Thread

If you run a business, you MUST understand accounting

Here is what you need to know:

Here is what you need to know:

1/ Introduction

There are a lot of MYTHS about how accounting works

At its core, accounting is based on “Accrual Accounting”

“Accrual Accounting” is a set of rules used to record business transactions

There are a lot of MYTHS about how accounting works

At its core, accounting is based on “Accrual Accounting”

“Accrual Accounting” is a set of rules used to record business transactions

In this thread I will:

1 Explain what "Accrual Accounting" is

2. Debunk common Accounting Myths

1 Explain what "Accrual Accounting" is

2. Debunk common Accounting Myths

2/ Accrual Accounting

Accrual Accounting is best understood through an example:

Let’s say you’re the owner of a store that sells pencils:

• You purchase 100 pencils for $1 each

• You then sell 50 of those pencils for $3 each

· What’s your profit?

Accrual Accounting is best understood through an example:

Let’s say you’re the owner of a store that sells pencils:

• You purchase 100 pencils for $1 each

• You then sell 50 of those pencils for $3 each

· What’s your profit?

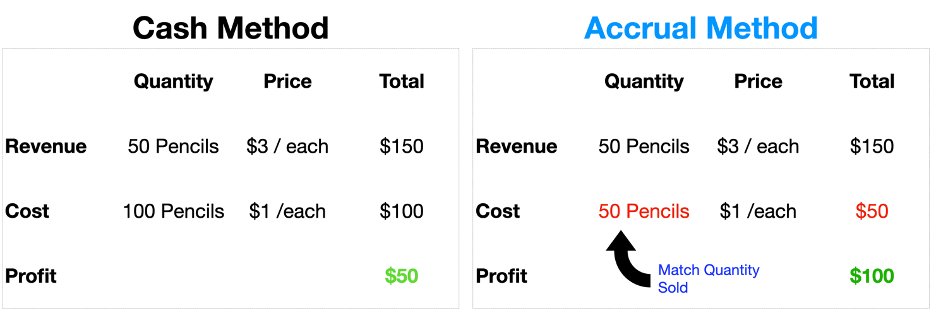

There are a couple of ways to calculate profit:

1. Using the “Cash Method” ➡️ how most people think accounting works

2. Using the “Accrual Method” ➡️ the method accounting is based on

Here is a chart:

1. Using the “Cash Method” ➡️ how most people think accounting works

2. Using the “Accrual Method” ➡️ the method accounting is based on

Here is a chart:

Notice how profit is completely different under the two methods?

• It’s $50 under the CASH method

• It’s $100 under the ACCRUAL method

Why is profit different under Accrual Accounting?

• It’s $50 under the CASH method

• It’s $100 under the ACCRUAL method

Why is profit different under Accrual Accounting?

The difference in the example above lies in how “Costs” are determined

Cash Accounting:

• You bought 100 pencils for $1, so you expense everything

➡️ Cost: 100 pencils * $1 = $100

Accrual Accounting:

• You only expense 50 pencils for $1

➡️ Cost: 50 pencils * $1 = $50

Cash Accounting:

• You bought 100 pencils for $1, so you expense everything

➡️ Cost: 100 pencils * $1 = $100

Accrual Accounting:

• You only expense 50 pencils for $1

➡️ Cost: 50 pencils * $1 = $50

This is because under Accrual Accounting you have to match:

QUANTITY SOLD = QUANTITY EXPENSED

QUANTITY SOLD = QUANTITY EXPENSED

3/ Matching Principle

Generally, under accrual accounting

The QUANTITY in your COST must match the QUANTITY in your REVENUE

Why?

Because of the “Matching Principle”

Generally, under accrual accounting

The QUANTITY in your COST must match the QUANTITY in your REVENUE

Why?

Because of the “Matching Principle”

MYTH: When you purchase goods, you can expense everything right away

Accounting doesn’t work like that

Instead, you only expense the portion of the goods you SOLD

Accounting doesn’t work like that

Instead, you only expense the portion of the goods you SOLD

In the above example, that’s 50 pencils NOT 100 pencils

The remainder of the unsold pencils are capitalized and expensed ONLY when they are SOLD

The remainder of the unsold pencils are capitalized and expensed ONLY when they are SOLD

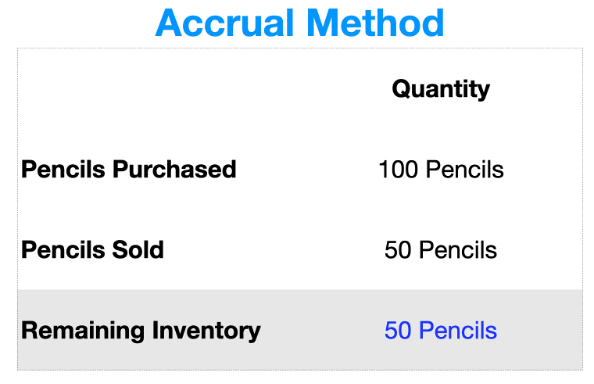

4/ Inventory

Because of the matching principle, there are consequences

One of those consequences is the creation of INVENTORY balances

Because of the matching principle, there are consequences

One of those consequences is the creation of INVENTORY balances

Inventory is “goods” that you’ve paid for but haven’t sold yet

These goods are capitalized on the balance sheet

In our pencils example above, the inventory balance would be calculated as:

These goods are capitalized on the balance sheet

In our pencils example above, the inventory balance would be calculated as:

5/ Capitalizing Assets

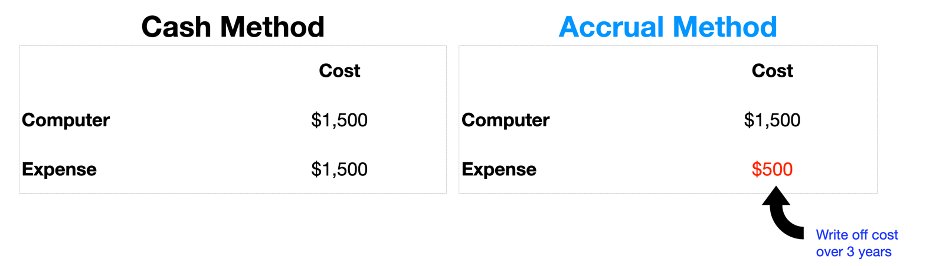

Closely related to the inventory example is the concept of Capitalizing Assets

MYTH: When a business buys a new computer, you can write-off/expense it right away

That’s not how accounting works

Closely related to the inventory example is the concept of Capitalizing Assets

MYTH: When a business buys a new computer, you can write-off/expense it right away

That’s not how accounting works

Because you will use your computer for 2 to 3 years

Accounting rules prevent you from expensing the computer when you buy it

Instead, just like inventory – the computer is capitalized and slowly expensed over time

Accounting rules prevent you from expensing the computer when you buy it

Instead, just like inventory – the computer is capitalized and slowly expensed over time

Let’s look at an example:

• You buy a computer for $1,500

• You have to expense the computer over a certain period say, 3 years

• In this case, can only expense $500 worth in the first year ($1,500 / 3 years)

• You buy a computer for $1,500

• You have to expense the computer over a certain period say, 3 years

• In this case, can only expense $500 worth in the first year ($1,500 / 3 years)

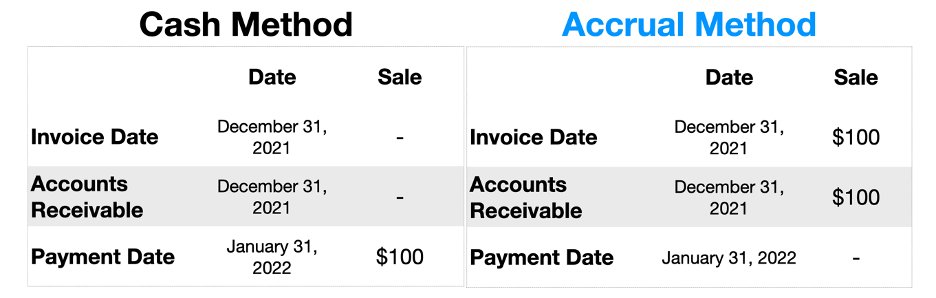

6/ Accounts Receivable

MYTH: You can only record a sale when cash is collected

Accounting doesn’t work like that

You have to record a sale when you invoice your customer

MYTH: You can only record a sale when cash is collected

Accounting doesn’t work like that

You have to record a sale when you invoice your customer

If your customer takes 1 month to pay your bill, you DON’T wait 1 month to book the sale

Instead, the sale is booked when the customer is invoiced

You then record accounts receivable to show that the customer owes you money for the sale

Instead, the sale is booked when the customer is invoiced

You then record accounts receivable to show that the customer owes you money for the sale

Let’s look at an example:

• You sell a service to a customer for $100

• You invoice the customer on December 31, 2021

• The customer pays on January 31, 2022

• You sell a service to a customer for $100

• You invoice the customer on December 31, 2021

• The customer pays on January 31, 2022

In the example above, For accrual Accounting:

The sale is booked in December 2021 when the customer was invoiced

NOT when payment was received

The sale is booked in December 2021 when the customer was invoiced

NOT when payment was received

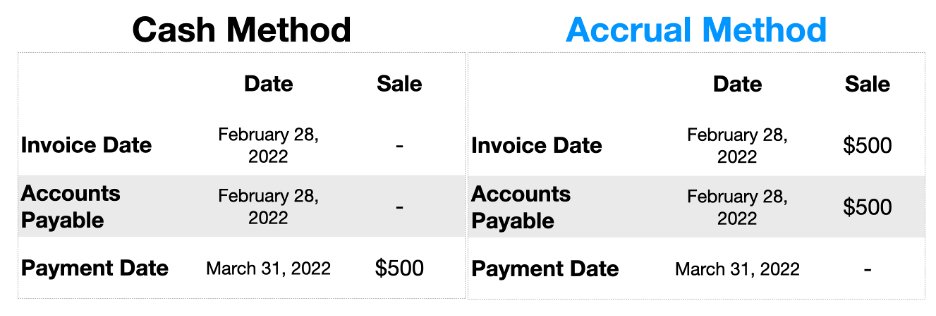

7/ Accounts Payable

MYTH: You can only record an expense when you pay cash to your suppliers

Accounting doesn’t work like that

You have to record an expense when you receive a bill from a supplier

MYTH: You can only record an expense when you pay cash to your suppliers

Accounting doesn’t work like that

You have to record an expense when you receive a bill from a supplier

If you take 1 month to pay the bill, you DON’T wait 1 month to book the expense

Instead, the expense is booked when you get the bill from your supplier

You then record ACCOUNTS PAYABLE to show that you owe money to your supplier

Instead, the expense is booked when you get the bill from your supplier

You then record ACCOUNTS PAYABLE to show that you owe money to your supplier

Let’s look at an example:

• You buy a service from a supplier for $500

• Your supplier sends you a bill on February 28, 2022

• You pay the bill on March 31, 2022

• You buy a service from a supplier for $500

• Your supplier sends you a bill on February 28, 2022

• You pay the bill on March 31, 2022

In the example above, for Accrual Accounting:

The expense is booked on February 28, 2022 when you RECEIVED the bill

NOT when you PAID the bill

The expense is booked on February 28, 2022 when you RECEIVED the bill

NOT when you PAID the bill

9/ Video Tutorial

Here is a short video that explains how accrual accounting works:

www.youtube.com/watch?v=OBxLJvpJ4Cc&ab_channel=THECFO

Here is a short video that explains how accrual accounting works:

www.youtube.com/watch?v=OBxLJvpJ4Cc&ab_channel=THECFO

TL;DR:

• You match revenues and expenses

• You capitalize unsold goods as inventory

• You capitalize assets

• You record revenue when a sale is made not when cash is collected

• You record expenses when you buy something not when you pay for it

• You match revenues and expenses

• You capitalize unsold goods as inventory

• You capitalize assets

• You record revenue when a sale is made not when cash is collected

• You record expenses when you buy something not when you pay for it

If you learned something new in this thread, retweet it!

Let's learn together and follow @AliTheCFO

I tweet about:

• Finance

• Business

• Personal Growth

Let's learn together and follow @AliTheCFO

I tweet about:

• Finance

• Business

• Personal Growth

Mentions

See All

Blake Burge @blakeaburge

·

Mar 21, 2022

Great thread, Ali!