Thread

The aftermath of @avi_eisen's on-chain CRV short.

What went right, and what went wrong.

Did AAVE 'win' this round?

Lets dive in. 👇

What went right, and what went wrong.

Did AAVE 'win' this round?

Lets dive in. 👇

Firstly to reiterate: Arkham cannot assume Avi's directional exposure.

One short position ≠ net short exposure.

The position on AAVE was built up over ~1 week, so it is difficult to verify how Avi may have been positioning the remainder of his capital, on- or off-chain.

One short position ≠ net short exposure.

The position on AAVE was built up over ~1 week, so it is difficult to verify how Avi may have been positioning the remainder of his capital, on- or off-chain.

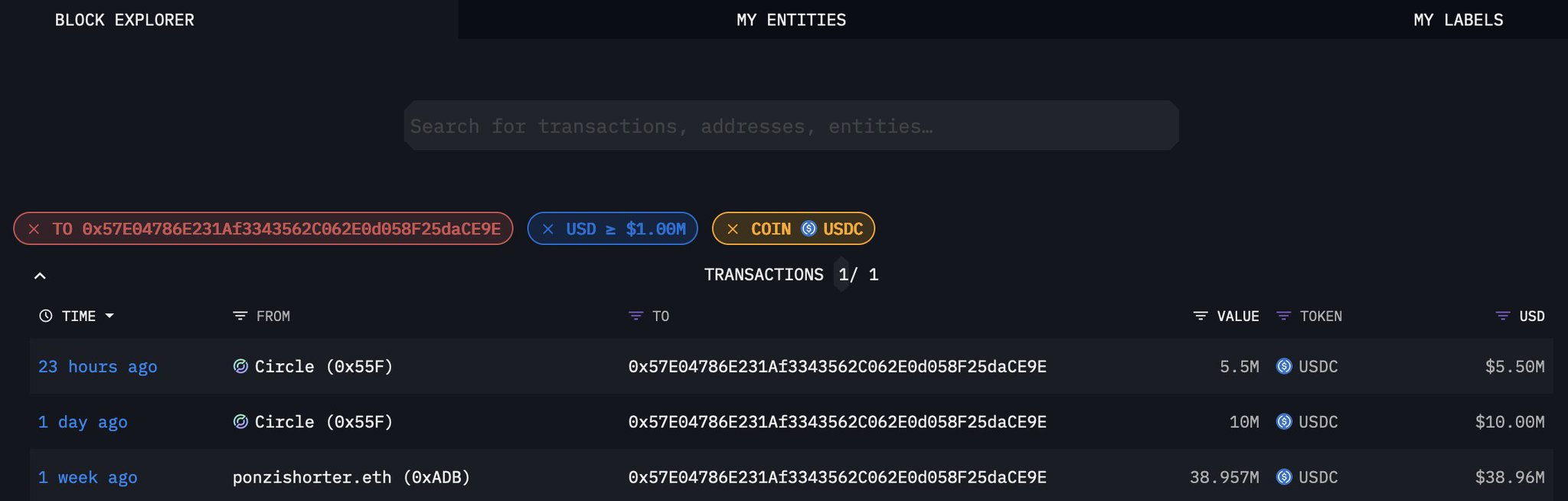

The core of Avi's on-chain position was based around injecting USDC collateral to a leveraged CRV borrow on AAVE.

Total inflows to the address: ~55.5 million USDC, from his address ponzishorter.eth and Circle.

Total outflows to OKX: ~71.5 million CRV tokens.

Total inflows to the address: ~55.5 million USDC, from his address ponzishorter.eth and Circle.

Total outflows to OKX: ~71.5 million CRV tokens.

His entire position was eventually liquidated leaving around $1.6 million of borrowed CRV in bad debt to the protocol.

AAVE framed this as the protocol working as intended.

However only yesterday, Arkham believed this could have resulted in "severe bad debt"

So why was that?

AAVE framed this as the protocol working as intended.

However only yesterday, Arkham believed this could have resulted in "severe bad debt"

So why was that?

CRV liquidity on-chain, and on CEX's, is relatively low.

The core problem was not with AAVE itself, but the liquidators' ability to source CRV.

Liquidation bots attempting to acquire CRV through buying it on-market would have faced themselves with a lot of slippage.

The core problem was not with AAVE itself, but the liquidators' ability to source CRV.

Liquidation bots attempting to acquire CRV through buying it on-market would have faced themselves with a lot of slippage.

If the liquidators are able to effectively source CRV with low slippage, or in a way that does not significantly impact market price, there is no problem.

But if there is slippage, it's not the liquidators' problem - it's AAVE's bad debt to bear.

But if there is slippage, it's not the liquidators' problem - it's AAVE's bad debt to bear.

Most liquidation transactions take place atomically.

That is, the liquidator sources the CRV, exchanges the debt tokens, then receives the liquidated collateral, all in one bundle.

There is a penalty to the liquidated party - so it pays quite well to be a liquidator!

That is, the liquidator sources the CRV, exchanges the debt tokens, then receives the liquidated collateral, all in one bundle.

There is a penalty to the liquidated party - so it pays quite well to be a liquidator!

The real issue is co-ordination.

The incentives:

Liquidators will liquidate the collateral as quickly as possible, happy to move price to do this - as they want to get paid.

AAVE tokenholders do not wish to see AAVE accrue bad debt, so want to prevent unfavourable liquidation.

The incentives:

Liquidators will liquidate the collateral as quickly as possible, happy to move price to do this - as they want to get paid.

AAVE tokenholders do not wish to see AAVE accrue bad debt, so want to prevent unfavourable liquidation.

It is very difficult to co-ordinate with a party whose code executes automatically.

As you can see, the liquidators repaying Avi's loan in chunks (screenshot) are multitudinous and uncaring.

As you can see, the liquidators repaying Avi's loan in chunks (screenshot) are multitudinous and uncaring.

Certain liquidators attempted to "buy time" by actually liquidating Avi with CRV tokens that they themselves, borrowed from AAVE.

This liquidator took on the debt, bought Avi's liquidated USDC at a discount, and unwound the position when the drama had subsided.

This liquidator took on the debt, bought Avi's liquidated USDC at a discount, and unwound the position when the drama had subsided.

However, even this was not enough to fully liquidate Avi's CRV short.

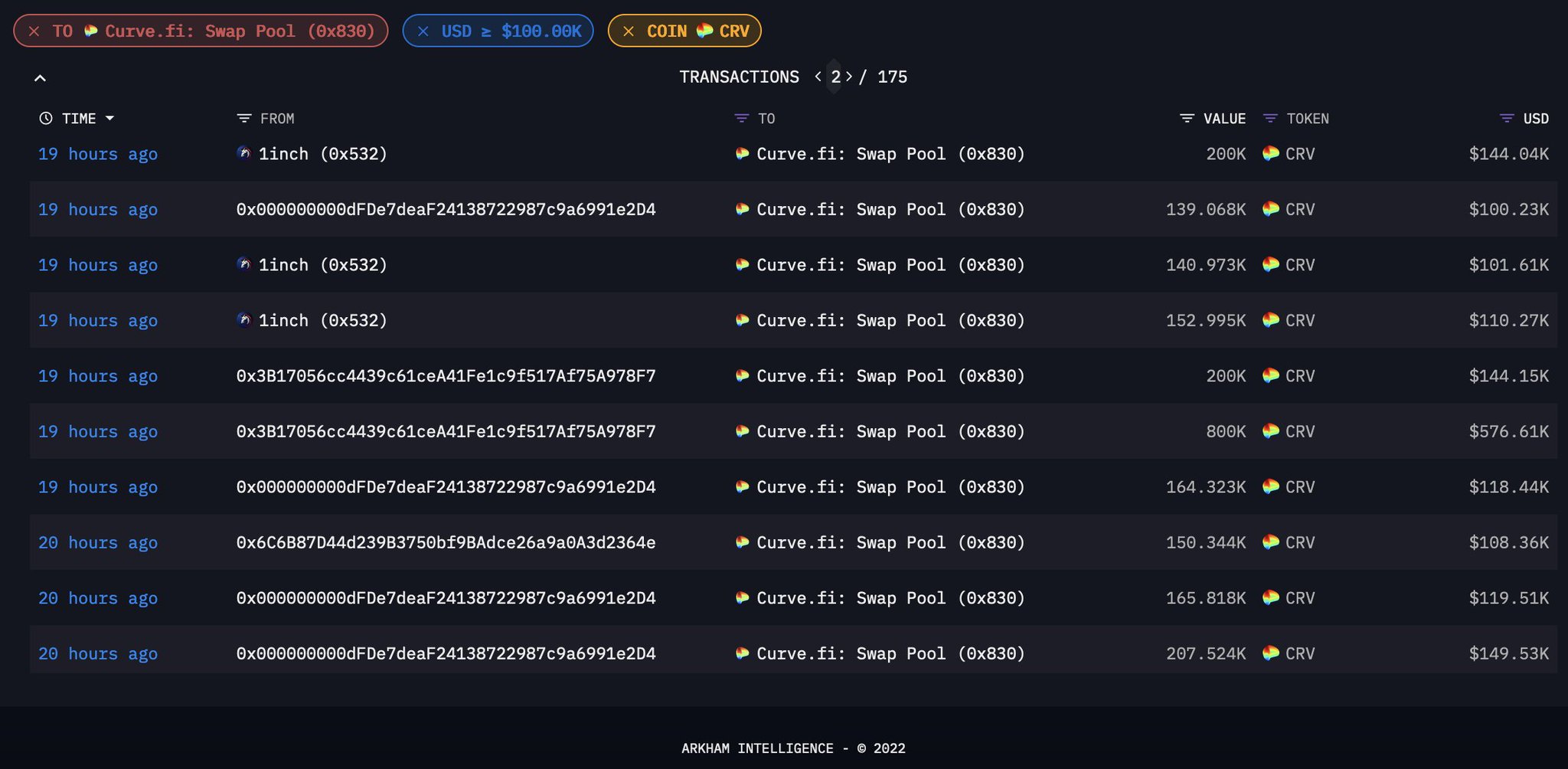

Other liquidators were busy sourcing CRV from the largest pool on-chain, which is the @CurveFinance CRV pool, featured yesterday.

Other liquidators were busy sourcing CRV from the largest pool on-chain, which is the @CurveFinance CRV pool, featured yesterday.

The price of CRV needed to be kept low enough to prevent liquidation on unfavourable terms.

Millions of dollars worth of CRV was sold into this pool for 40 minutes straight - until the entire position was liquidated.

(unfortunately, the graphic doesn't show every transaction)

Millions of dollars worth of CRV was sold into this pool for 40 minutes straight - until the entire position was liquidated.

(unfortunately, the graphic doesn't show every transaction)