Thread by Ram Ahluwalia, crypto CFA

- Tweet

- Nov 25, 2022

- #Cryptocurrency #CentralBank

Thread

1/ DCG published a letter to investors. It clarifies several misconceptions. It also raises new questions around the Promissory Note.

I have pored over this and the Grayscale 10-Q to connect some dots. We'll cover what happened and what we learned.

Let's break it down... 🧵

I have pored over this and the Grayscale 10-Q to connect some dots. We'll cover what happened and what we learned.

Let's break it down... 🧵

2/ What did we learn?

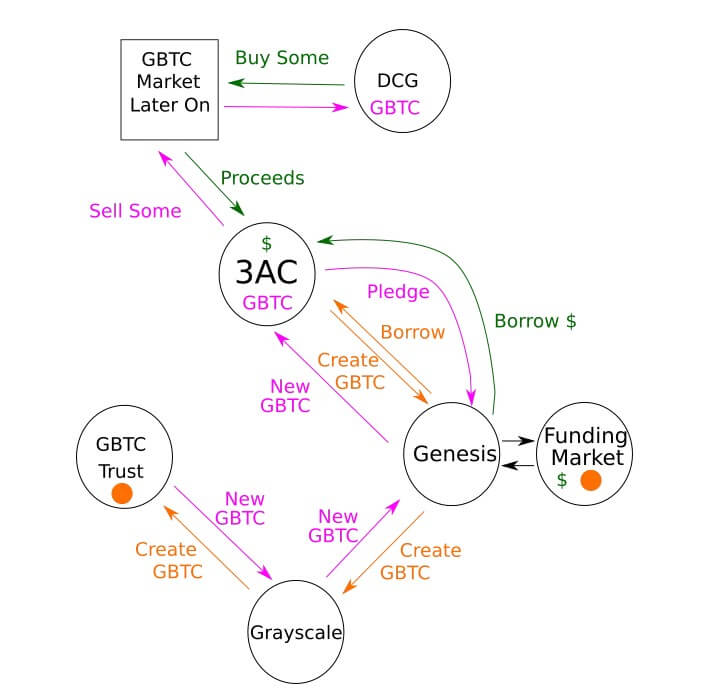

DCG was levered long GBTC. 3AC blows up. This writedown reduces equity capital at Genesis Lending.

Net net this increases the DCG's already levered exposure to GBTC.

And the more GBTC slides in price, the more DCG's leverage increases.

How exactly?

DCG was levered long GBTC. 3AC blows up. This writedown reduces equity capital at Genesis Lending.

Net net this increases the DCG's already levered exposure to GBTC.

And the more GBTC slides in price, the more DCG's leverage increases.

How exactly?

3/ DCG owes ~$2 Bn to two creditors: subsidiary Genesis Lending and Eldridge

- Genesis Lending. There are two loans a $575 MM loan (loan #1) and a $1.1 Bn loan 'Promissory Note' (loan #2)

- A group led by Eldridge issued a credit facility of $350 MM

- Genesis Lending. There are two loans a $575 MM loan (loan #1) and a $1.1 Bn loan 'Promissory Note' (loan #2)

- A group led by Eldridge issued a credit facility of $350 MM

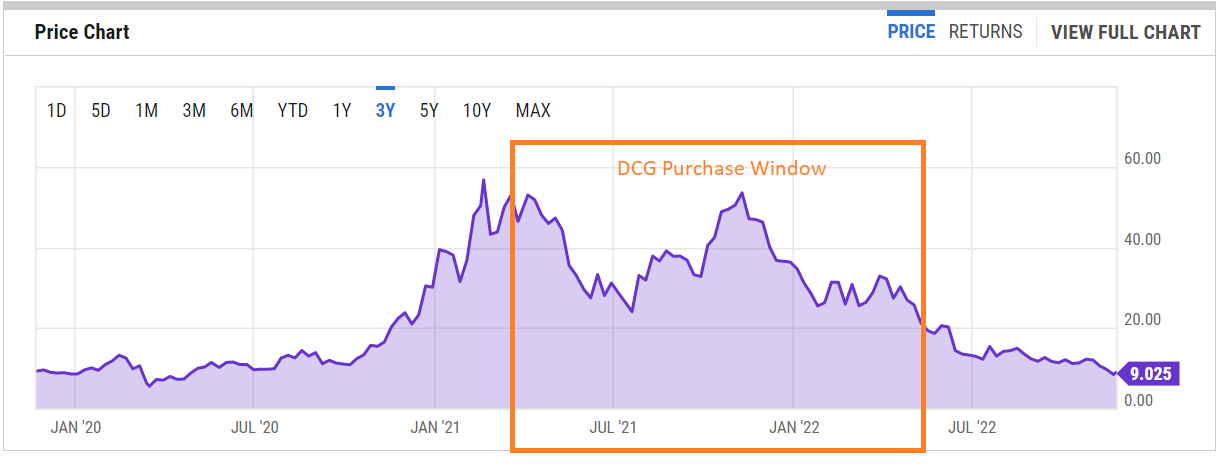

4/ We'll focus here on Loan #1 - ('GBTC Loan') - DCG pledged its GBTC holdings to borrow $575 MM from subsidiary Genesis Lending. We don't know the timing.

DCG purchased $778 MM of GBTC from March 2021 thru Jun 2022. DCG stopped purchases after 3AC blow-up, Source: 10Q

DCG purchased $778 MM of GBTC from March 2021 thru Jun 2022. DCG stopped purchases after 3AC blow-up, Source: 10Q

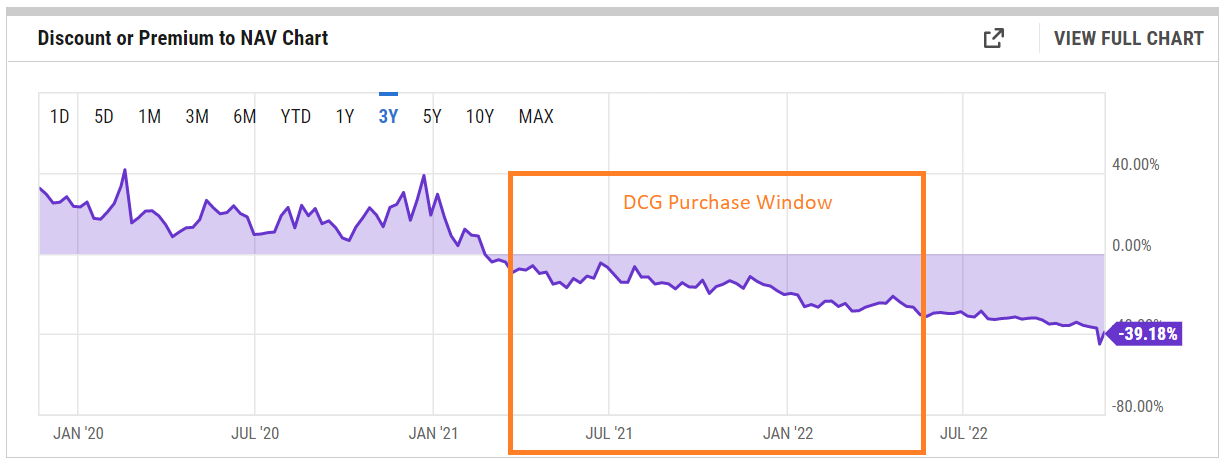

5/ DCG was betting the discount to NAV would close - the same trade 3AC was making. Genesis Lending was financing both DCG and 3AC on the same trade.

They shared the same view. 3AC buying GBTC helps close the gap.

GBTC was at a Discount to NAV of 7% to 30% during the period

They shared the same view. 3AC buying GBTC helps close the gap.

GBTC was at a Discount to NAV of 7% to 30% during the period

6/ But DCG faced a double whammy. The value of GBTC dropped due to: i) a decline in the value of bitcoin, ii) and a widening of the NAV discount to 45%

3AC was once the largest holder of GBTC (38 MM shares). DCG assumed some or all of this GBTC when they margin called.

3AC was once the largest holder of GBTC (38 MM shares). DCG assumed some or all of this GBTC when they margin called.

7/ The discount kept widening leading to the 3AC blow-up. 3AC had a collateral shortfall of $462 MM.

This exposed Genesis Lending to insolvency and DCG came to the rescue.

DCG holdings of GBTC shares at the end of June have now nearly doubled to 67 MM shares held

This exposed Genesis Lending to insolvency and DCG came to the rescue.

DCG holdings of GBTC shares at the end of June have now nearly doubled to 67 MM shares held

8/ As an aside, it's unusual for a closed-end fund to trade more than 25% discount to NAV for this long. I respect the long thesis.

However, the parties bet way too much. And they did not hedge BTC price declines. (Did anyone hedge?)

The gap widening was the first domino...

However, the parties bet way too much. And they did not hedge BTC price declines. (Did anyone hedge?)

The gap widening was the first domino...

9/ After the 3AC blow-up, DCG stops buying GBTC thru end of September.

DCG is already levered long GBTC and the discount & price of GBTC is going against them. Ever since 3AC, DCG is is focused on deleveraging their balance sheet.

DCG is already levered long GBTC and the discount & price of GBTC is going against them. Ever since 3AC, DCG is is focused on deleveraging their balance sheet.

10/ We won't know if DCG sold GBTC after Sept (until Feb filing). I expect they are - that would explain the discount widening to record levels - nearly 50%.

The market knows DCG is attempting to delever and also holds the most GBTC. (Folks may be front running the 'JPM whale'.)

The market knows DCG is attempting to delever and also holds the most GBTC. (Folks may be front running the 'JPM whale'.)

11/ DCG is delevering thru earnings and potentially GBTC asset sales. DCG's weighted average purchase price of GBTC was ~$24 (vs. $9 where it trades today).

If DCG does sell GBTC, they would incur significant realized losses.

DCG's *unrealized* losses in Q3 alone total $268 MM

If DCG does sell GBTC, they would incur significant realized losses.

DCG's *unrealized* losses in Q3 alone total $268 MM

12/ The unrealized loss is about the same as Grayscale's current annual run-rate revenue generation of $273 MM.

Note 1: We can only measure Grayscale revenue (not earnings or margin)

Note 2: Grayscale's Q3 revs were $68 MM down ~50% YOY

Note 1: We can only measure Grayscale revenue (not earnings or margin)

Note 2: Grayscale's Q3 revs were $68 MM down ~50% YOY

13/ Grayscale has sufficient earnings power to pay off Loan #1.

But there is the business of Loan #2 - the $1.1 Bn Promissory Note due in 10 years.

That loan is the bigger headache for DCG and giving prospective investors some pause.

More in next thread. Please give a RT! 🙏

But there is the business of Loan #2 - the $1.1 Bn Promissory Note due in 10 years.

That loan is the bigger headache for DCG and giving prospective investors some pause.

More in next thread. Please give a RT! 🙏

14/ My take is DCG has enough revenue generating power to absorb these liabilities and losses. But I can only see the Grayscale P&L.

DCG is a source of strength. They can absorb $2n in losses. I don't see a DCG solvency risk on the table.

That's good news for the ecosystem.

DCG is a source of strength. They can absorb $2n in losses. I don't see a DCG solvency risk on the table.

That's good news for the ecosystem.

15/ Grayscale’s revenues are directly linked to the value of Bitcoin. As I noted, Grayscale generates 50% less revenue YOY. If BTC drops a bunch, then we need to re-assess. The smart move for DCG is raise capital so they can immunize fully against BTC price risk

16/ Clarification 1:

The $575 MM loan from Genesis Lending to DCG may simply be a corporate loan (e.g. DCG may not have pledged GBTC collateral). It's doesn't change the broad conclusion - but that mean DCG has less risk of a margin call from Genesis. DCG has not clarified that.

The $575 MM loan from Genesis Lending to DCG may simply be a corporate loan (e.g. DCG may not have pledged GBTC collateral). It's doesn't change the broad conclusion - but that mean DCG has less risk of a margin call from Genesis. DCG has not clarified that.

17/ Parting thought. The ‘duration mismatch’ - the opening of the letter is a fig leaf. If that were the case, Genesis could seek a credit facility for its assets (the same way DCG did with Eldridge). Or they could sell the loans at par to generate liquidity and payback creditors

18/ The core issue is an impairment to equity (and likely operational and asset quality issues). 3AC ripped a hole thru the the Genesis balance sheet. DCG’s promissory note is a bandaid. The remedy for a loss of equity capital is fresh equity capital. It’s that simple folks.

Mentions

See All

Adam Back @adam3us

·

Nov 25, 2022

good thread summarizing DCG + genesis loans.