Thread

If you've never heard of TARGET2, you will soon. Why?

Europe has a rapidly growing capital balance problem.

Time for an ECB 🧵👇

Europe has a rapidly growing capital balance problem.

Time for an ECB 🧵👇

🎯 What is TARGET2?

First, TARGET is an acronym that stands for Trans-European Automated Real-time Gross Settlement Express Transfer System

Right. We’ll stick with TARGET

And 2 just means it’s the second iteration of the payment system implemented by the Eurozone.

First, TARGET is an acronym that stands for Trans-European Automated Real-time Gross Settlement Express Transfer System

Right. We’ll stick with TARGET

And 2 just means it’s the second iteration of the payment system implemented by the Eurozone.

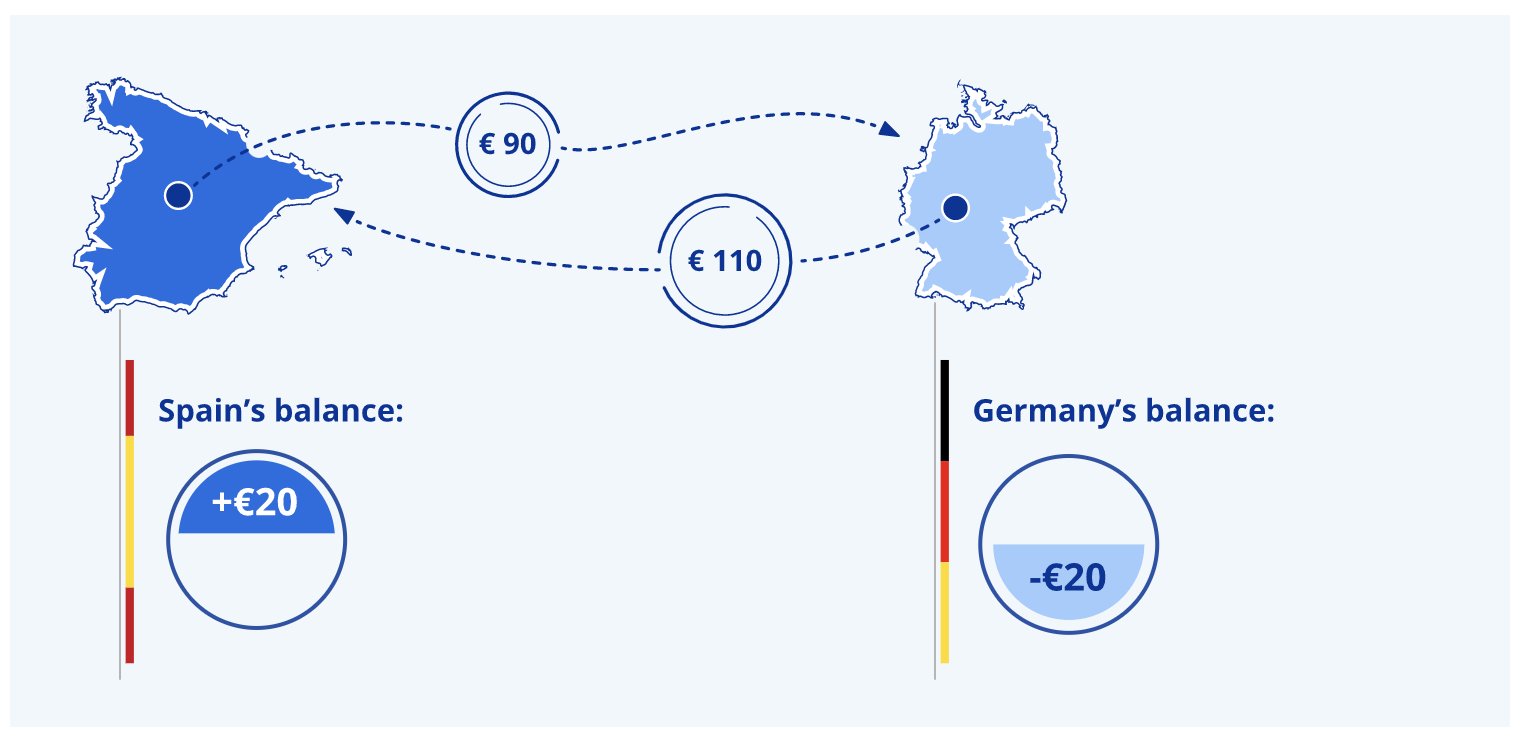

Put simply, TARGET2 is the payment system used by Eurozone central banks to settle cross-border payments in real time

TARGET2 transactions are anything from payment for a goods delivery, to the purchase of a security or loan payment, to the simple deposit of funds at a bank.

TARGET2 transactions are anything from payment for a goods delivery, to the purchase of a security or loan payment, to the simple deposit of funds at a bank.

At the end of each business day, all claims and liabilities are automatically cleared and transferred to the ECB (European Central Bank), leaving each NCB (National Central Bank) with a total liability or claim on the TARGET2 (ECB) balance sheet.

i.e., (www.ecb.europa.eu)

i.e., (www.ecb.europa.eu)

One Big Key: TARGET2 also settles all ECB monetary policy operations

TARGET2, therefore, gives us insight as to which country is borrowing and which is lending,

and hence, how the ECB is playing games with strong country balance sheets propping up weaker ones in the Eurozone.

TARGET2, therefore, gives us insight as to which country is borrowing and which is lending,

and hence, how the ECB is playing games with strong country balance sheets propping up weaker ones in the Eurozone.

FYI, we have a settlement system in the US Federal Reserve System called the Interdistrict Settlement Account (ISA) amongst the twelve Fed branches

A big difference between TARGET2 and ISA is that the balances between the reserve banks are resolved regularly with settlement.

A big difference between TARGET2 and ISA is that the balances between the reserve banks are resolved regularly with settlement.

In contrast, there's no mechanism in place to ensure settlement between Eurozone Central Banks in the TARGET2 system

The balances are just calculated and noted. 🙄

The balances are just calculated and noted. 🙄

🧐 What are the current balances?

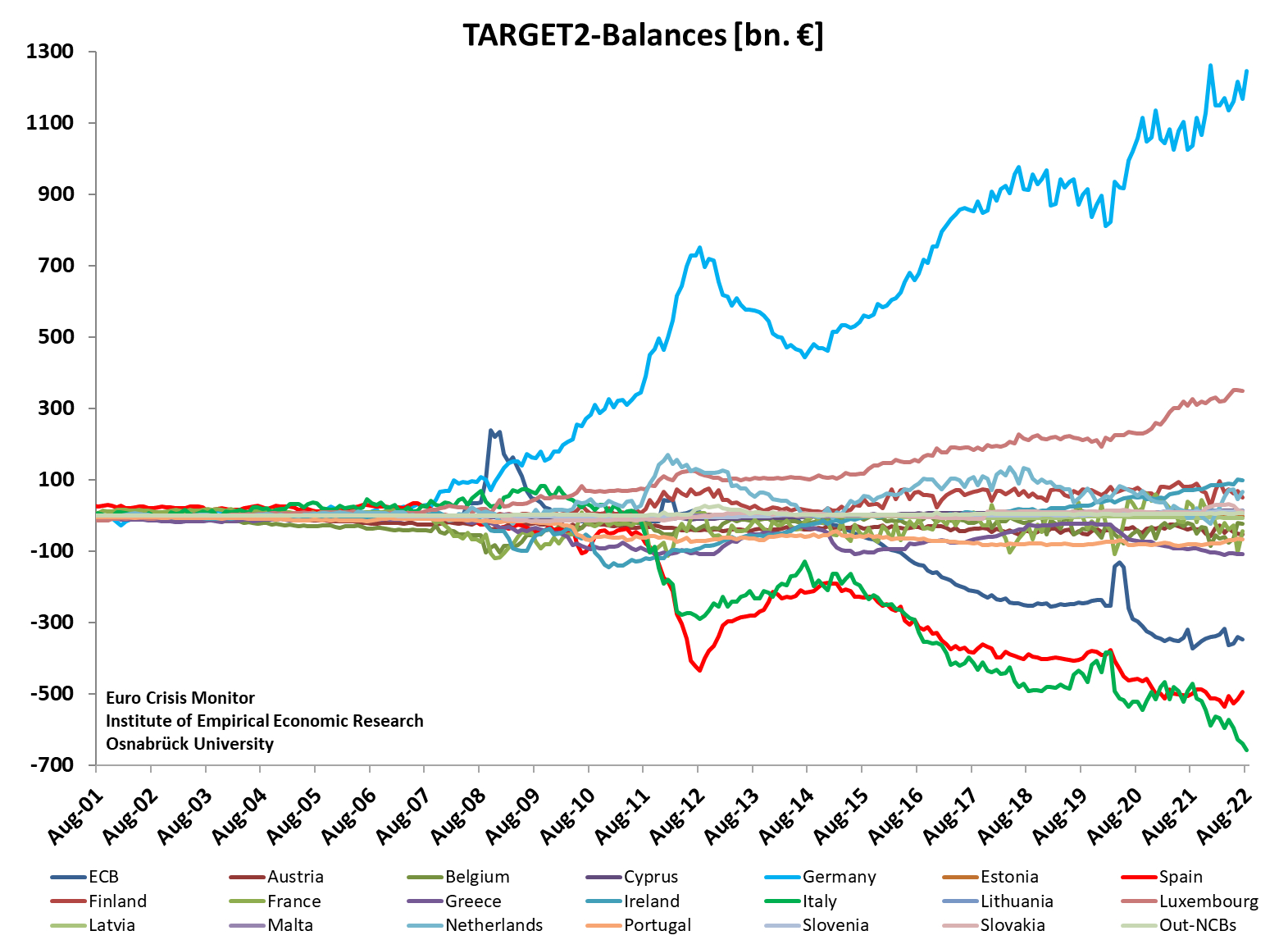

Before 2008, the balances (liabilities and claims) of each central bank remained relatively small

This is partly because of the opaque nature of the original TARGET system that was used up until 2007.

Before 2008, the balances (liabilities and claims) of each central bank remained relatively small

This is partly because of the opaque nature of the original TARGET system that was used up until 2007.

A bigger reason is the virtually unlimited credit facilities made available by Eurozone central banks and the ECB after 2008

Then, in March 2020, the ECB further increased the Asset Purchase Program (APP) and added a new program, the Pandemic Emergency Purchase Program (PEPP).

Then, in March 2020, the ECB further increased the Asset Purchase Program (APP) and added a new program, the Pandemic Emergency Purchase Program (PEPP).

So, more QE exacerbated imbalances between countries with current account surpluses (i.e., Germany) and those with current account deficits (i.e, Italy).

Reminder: current accounts are just trade imbalances

If I export more than I import, then I have a surplus, and vice versa.

Reminder: current accounts are just trade imbalances

If I export more than I import, then I have a surplus, and vice versa.

So, where do the balances stand, and can you guess which country is essentially the Central Bank to the rest of the Eurozone?

You got it. No surprise, Germany is Europe’s sugar daddy.

You got it. No surprise, Germany is Europe’s sugar daddy.

😨 What are the implications?

We have an expression on Wall Street that goes like this:

If you owe the bank $100,000, it’s your problem, but if you owe the bank $100 million, it’s the bank’s problem

Germany has a problem.

We have an expression on Wall Street that goes like this:

If you owe the bank $100,000, it’s your problem, but if you owe the bank $100 million, it’s the bank’s problem

Germany has a problem.

As banker to Europe, with current net claims of €1.2T, Germany has little to no recourse but to continue funding the problem and pushing toward a reversal for deficit running countries

The most indebted country?

Italy, with a TARGET2 balance of €658B.

The most indebted country?

Italy, with a TARGET2 balance of €658B.

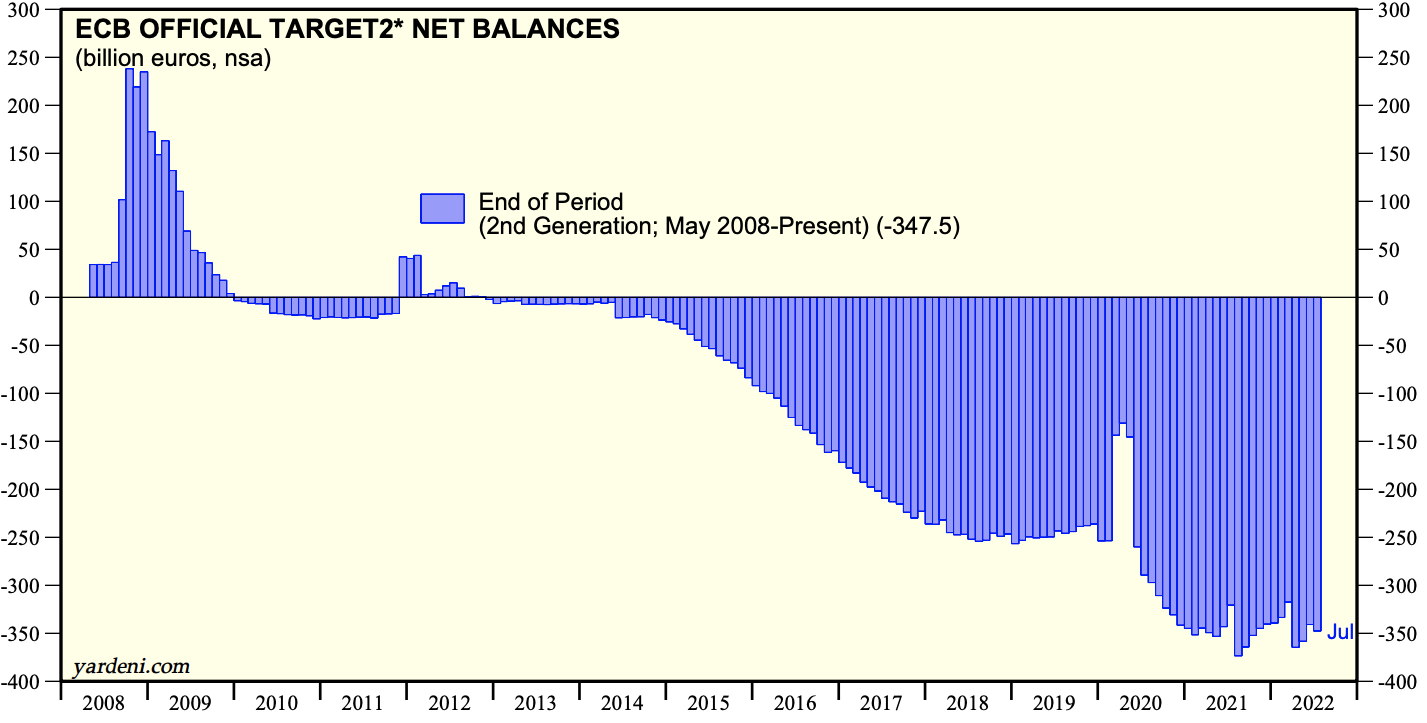

But did you notice that blue line in the chart above? The one that represents the ECB itself?

That’s right, the ECB has a negative balance of ~€350B, and so it owes Germany, too

This is the ECB’s idea of free-market monetary policy.

That’s right, the ECB has a negative balance of ~€350B, and so it owes Germany, too

This is the ECB’s idea of free-market monetary policy.

☠️ The end of Europe?

You may ask, if the ECB keeps borrowing from Germany to fund the problem, can they eventually make it better, maybe fix it?

Well...

You may ask, if the ECB keeps borrowing from Germany to fund the problem, can they eventually make it better, maybe fix it?

Well...

You know that friend who has an adult kid in their 30’s or 40’s, still living in their basement? The parent keeps giving him money, rationalizing that with just a bit more help, he’ll get back on his feet? Someday, soon...

Exactly

Germany = Parent, Italy (and others) = Kid(s)

Exactly

Germany = Parent, Italy (and others) = Kid(s)

As the ECB faces historic inflation and the challenge to tackle it, they’ve been raising the target central bank rates

This has been putting pressure on countries that have weaker balance sheets

And so, today’s main problem child is Italy.

This has been putting pressure on countries that have weaker balance sheets

And so, today’s main problem child is Italy.

Besides the TARGET2 balances, how else can we tell?

Take a look at the spread between the Italian 10-year government bond yields and the comparable 10-year German bund yield:

Take a look at the spread between the Italian 10-year government bond yields and the comparable 10-year German bund yield:

That’s a 2.51% difference in yield for the same duration bonds, both domiciled in Europe

It means there’s a perceived higher risk owning Italian bonds versus German bonds (Bunds)

It’s also telling us that the risk is increasing as overall rates have increased this past year.

It means there’s a perceived higher risk owning Italian bonds versus German bonds (Bunds)

It’s also telling us that the risk is increasing as overall rates have increased this past year.

And then look what happened since last Friday (Sept 23rd):

As yields spiked across the UK and Europe, the Italy/Germany spread widened significantly:

As yields spiked across the UK and Europe, the Italy/Germany spread widened significantly:

If you’ve been watching ECB policy or you read 🧠The Informationist Newsletter, you know that the ECB has announced a new tool they plan to use to 'prevent' banking problems in weaker countries due to rising rates.

Here’s The Informationist article: jameslavish.substack.com/p/-whats-an-anti-fragmentation-tool?r=8di03&s=w&utm_campaign=post&utm_medium...

Here’s The Informationist article: jameslavish.substack.com/p/-whats-an-anti-fragmentation-tool?r=8di03&s=w&utm_campaign=post&utm_medium...

TL;DR: The Anti-Fragmentation Tool (or Transition Protection Instrument) is a sneaky term for Yield Curve Control

It means the ECB will buy Italian 10YR bonds (or any other bond in any other country) to ‘defend the Euro’

But really to keep Italian (and other) banks from failing

It means the ECB will buy Italian 10YR bonds (or any other bond in any other country) to ‘defend the Euro’

But really to keep Italian (and other) banks from failing

Also, the CDS (Credit Default Swap) spread shows the fixed income market agrees Italy has an elevated risk

Notice rates spiking in July before Lagarde and the ECB announced their new tools, then receding...

And now the risk is right back where it was:

Notice rates spiking in July before Lagarde and the ECB announced their new tools, then receding...

And now the risk is right back where it was:

What you should gleam from this:

The ECB must continue QE/manipulating yields to manage Italy's interest rates from spiking beyond a level that could lead to a credit crisis

That level was estimated to be ~2.4% spread between the Italian and German 10YR bonds

Yep, we're there.

The ECB must continue QE/manipulating yields to manage Italy's interest rates from spiking beyond a level that could lead to a credit crisis

That level was estimated to be ~2.4% spread between the Italian and German 10YR bonds

Yep, we're there.

So, the manipulation continues

And with TARGET2 imbalances continuing to grow, it becomes unlikely the ECB can ever engineer a reversal to actually settle out these balances

And this, my friends, is what I believe will be the oak tree that breaks the proverbial camel’s back.

And with TARGET2 imbalances continuing to grow, it becomes unlikely the ECB can ever engineer a reversal to actually settle out these balances

And this, my friends, is what I believe will be the oak tree that breaks the proverbial camel’s back.

I don’t profess to know when, as these things can drag on for many months or even years

But I would say that if the ECB continues as is, the EU will break apart, as Germany ultimately decides to swallow its losses and move on...

And I believe that happens within this decade.

But I would say that if the ECB continues as is, the EU will break apart, as Germany ultimately decides to swallow its losses and move on...

And I believe that happens within this decade.

This thread is a summary of a recent 🧠Informationist Newsletter. If you enjoyed it, make sure to:

1. Follow @jameslavish to see more investment related content

2. Subscribe to The Informationist to learn one simplified financial concept weekly: jameslavish.substack.com

1. Follow @jameslavish to see more investment related content

2. Subscribe to The Informationist to learn one simplified financial concept weekly: jameslavish.substack.com