Thread

Will your marketplace soar or sputter out?

It may depend on one critical metric that many startups ignore.

Here's how to figure out if you have a "layer cake" or a "leaky bucket" ⬇️

It may depend on one critical metric that many startups ignore.

Here's how to figure out if you have a "layer cake" or a "leaky bucket" ⬇️

What is this magic metric? Gross merchandise value (GMV) retention.

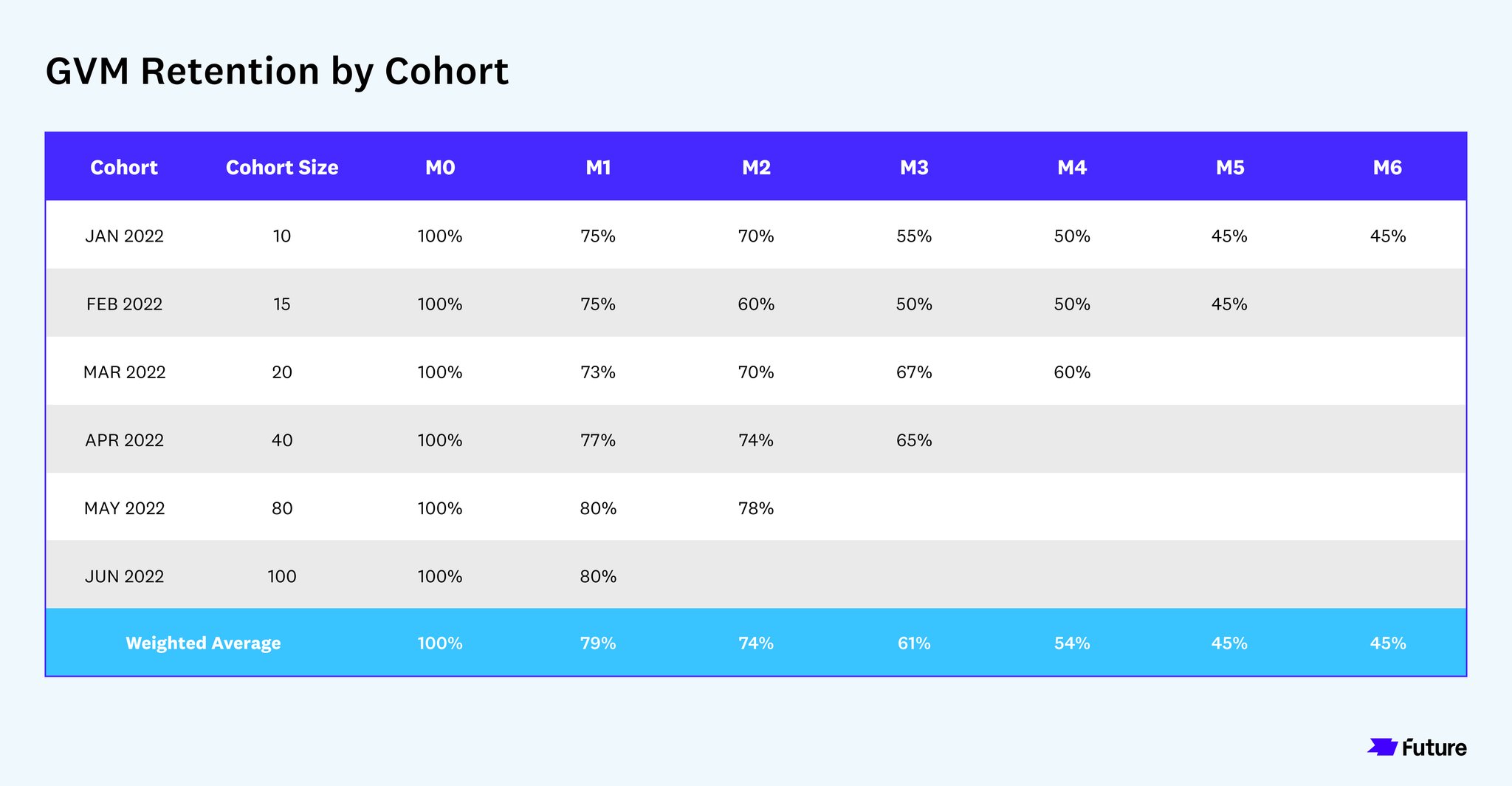

Most companies calculate user retention, or how many users from a cohort return monthly.

GMV retention is similar, but focuses on how much a cohort spends (or generates) on your marketplace each month.

Most companies calculate user retention, or how many users from a cohort return monthly.

GMV retention is similar, but focuses on how much a cohort spends (or generates) on your marketplace each month.

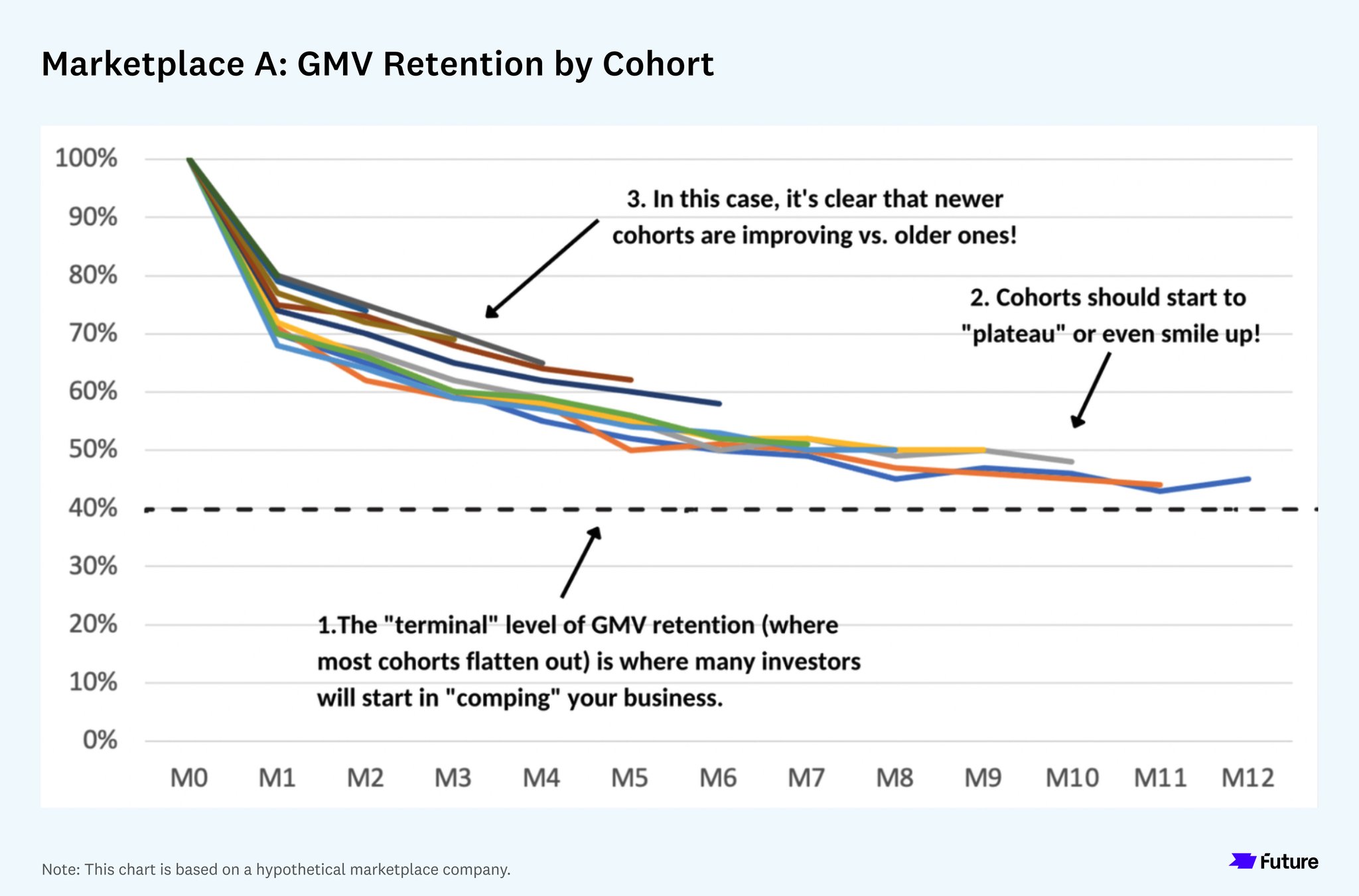

This is calculated monthly and displayed in "spaghetti charts" where each line represents one cohort.

Say Cohort 1 sold $50k in month 1 and $25k in month 2 - that's 50% seller GMV retention.

Ideally, retention flattens out over time. In some cases, it even "smiles" (curves up).

Say Cohort 1 sold $50k in month 1 and $25k in month 2 - that's 50% seller GMV retention.

Ideally, retention flattens out over time. In some cases, it even "smiles" (curves up).

Investors also look at trends over time to get a sense of whether retention for newer cohorts is improving or getting worse.

Why is this so important?

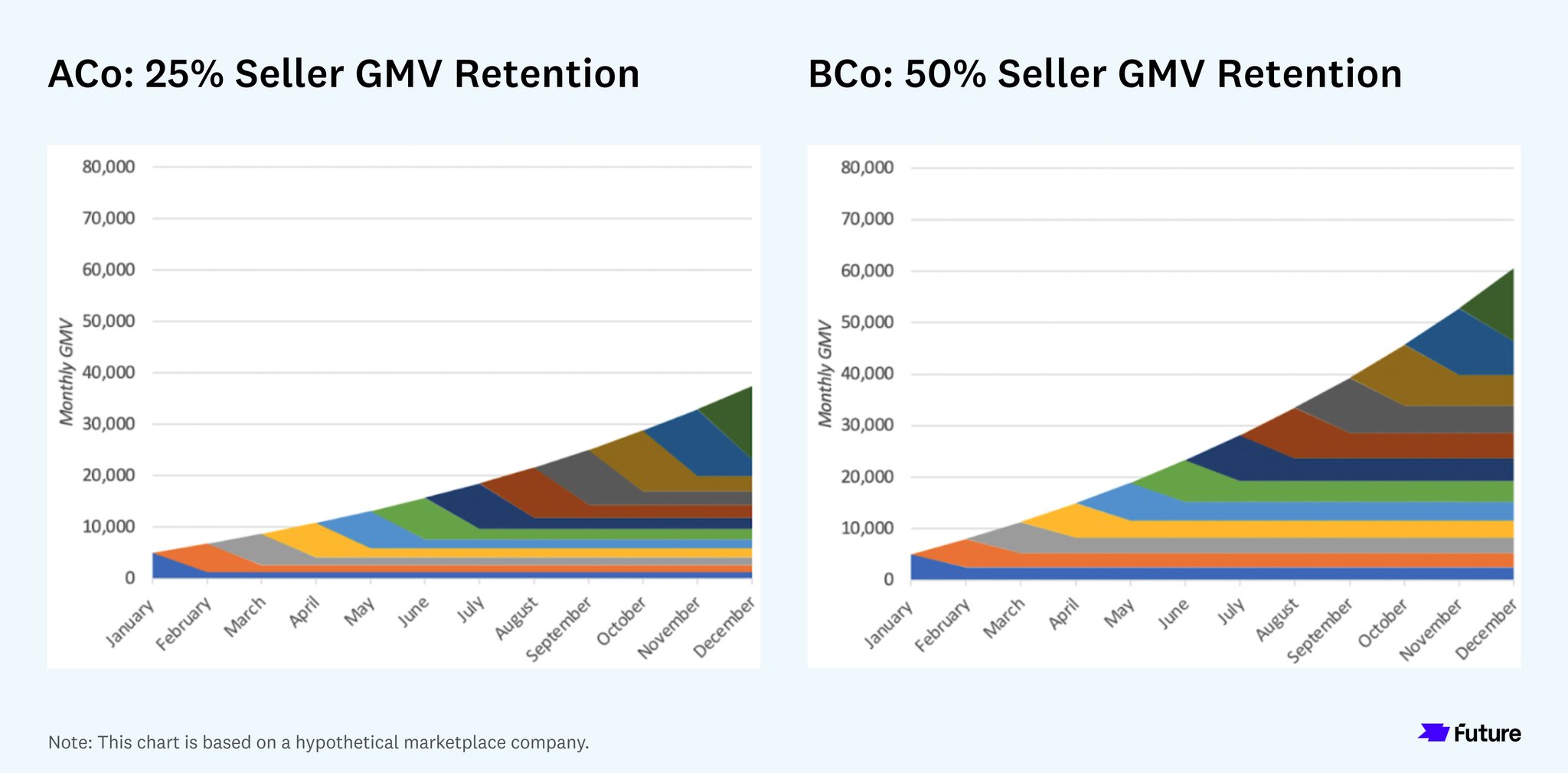

A company with 50% GMV retention will be ~2x ahead of a co with 25% GMV retention in a year! (all else equal)

Why is this so important?

A company with 50% GMV retention will be ~2x ahead of a co with 25% GMV retention in a year! (all else equal)

High GMV retention implies product-market fit, as users are finding enough value to maintain or expand spend on the platform.

It also allows you to:

(1) Hit your GMV targets with slower new user growth

(2) Spend more on marketing and still see a compelling LTV/CAC

It also allows you to:

(1) Hit your GMV targets with slower new user growth

(2) Spend more on marketing and still see a compelling LTV/CAC

What is "good" GMV retention?

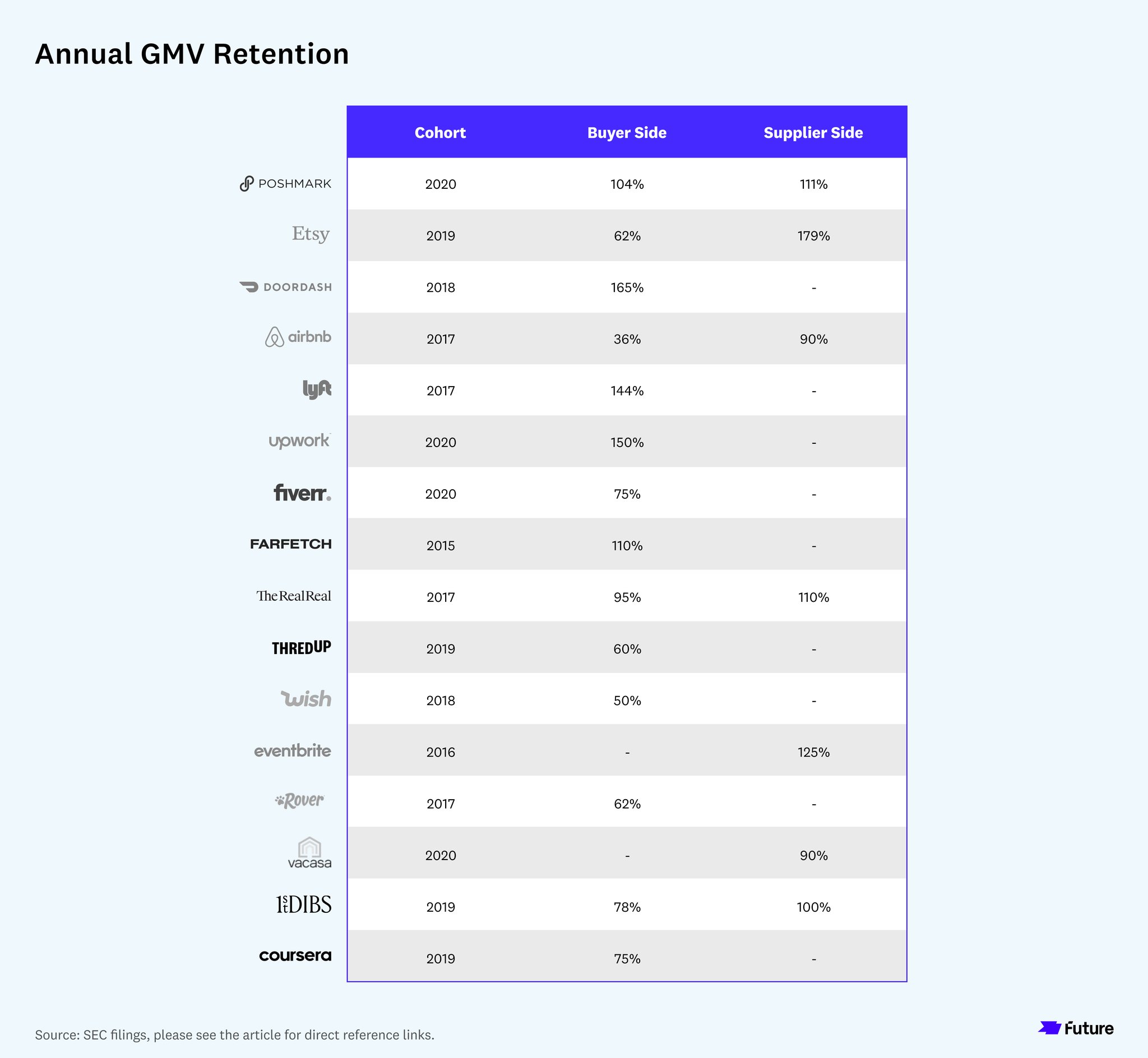

It's typically higher for sellers, as they build a biz on your platform and should come back often.

Publicly traded marketplaces often see 90%+ for sellers and 60%+ for buyers. But top decile cos can see 100%+ GMV retention on at least one side!

It's typically higher for sellers, as they build a biz on your platform and should come back often.

Publicly traded marketplaces often see 90%+ for sellers and 60%+ for buyers. But top decile cos can see 100%+ GMV retention on at least one side!

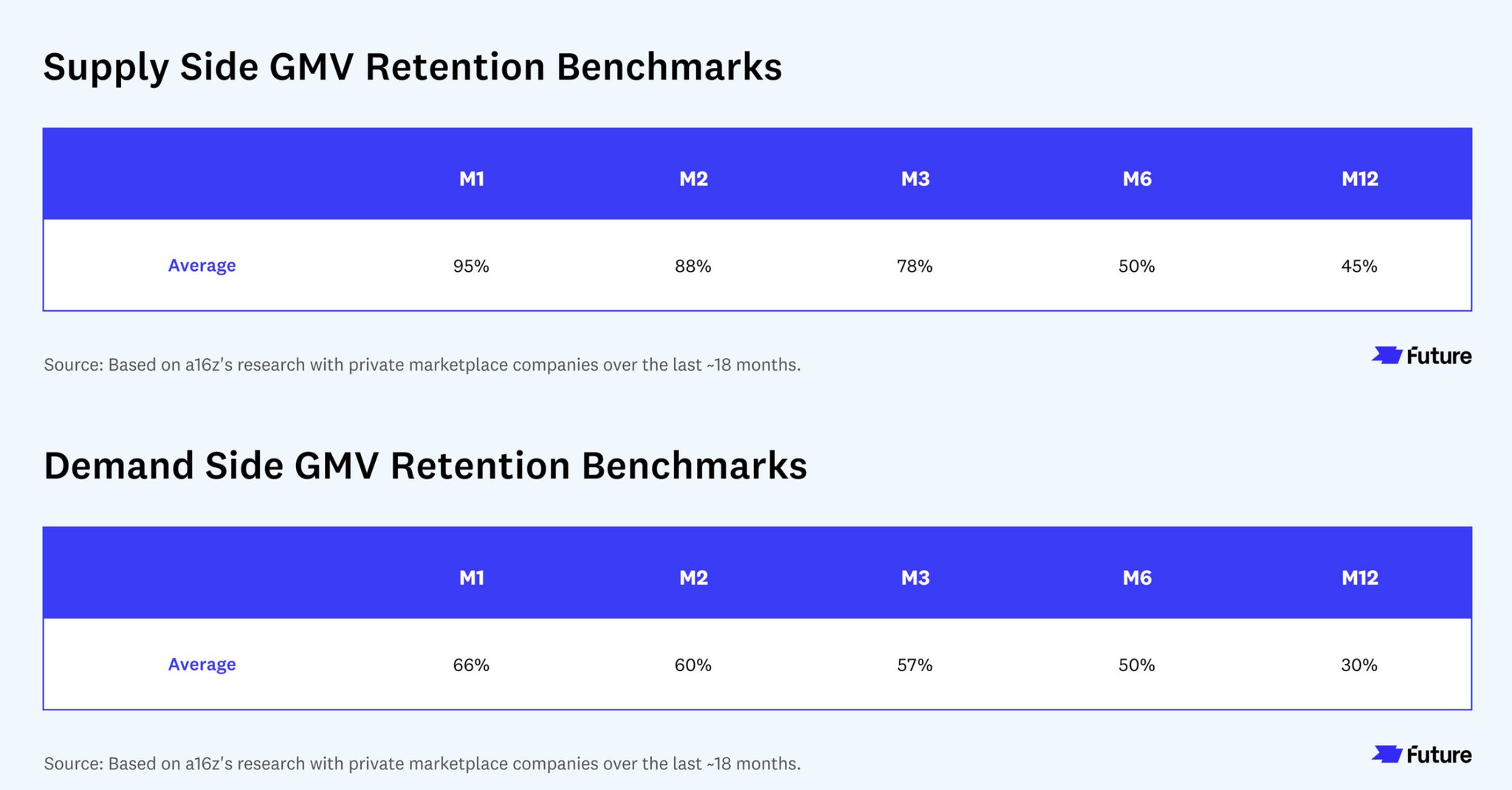

At @a16z, we also keep benchmarks on GMV retention for seed through Series B marketplaces.

The average company sees supply side GMV retention at 90% at m1, plateauing around 45-50% by m12.

Demand side retention starts closer to 70% at m1, plateauing around 30% by m12.

The average company sees supply side GMV retention at 90% at m1, plateauing around 45-50% by m12.

Demand side retention starts closer to 70% at m1, plateauing around 30% by m12.

More on how to calculate GMV retention (including a spreadsheet template), as well as how you can build a high GMV retention platform, on @future:

future.a16z.com/gmv-retention-marketplace-metric/

And if you're building an early stage marketplace - my DMs are open!

future.a16z.com/gmv-retention-marketplace-metric/

And if you're building an early stage marketplace - my DMs are open!