Thread

** Inflation: some optimism from expectations data

The data from surveys of inflation expectations in the second half of 2022 will be very informative to distinguish three theories. They have important implications fo what inflation *will be*.

🧵

The data from surveys of inflation expectations in the second half of 2022 will be very informative to distinguish three theories. They have important implications fo what inflation *will be*.

🧵

The “ignore it” view is that inflation expectations do not matter and are useless to predict inflation. That view took a serious beating in 2021-22. Those who dismissed the expectations data badly missed the 2021-22 run-up in inflation.

A related version of the ignore-it view is that expectations matter, but measurement is too noisy to be all that useful. In normal times, this is debatable. But in large turning points for inflation, this is not true: the data shows the anchor drifting.

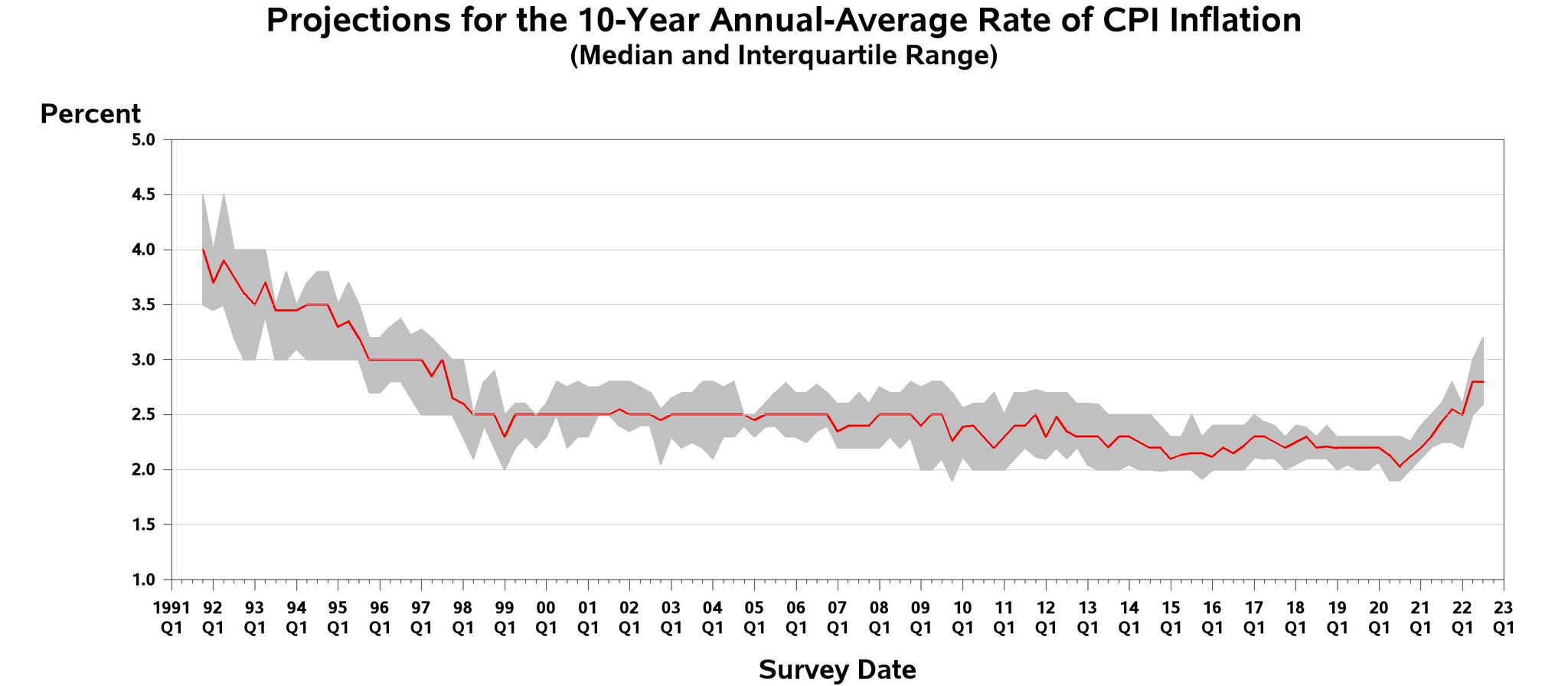

Under the “ignore it” view, you will insist on staring at the median SPF over next ten years (don't 🥺). Nothing happened last year, nothing will happen next year. You thought then inflation would stay low, you think now inflation will stay high.

philadelphiafed.org/surveys-and-data/real-time-data-research/spf-q3-2022…

philadelphiafed.org/surveys-and-data/real-time-data-research/spf-q3-2022…

The second “adaptive” view is that expectations of the future are a mirror of present inflation. People over-extrapolate, pay too much attention to a few prices, or cannot get over past experiences. This view goes further: only outcomes drive expectations

www.youtube.com/watch?v=2cZiVBsHsVU&t=21s

www.youtube.com/watch?v=2cZiVBsHsVU&t=21s

Under adaptive expectations, current high inflation will lead to high inflation expectations now and next year. That leads to a scary prospect: expectations will make inflation persist unless a deep recession brings both down.

Ball, Leigh, and Mishra had some insightful calculations at @BrookingsEcon . Even a little bit of adaptive expectations means a lot more unemployment for very long to bring inflation down and expectations to follow. Gloom and doom ahead.

www.brookings.edu/bpea-articles/understanding-u-s-inflation-during-the-covid-era/

www.brookings.edu/bpea-articles/understanding-u-s-inflation-during-the-covid-era/

Adaptive expectations are (broadly) consistent with the survey data of last year. Inflation went up, expectations went up. Expectations will keep rising. It implies that the policy mistake of last year casts a long shadow. Little to do now but suffer.

A third “modern” view is that expectations look ahead, take policy into account, and are affected by communication. People are inattentive and biased but they are forward looking. Data, from surveys or markets, is important to measure where they are.

Because the data is noisy, you have to be careful measuring inflation expectation. But if you do so, you saw expectations moving up in the second half of 2021 and staying scarily high in the first half of 2022.

personal.lse.ac.uk/reisr/papers/22-Sintra.pdf

personal.lse.ac.uk/reisr/papers/22-Sintra.pdf

The Fed pivoted 6 months ago in policy and speeches. The ignore-it and adaptive views say this doesn't matter. The modern view says expectations will respond. I noted at

@BrookingsEcon last week a clear decline in 5y expectations(Michigan) since May-June

www.youtube.com/watch?v=jI9YmGzTh6Y

@BrookingsEcon last week a clear decline in 5y expectations(Michigan) since May-June

www.youtube.com/watch?v=jI9YmGzTh6Y

The NY Fed survey data came out yesterday. It shows an even steeper decline in inflation expectations than the Michigan data. Maybe it is a coincidence. But I’d venture that the (good) hawkish policy of the past few months is already paying off.

If the modern view is right, then US inflation will come down faster with less pain in 2023 than Ball-Mishra-Leigh. Not by luck nor because "team transitory" was right (it wasn't). But because of good monetary policy in the last few months.

Let’s wait and see. Expectations data are much too noisy, more months of surveys. Also the link from expectations to outcomes is noisy and with lags. My forecast of inflation has wide bands. But I'm a little more optimistic than @LHSummers or @jasonfurman