Thread

Russia’s economy is melting in a way that we haven’t seen in recent history.

This is uncharted territory for economic policy.

Here’s what’s happening:

This is uncharted territory for economic policy.

Here’s what’s happening:

War is happening in 2 separate battlefields.

The 1st: Ukraine, a land that Russia is destroying with bombs, missiles, and tanks... visceral and painful.

The 2nd: the Economic Stadium. The space of relationships and trade between people, companies, banks, and countries.

The 1st: Ukraine, a land that Russia is destroying with bombs, missiles, and tanks... visceral and painful.

The 2nd: the Economic Stadium. The space of relationships and trade between people, companies, banks, and countries.

Note before I continue this post: nothing compares to the tragedy of human loss.

This post is strictly about Russian economic consequences. I do not feel like I have a unique insight on the non-economic, tragic consequences of this war.

This post is strictly about Russian economic consequences. I do not feel like I have a unique insight on the non-economic, tragic consequences of this war.

Russia might be strong in the first war, but it definitely isn’t in the second one.

It is losing the second war because it is fighting on many economic fronts, all extremely difficult and all extremely painful:

1. Widespread seclusion 2. Internal crisis

It is losing the second war because it is fighting on many economic fronts, all extremely difficult and all extremely painful:

1. Widespread seclusion 2. Internal crisis

Let’s start with the “Great Seclusion”.

Note: I just coined this phrase, so don’t take it too seriously.

I’m calling it "great" because we’re witnessing a sudden economic isolation never seen before in modern history.

Note: I just coined this phrase, so don’t take it too seriously.

I’m calling it "great" because we’re witnessing a sudden economic isolation never seen before in modern history.

In the last week, the West has declared a barrage of economic and financial sanctions.

1. The US and Europe cut off a number of Russian banks from SWIFT.

This is major because SWIFT is a piece of infrastructure that is critical to global money flows:

1. The US and Europe cut off a number of Russian banks from SWIFT.

This is major because SWIFT is a piece of infrastructure that is critical to global money flows:

Now, most Russian banks can’t trade high volumes, which makes them highly unattractive for your deposits.

What do you do? You flock to withdraw your money and investments from Russian banks.

World 1 - 0 Russia

What do you do? You flock to withdraw your money and investments from Russian banks.

World 1 - 0 Russia

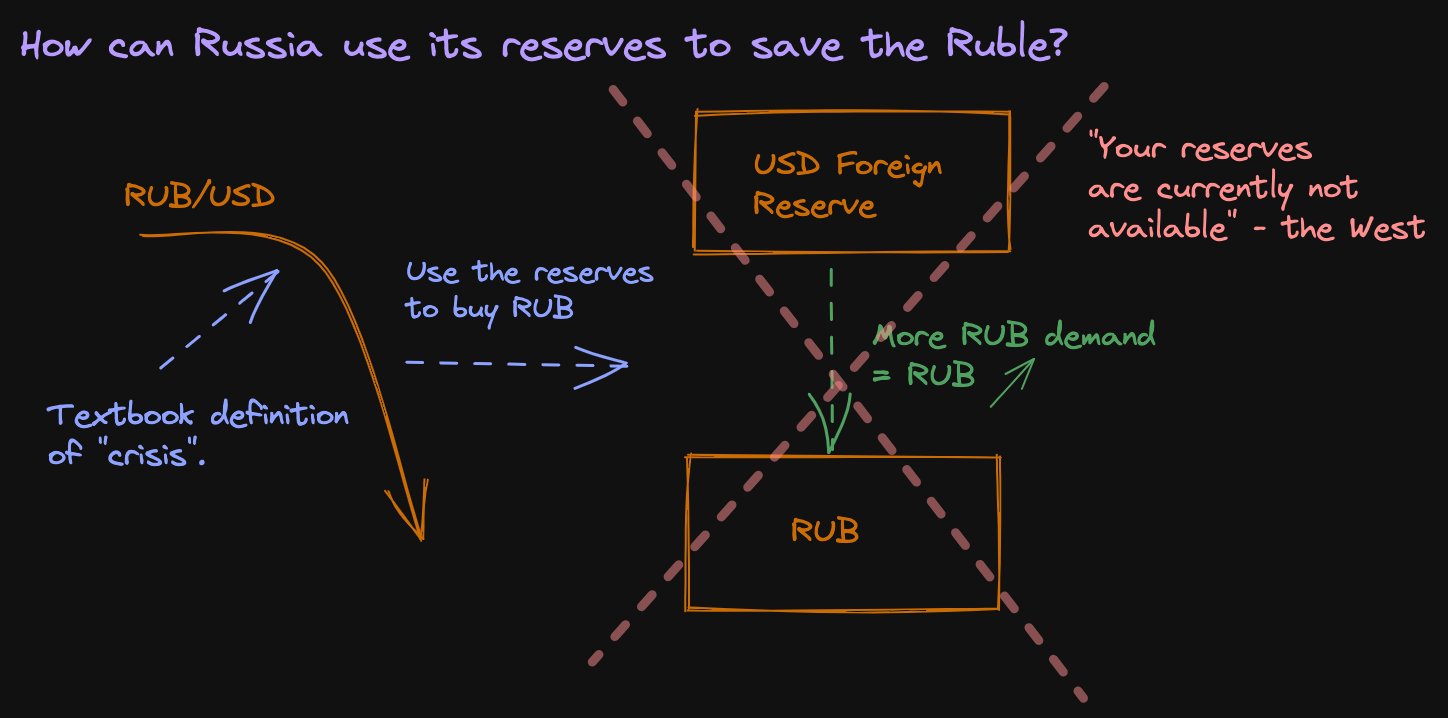

2. The ECB and the US Treasury decided to freeze all Russian reserves kept in foreign countries.

How big is the impact? Russia’s central banks holds ~600 Billion dollars in foreign reserves.

I'll let it sink in: 600 Billion dollars.

How big is the impact? Russia’s central banks holds ~600 Billion dollars in foreign reserves.

I'll let it sink in: 600 Billion dollars.

Bottom line: the “Western Bank” is telling Russia that its assets set side for a crisis, went from 600 Billion to 0… overnight… during a crisis.

World 2 - 0 Russia.

World 2 - 0 Russia.

3. No one wants to play with the bully (Russia) at recess anymore

Major countries and major companies have completely stopped doing business with Russia.

Even major international sporting events like soccer are disqualifying the country for lack of fair play.

Major countries and major companies have completely stopped doing business with Russia.

Even major international sporting events like soccer are disqualifying the country for lack of fair play.

Now, onto the next one: the destruction from within.

Russia’s body is failing, as it gears up towards a big fight in the economic arena.

Its internal economy is at the brink of collapse.

Russia’s body is failing, as it gears up towards a big fight in the economic arena.

Its internal economy is at the brink of collapse.

The economic block that Russia is facing is rough. Its consequences are already clear.

The ruble is trading like rubble (I cringed at this pun, but whatever, I’ll leave it in).

I won’t quote a % decline because it’s basically in free fall: %s are rounding errors at this point

The ruble is trading like rubble (I cringed at this pun, but whatever, I’ll leave it in).

I won’t quote a % decline because it’s basically in free fall: %s are rounding errors at this point

Russian stocks have halved on foreign exchanges… in the good case. Trading on those stocks has been halted… in the bad case.

Stop losses have been hit and the Russian stock market has halted trading as a mitigating factor:

Losses will be hard when it reopens.

Stop losses have been hit and the Russian stock market has halted trading as a mitigating factor:

Losses will be hard when it reopens.

With lack of reserves and the ruble falling hard, bank runs have started and people don’t have access to their money.

To make things worse, with the current economic damage, unemployment will rise heavily…

To make things worse, with the current economic damage, unemployment will rise heavily…

High inflation and high unemployment could also lead to a massive brain drain… that’s if Russians can fly to other countries with all the travel bans.

Rising unemployment is yet another example of the people suffering the consequences of decisions made by their leaders.

Rising unemployment is yet another example of the people suffering the consequences of decisions made by their leaders.

Russia could print money to keep things running:

If printing money in the US has led to our current levels of inflation, imagine what printing money in Russia while the ruble is eating dust would do…

We might be talking “children flying Kites made out of money” type inflation

If printing money in the US has led to our current levels of inflation, imagine what printing money in Russia while the ruble is eating dust would do…

We might be talking “children flying Kites made out of money” type inflation

Actually, Russia has been (justifiably) trying to control inflation.

It raised its interest rate to 20%. I repeat: 20%.

We’ve never seen that in the US… like ever.

World 3 - 0 Russia

It raised its interest rate to 20%. I repeat: 20%.

We’ve never seen that in the US… like ever.

World 3 - 0 Russia

These measures clearly have had disastrous consequences already, and the ripple effects could be far and wide on the rest of the world (we’ll talk about these another day).

We hope that these sanctions and pressure points bring Putin to sit on the negotiating table:

We hope that these sanctions and pressure points bring Putin to sit on the negotiating table:

“History teaches that wars begin when governments believe the price of aggression is cheap.” - Reagan

Mentions

See All

Sahil Bloom @SahilBloom

·

Mar 4, 2022

This was a great one.