Thread

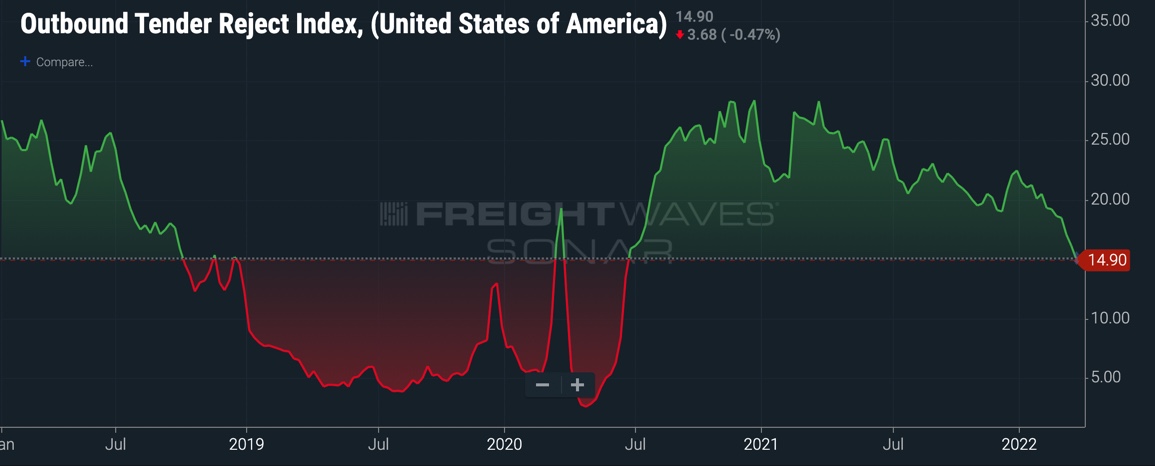

Tender rejections are the best indicator into realtime supply/demand in the trucking. A high rejection rate = trucking cos have more options in freight to pick from. (more options = more rejections; less options = less rejections). Why are rejections falling? Thread 1/n

The first place I check out is demand. Outbound Tender Volume is an index which measures the amount of loads being requested in the market. This is the chart for the past year. Trucking volumes are at the lowest levels in a year (ignore the big dips- those are holidays). 2/n

March is usually a good month for trucking. This year, it has not been. Its very soft. Causes? Consumers are shifting away from goods and towards services & experiences; Inflation is causing consumers to also buy less quantity. They may spend same $, but get less. 3/n

Warehouses have started to fill up and inventories are building. Shippers were very worried last year about running out - so they ordered more than they need to ensure they would have enough. It may have been too much. 4/n

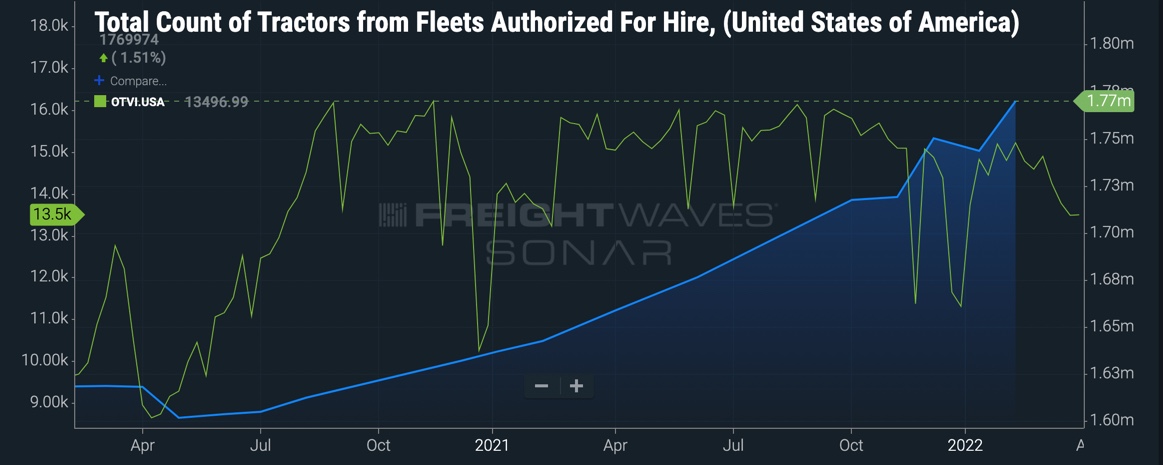

Next we can look the supply side. What does capacity look like? This is harder to track. The most reliable data on capacity is the FMCSA database, which tracks the number of trucks. Since April 2020, we've added 170k trucks. 5/n

When plotted together: truck count with volume, we can see the trucks in the market has now caught up and surpassed the freight volume. (blue= trucks in the market; green = truckload volume. The data on truck counts is reported monthly, volume is daily). 6/n

So conceptually, the market has now corrected. The number of trucks has started to soak up all the freight demand. The biggest risk the number of new trucks increase at a rate faster than the freight market - which I believe is a near certainty. 7/n

Why? It happens in every cycle. Trucking always over builds. The market is way too fragmented for anyone to have real discipline on managing the total fleet count. I have been around trucking my whole life (42 years) and the cycle has always existed. 8/n

I've heard in every cycle all the reasons that "this time is different." It never is. The trucking market always over builds and then crashes. Always. Buckle up - its going to be a tough ride from here. End.

Mentions

See All

Joe Weisenthal @TheStalwart

·

Mar 29, 2022

This is a great, must-read thread from @freightalley. All of it. Trucking market coming back into balance. Prices coming down. Demand slowing. Inventories building up after anticipatory over-ordering last year. Just one part of the overall supply chain, but a critical one.

Michael Green @profplum99

·

Apr 1, 2022

Best thread I read today