Thread by Compounding Quality

- Tweet

- Aug 28, 2022

- #Stockmarket

Thread

🧵 It's every investor's dream to make a 10-bagger (a stock that goes up tenfold), or even a 100-bagger (a stock that goes up 100x).

In this thread we will learn you how to identify multibaggers together with 104 (!) concrete examples.

⬇️⬇️⬇️⬇️⬇️⬇️⬇️

In this thread we will learn you how to identify multibaggers together with 104 (!) concrete examples.

⬇️⬇️⬇️⬇️⬇️⬇️⬇️

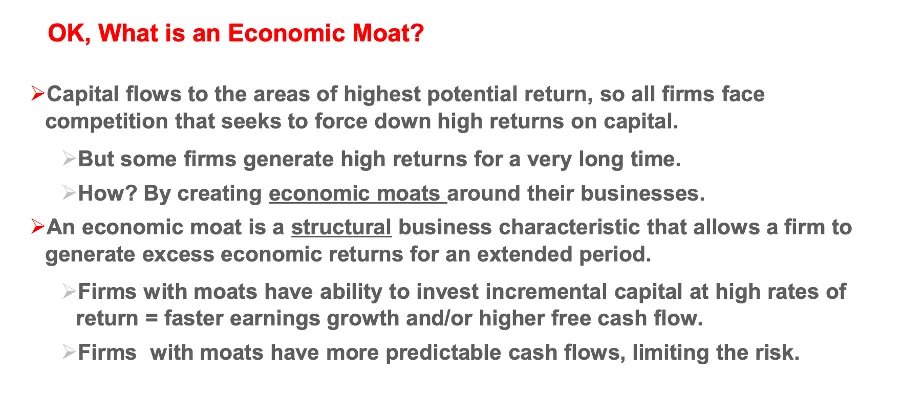

Lesson 1: Look for business with a wide moat.

A wide moat is essential for every Quality Investment. Almost all multibaggers (91%) are characterized by a wide economic moat. Barriers to entry are the most preferred moat source for multibaggers (81%).

A wide moat is essential for every Quality Investment. Almost all multibaggers (91%) are characterized by a wide economic moat. Barriers to entry are the most preferred moat source for multibaggers (81%).

Lesson 2: Invest in financially healthy companies.

Great companies are very cash-generative and have a healthy balance sheet. Seek for companies with a low net debt / EBITDA and high interest coverage. When the company has a net cash position, this is a great surplus.

Great companies are very cash-generative and have a healthy balance sheet. Seek for companies with a low net debt / EBITDA and high interest coverage. When the company has a net cash position, this is a great surplus.

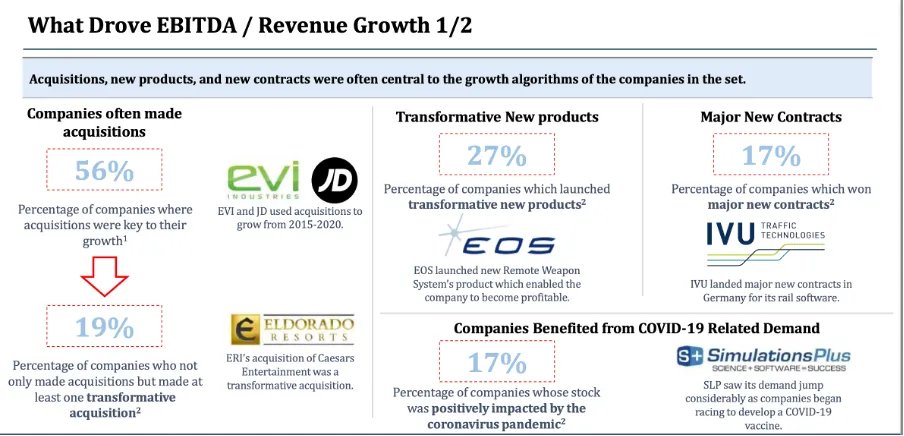

Lesson 3: Acquisitions can create a lot of value.

While many acquisitions fail to create value, the best performing stocks use acquisitions to bolster their returns.

If you want phenomenal returns, find great acquirers. Constellation Software, and Lifco are beautiful examples.

While many acquisitions fail to create value, the best performing stocks use acquisitions to bolster their returns.

If you want phenomenal returns, find great acquirers. Constellation Software, and Lifco are beautiful examples.

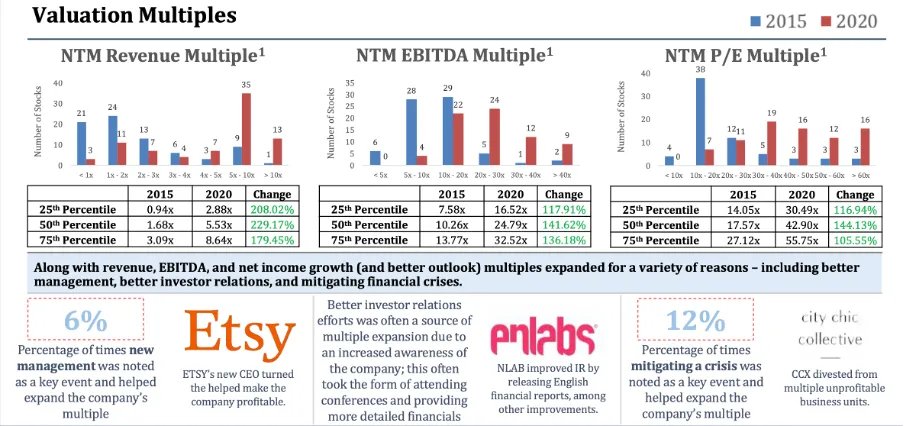

Lesson 4: Don’t rely on multiples.

When you want to buy something great, you have to pay for it.

While it’s always better to buy a great business at a low multiple, many of the top performing stocks started compounding with multiples which were already high.

When you want to buy something great, you have to pay for it.

While it’s always better to buy a great business at a low multiple, many of the top performing stocks started compounding with multiples which were already high.

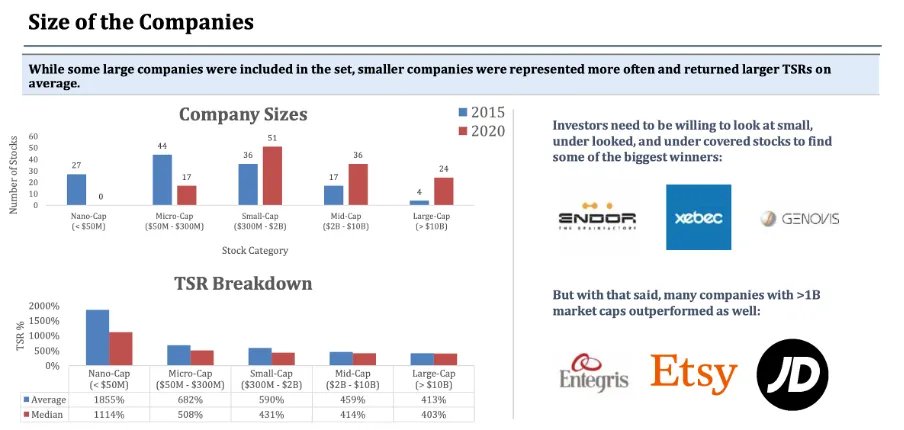

Lesson 5: Invest in small caps.

In general, small caps perform better than large cap stocks because they have more upside potential.

When you can find an owner-operator small cap stock which is a market leader in a niche with high margins, you have found a (potential) goldmine.

In general, small caps perform better than large cap stocks because they have more upside potential.

When you can find an owner-operator small cap stock which is a market leader in a niche with high margins, you have found a (potential) goldmine.

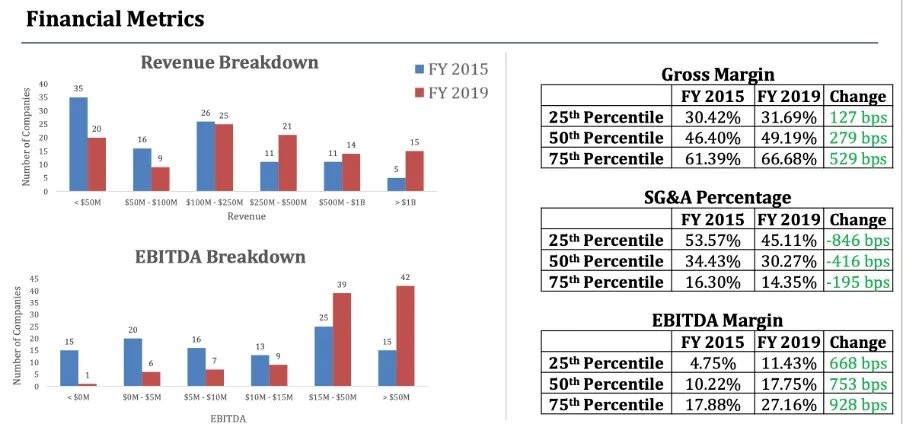

Lesson 6: Margin expansion is great.

As a quality investor, you should love margin expansion.

When the profit margin of a company doubles, the EPS of the company doubles too.

In the long term, earnings growth is the leading factor for stock price performance.

As a quality investor, you should love margin expansion.

When the profit margin of a company doubles, the EPS of the company doubles too.

In the long term, earnings growth is the leading factor for stock price performance.

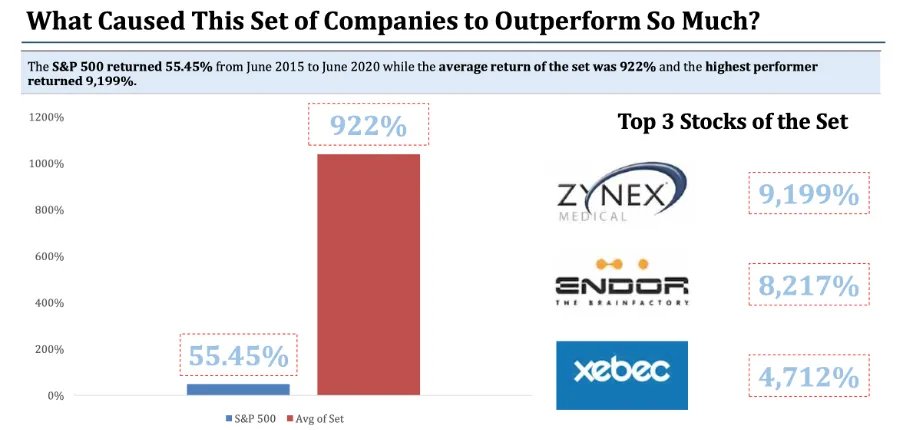

Lesson 7: Let your winners run.

The only thing you need during a successful investment career, is a few big winners.

Between June 2015 and June 2020 Zynex Medical, the best performing stocks over the studied period, returned almost 9200% (!) to shareholders.

The only thing you need during a successful investment career, is a few big winners.

Between June 2015 and June 2020 Zynex Medical, the best performing stocks over the studied period, returned almost 9200% (!) to shareholders.

Lesson 8: Organic growth is the most preferred source of growth.

When you can buy companies which can reinvest a lot of their FCF in organic growth opportunities at high margins, the company’s earnings will explode over time.

When you can buy companies which can reinvest a lot of their FCF in organic growth opportunities at high margins, the company’s earnings will explode over time.

Lesson 9: Learn with concrete examples.

Do you want to learn more? Download all 104 (!) multibagger stocks which where studied here:

qualitycompounding.substack.com/p/-how-to-find-multibaggers

Do you want to learn more? Download all 104 (!) multibagger stocks which where studied here:

qualitycompounding.substack.com/p/-how-to-find-multibaggers