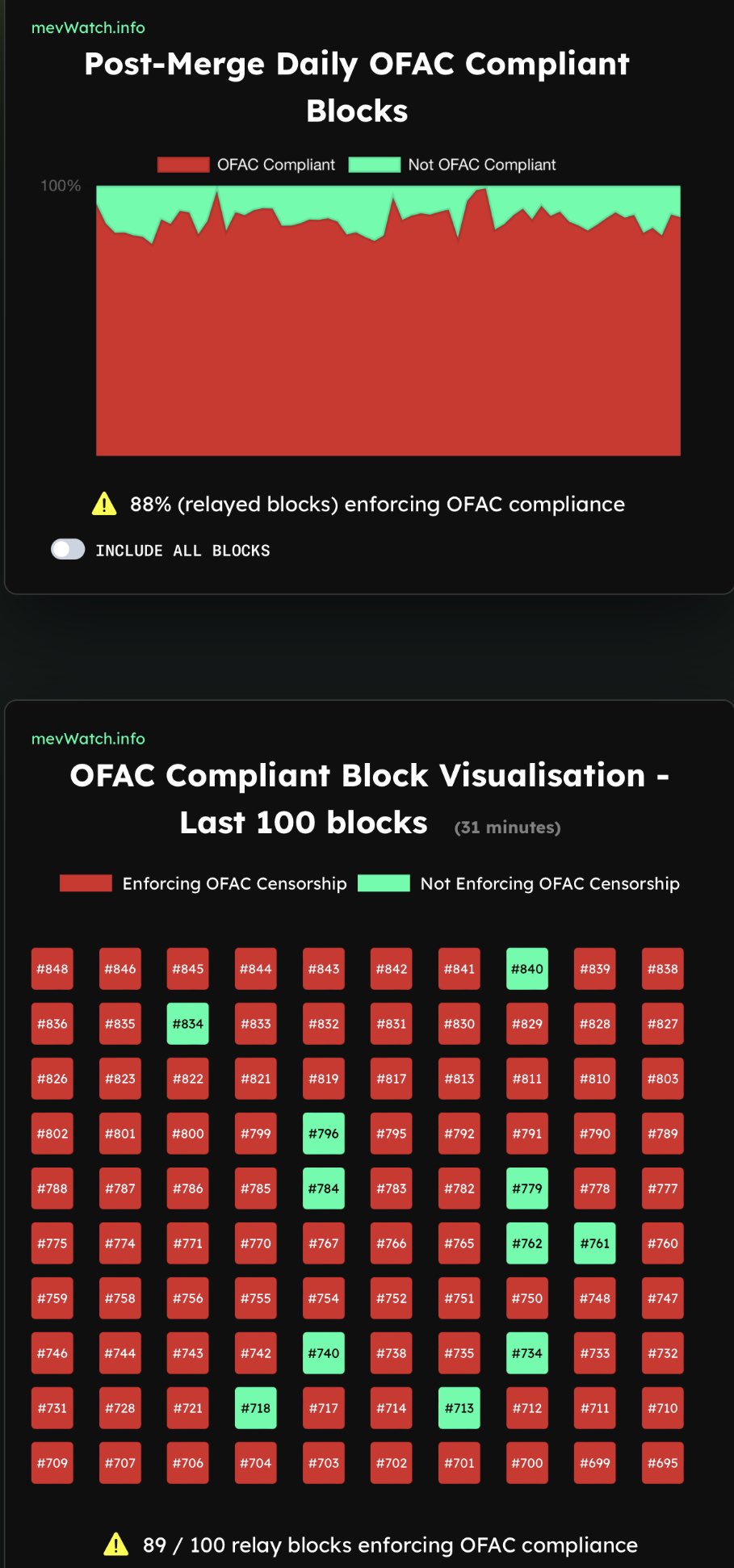

Wow. @ercwl does not understand who the average Ethereum holder is.

He thinks they can do a user activated soft fork of ethereum to block OFAC compliance …

What a joke.

He’s either just shit disturbing or delusional.

His tungsten cube will soon be mine.

He thinks they can do a user activated soft fork of ethereum to block OFAC compliance …

What a joke.

He’s either just shit disturbing or delusional.

His tungsten cube will soon be mine.

88% of relayed Ethereum blocks are now being censored.

What happened to the user activated soft fork @ercwl?

This is what happens when you collude with Wall St, Silicon Valley, WEF & the gov't to build your ecosystem as you prove time after time your governance is centralized.

What happened to the user activated soft fork @ercwl?

This is what happens when you collude with Wall St, Silicon Valley, WEF & the gov't to build your ecosystem as you prove time after time your governance is centralized.

Central Banks are loving ethereum as their dystopian CBDC blockchain of choice because they know that it is captured.

All of the big Silicon Valley VC backed web 2.0 tech companies became tyranny brokers.

The same profit monsters are building web3.

cointelegraph.com/news/norwegian-central-bank-uses-ethereum-to-build-national-digital-currency

All of the big Silicon Valley VC backed web 2.0 tech companies became tyranny brokers.

The same profit monsters are building web3.

cointelegraph.com/news/norwegian-central-bank-uses-ethereum-to-build-national-digital-currency

👀

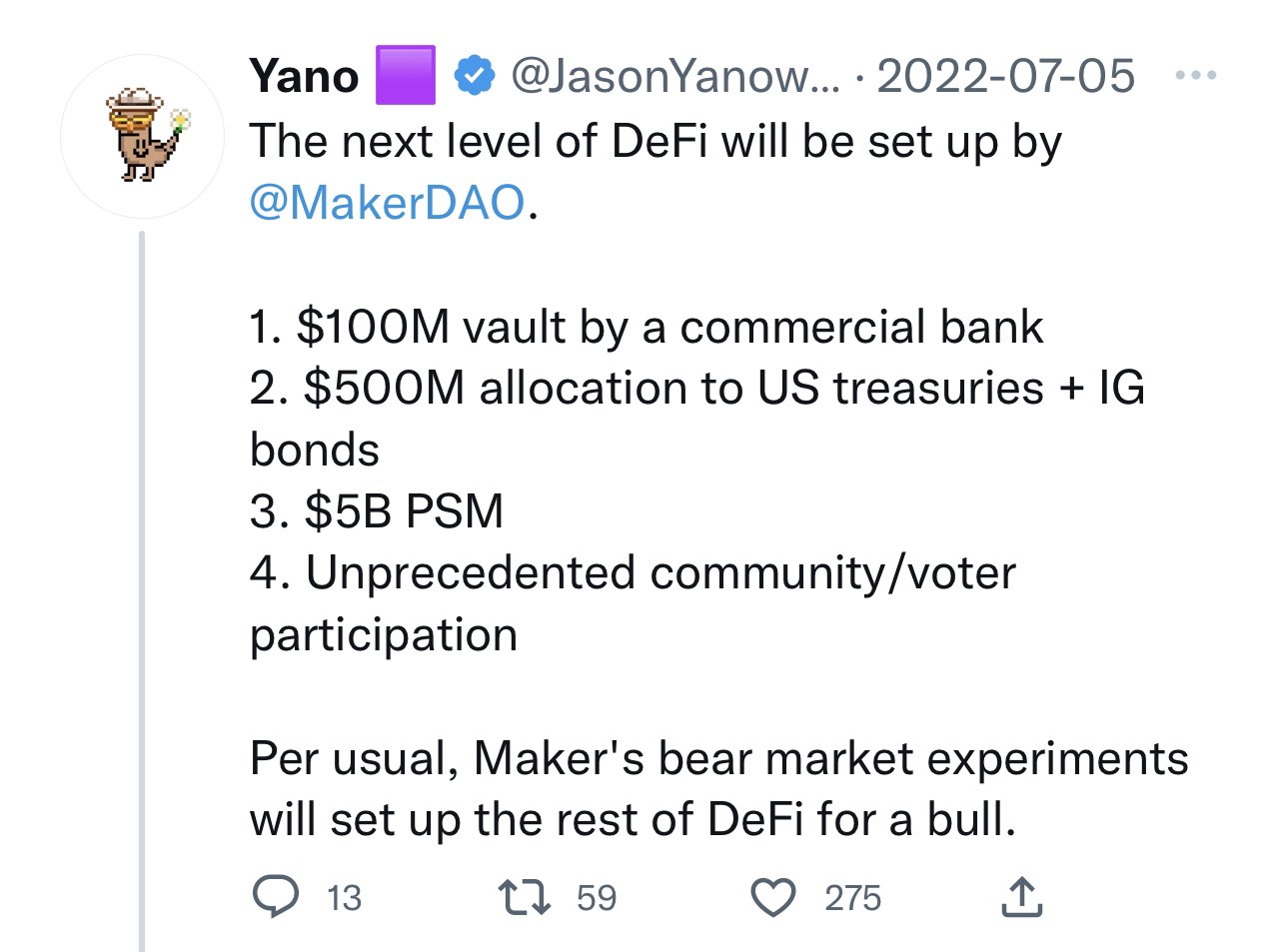

More proof DeFi is a LARP and the biggest primitives have already capitulated on the “decentralized” part.

You can’t be decentralized if you are giving your treasury to Coinbase and buying US Treasuries 🤦♂️🤦♂️🤦♂️

How long until Maker updates the DAI contract to enforce OFAC 🤔

You can’t be decentralized if you are giving your treasury to Coinbase and buying US Treasuries 🤦♂️🤦♂️🤦♂️

How long until Maker updates the DAI contract to enforce OFAC 🤔

Even the founder of MakerDAO (who died shortly after this tweet) agrees with this sentiment of Ethereum being captured by bankers.

Mentions

There are no mentions of this content so far.