Thread by Jamie Coutts CMT

- Tweet

- Sep 2, 2022

- #Cryptocurrency #Economics

Thread

What drives #crypto assets?

Answer: network adoption.

But drives network adoption?

Answer: Intrinsic (e.g. technology) & External (macro, societal) factors.

Today let's focus in on the external i.e. macro, and a critical indicator for liquidity🧵

Answer: network adoption.

But drives network adoption?

Answer: Intrinsic (e.g. technology) & External (macro, societal) factors.

Today let's focus in on the external i.e. macro, and a critical indicator for liquidity🧵

Whilst the intrinsic & extrinsic forces are structural and mainly self-reinforcing, macro forces can periodically slow adoption and suppress network activity.

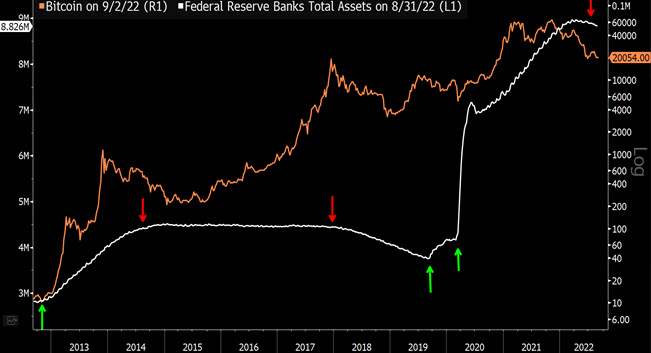

What macro forces are we talking about? Primarily the price (interest rates) and the quantity of money (liquidity or supply). Since 2017 I have used the Fed Balance Sheet as my proxy for liquidity. Not perfect, but pretty darn good. M2 is also great; hat tip @RaoulGMI

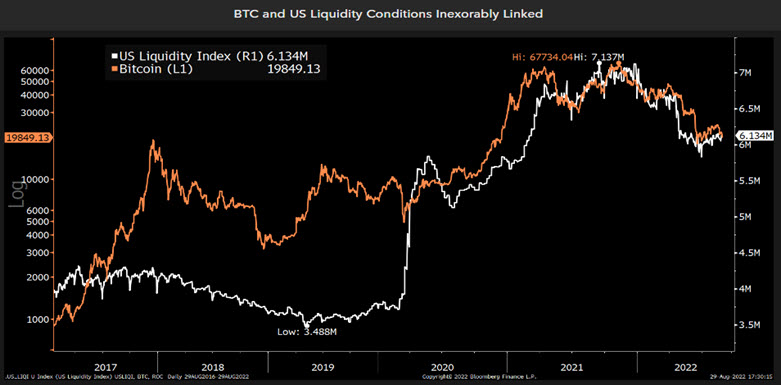

@RaoulGMI @CryptoHayes post then added the Repos and US Treasury into the equation. The result is a more holistic measure of the quantity & velocity of money entering/exiting the financial system mediumhttps://entrepreneurshandbook.co/teach-me-daddy-33e7a66dfe76

@RaoulGMI @CryptoHayes But does it provide greater insight? Bitcoin's lockstep correlation with this US liquidity index since the pandemic is v apparent. The net reduction in liquidity since Q421 has greatly impacted mkts, esp Bitcoin.

@RaoulGMI @CryptoHayes Although all risk assets are impacted by the same relationship, #BTC is more responsive than equities--reacting to subtle shifts in liquidity & more pronounced moves at significant inflection points.

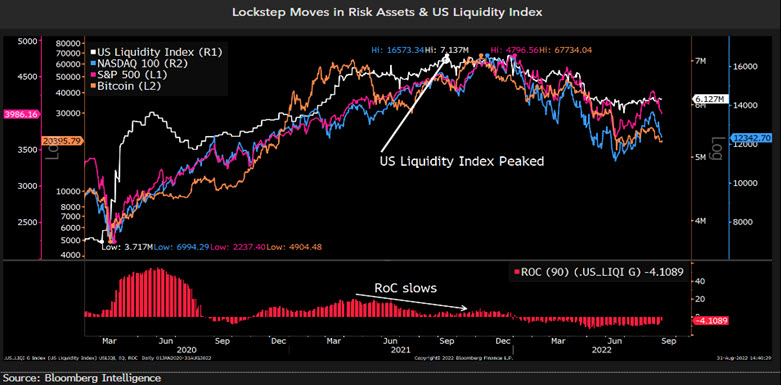

@RaoulGMI @CryptoHayes Could we use this as a regime filter, i.e. Liquidity ⬆️ = Bullish Bitcoin (crypto) and vice versa ?

Yes, it would appear so. Rudimentary backtests also confirm there some signal here

Yes, it would appear so. Rudimentary backtests also confirm there some signal here

@RaoulGMI @CryptoHayes So where are we now? The new liquidity index is currently in a bearish regime. This signal was triggered in Dec-21, helping avoid the 60% drawdown that followed. Not bad.

@RaoulGMI @CryptoHayes But conditions have been more neutral between May to Aug. This happened to coincide with the recent lows in risk assets & subsequent counter-trend rallies. Coincidence, Not!

@RaoulGMI @CryptoHayes The US Govt (Treasury) drew down $400B from Fed acct (stimulus) since May, offsetting the equivalent tightening from Private & Fed. What to do if the Liquidity regime flips because of this? IMO probably best to net out govt and focus on Fed and the Private sector;

@RaoulGMI @CryptoHayes Creating a new index which nets out Treasury we can see that below the surface, liquidity has declined since April, albeit at a slower rate. Watch this going forward 👀

@RaoulGMI @CryptoHayes Simply put - macro impacts network adoption.