Thread

$BTC at 35k

How did we get here and what possibly comes next?

A thread on macro, bitcoin on-chain and derivatives 👇👇

How did we get here and what possibly comes next?

A thread on macro, bitcoin on-chain and derivatives 👇👇

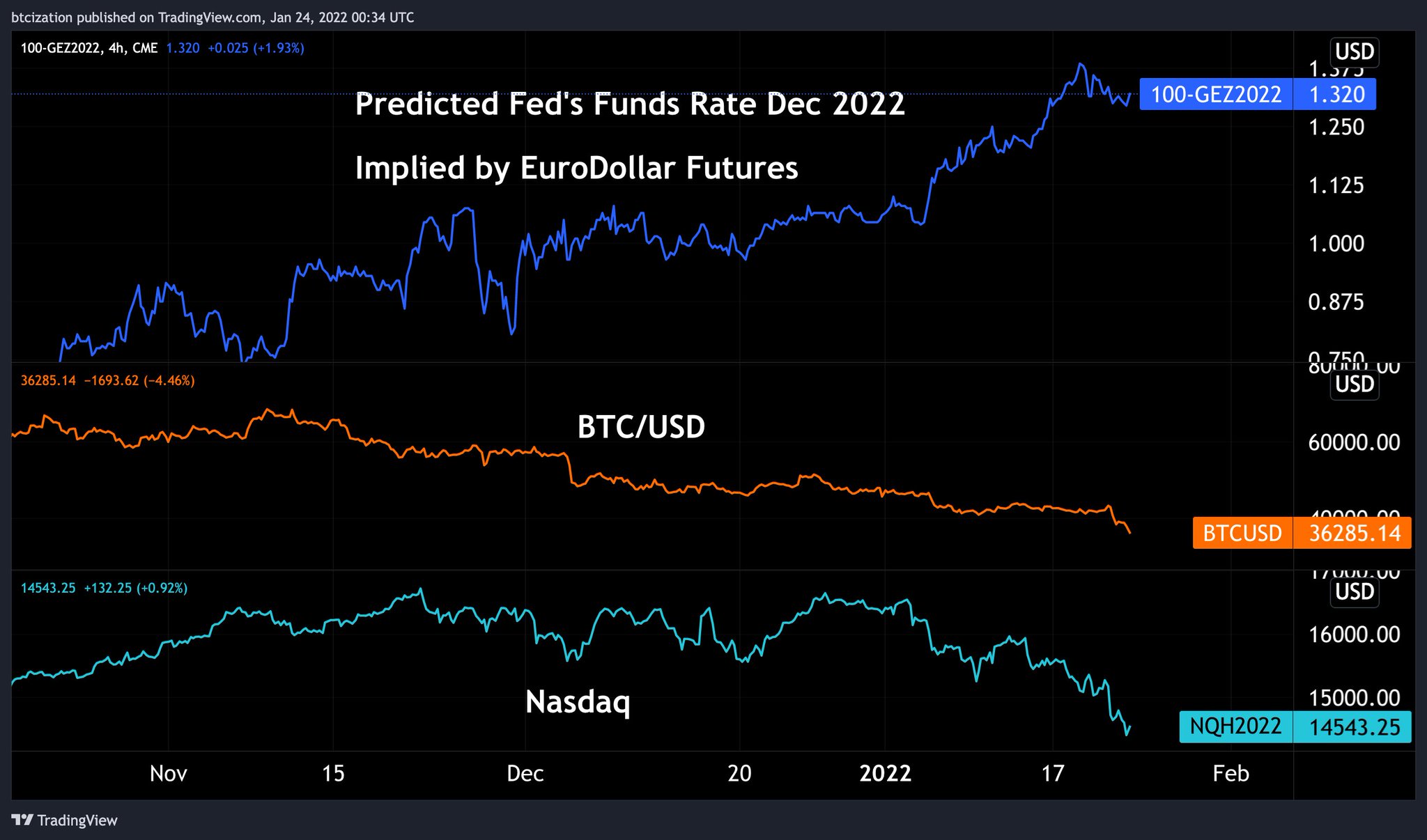

Talk of the town has been the recent $BTC correlation to the Nasdaq (and other types of risk assets).

Currently the Nasdaq is 14% off the highest and the most oversold its been since March 2020. The breakdown has been sharp.

$BTC - $NDX 30 day correlation at 0.80

1/

Currently the Nasdaq is 14% off the highest and the most oversold its been since March 2020. The breakdown has been sharp.

$BTC - $NDX 30 day correlation at 0.80

1/

Eurodollar futures, a market for the expected Feds funds rate is now pricing in 4 rate hikes by December of 2022.

When easy money monetary policy is expected to tighten, markets react.

2/

When easy money monetary policy is expected to tighten, markets react.

2/

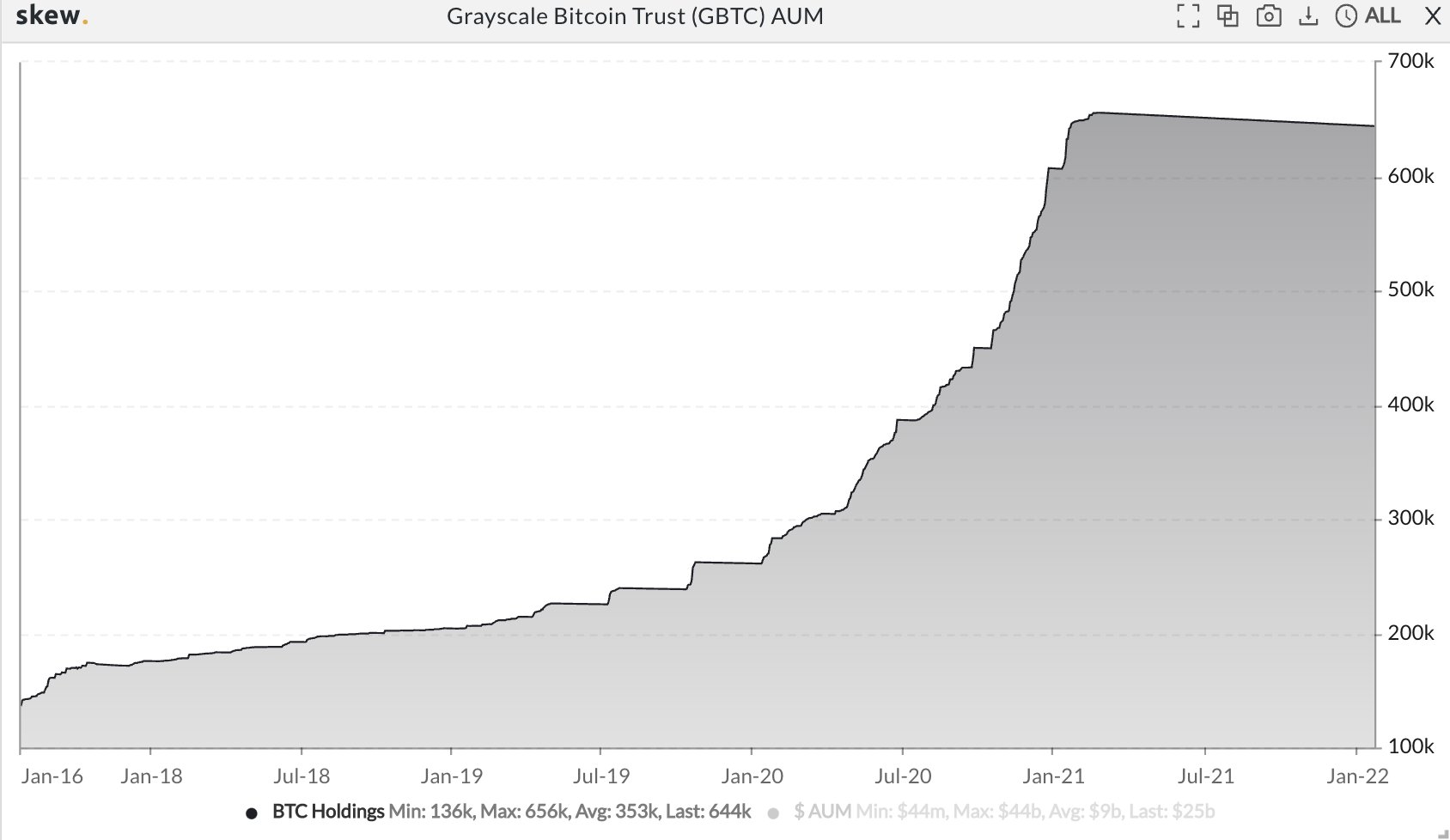

Increasing adoption by macro funds in 2020-21 has $BTC acting increasingly like a correlated risk on asset.

We can look to Grayscale, a driving force early in the bull run, whom scooped up 400k BTC in return for $GBTC shares on behalf of accredited investors and institutions

3/

We can look to Grayscale, a driving force early in the bull run, whom scooped up 400k BTC in return for $GBTC shares on behalf of accredited investors and institutions

3/

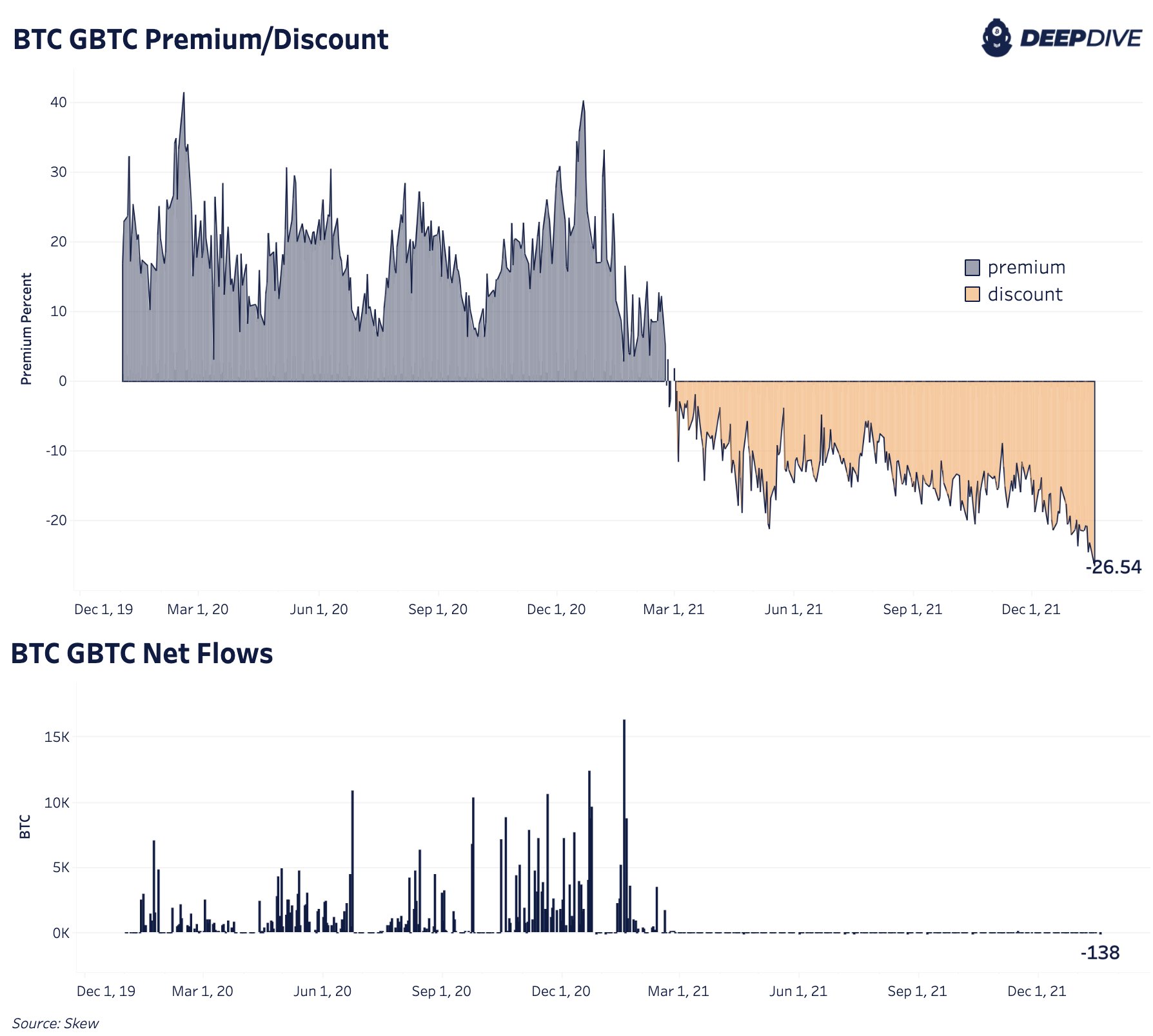

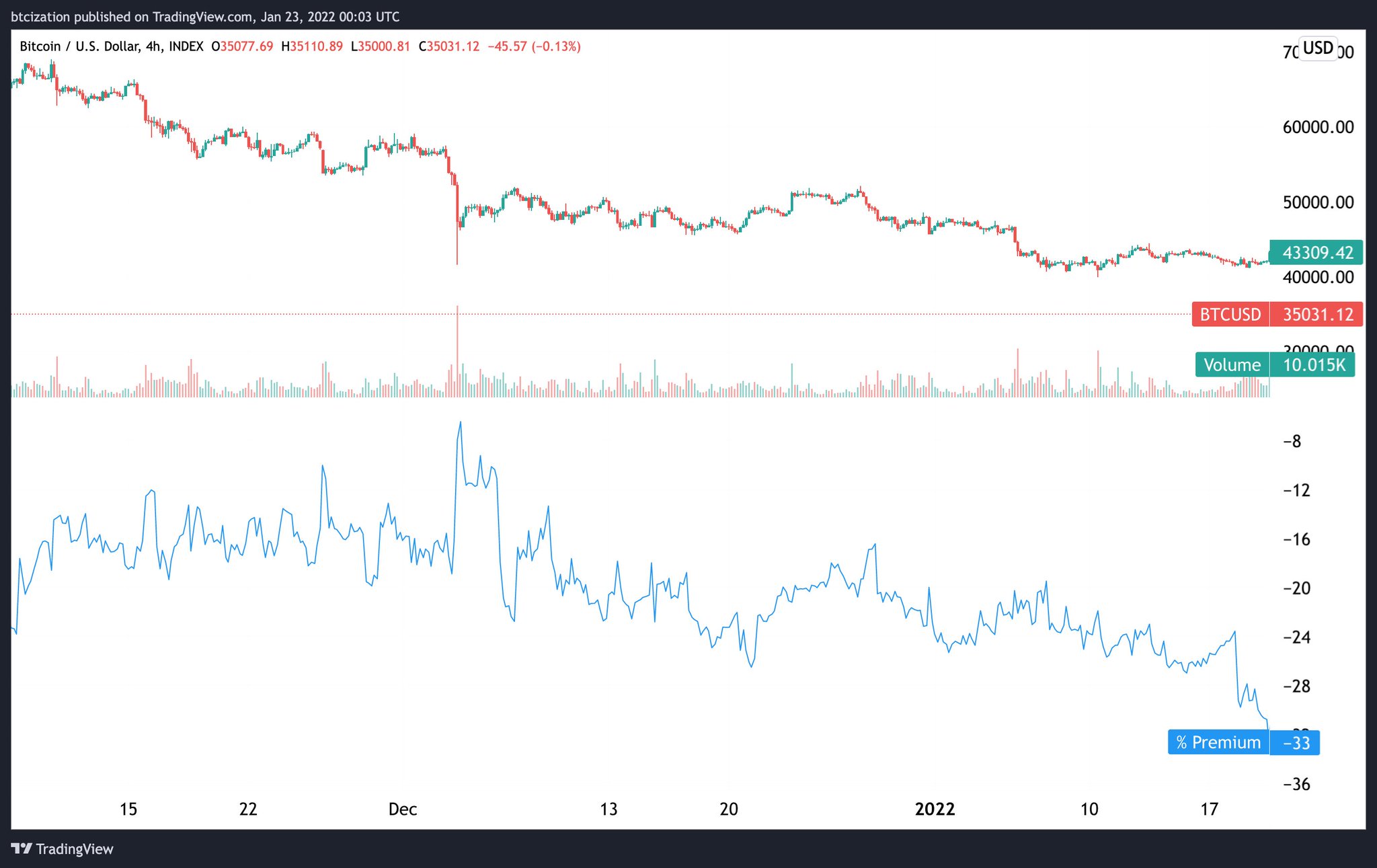

Investors looking to arbitrage the "risk free" trade (with a 6-month lockup) of acquiring $GBTC shares at NAV from Grayscale and marking their books with the premium came to realize the arb was broken when shares began trading at a discount to NAV in February.

4/

4/

However it's important to remember, the 650k worth of BTC still exist & trade as a derivative in the form of $GBTC shares in OTC markets

As the premium turned to a discount, inflows stopped and an incentive for investor to allocate to $GBTC rather than $BTC itself emerged.

5/

As the premium turned to a discount, inflows stopped and an incentive for investor to allocate to $GBTC rather than $BTC itself emerged.

5/

Indiscriminate selling of $GBTC took place recently as markets went risk off, and the $GBTC discount to NAV widened to new all time lows, which makes sense given the profile of many holders of the trust:

The same macro investors who began allocating to $BTC in 2020-2021.

6/

The same macro investors who began allocating to $BTC in 2020-2021.

6/

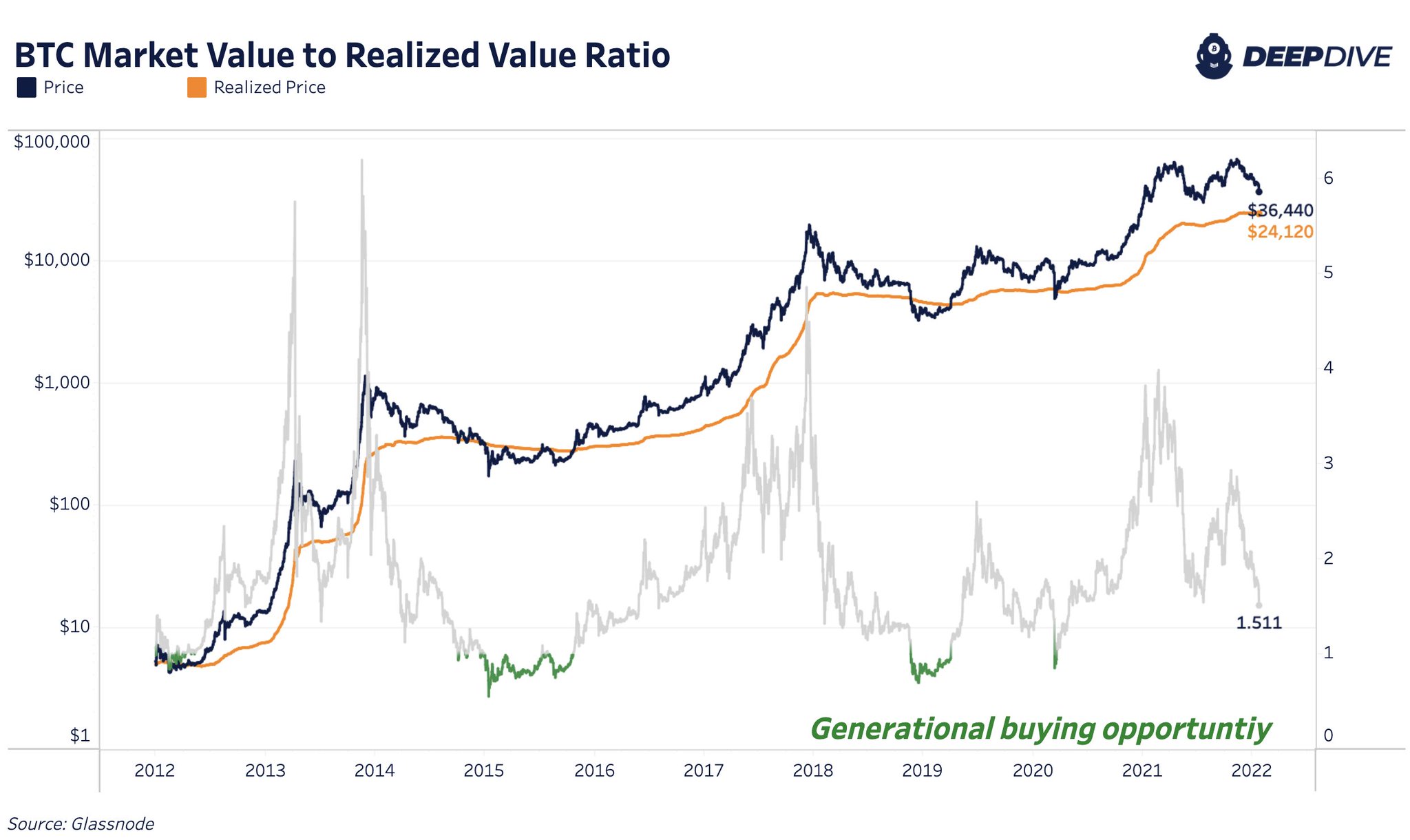

Now let's look at where is $BTC trading relative to historical valuations.

Currently the network's on-chain cost basis is 24k.

A ratio of the cost basis & price; the MVRV ratio, shows the historical boom/bust cycles of bitcoin.

Currently MVRV is ~1.5.

7/

Currently the network's on-chain cost basis is 24k.

A ratio of the cost basis & price; the MVRV ratio, shows the historical boom/bust cycles of bitcoin.

Currently MVRV is ~1.5.

7/

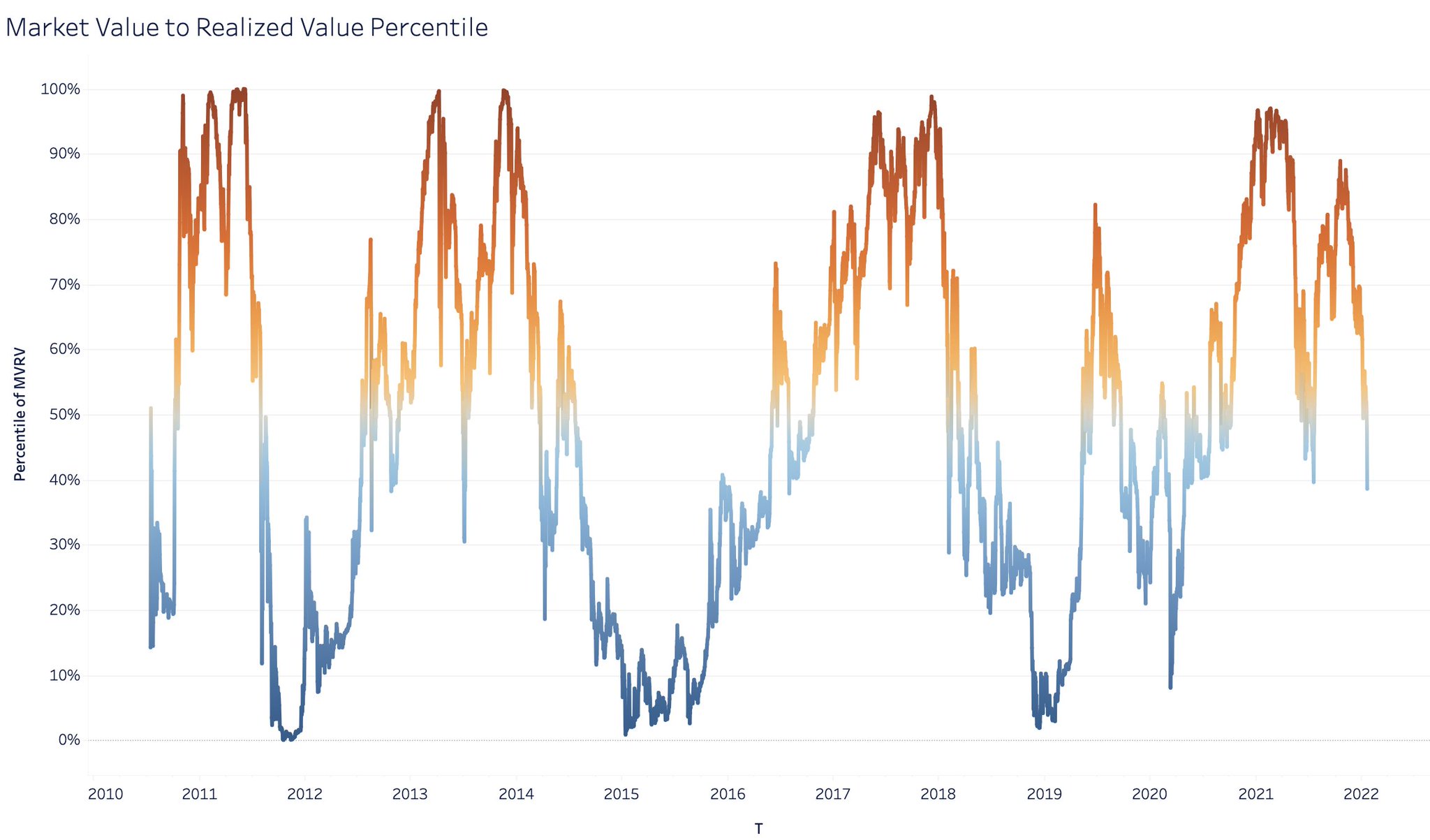

The current MVRV ratio is in the 38th percentile of historical readings.

In the past $BTC dips below realized price (MVRV below 1.0) have served as generational buying opportunities.

It's anyones guess if we get to 24k, but it would certainly be extremely attractive to buy.

8/

In the past $BTC dips below realized price (MVRV below 1.0) have served as generational buying opportunities.

It's anyones guess if we get to 24k, but it would certainly be extremely attractive to buy.

8/

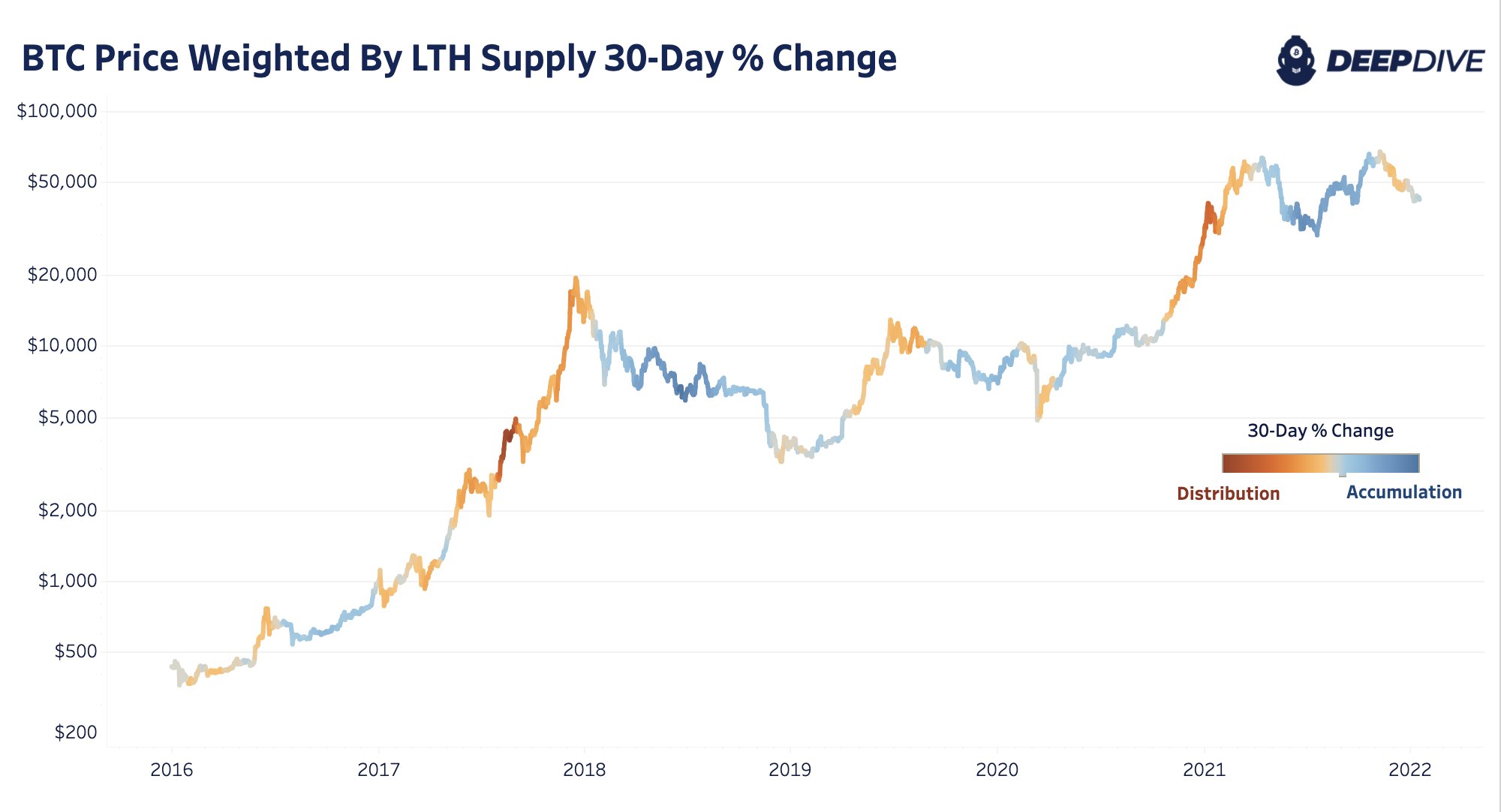

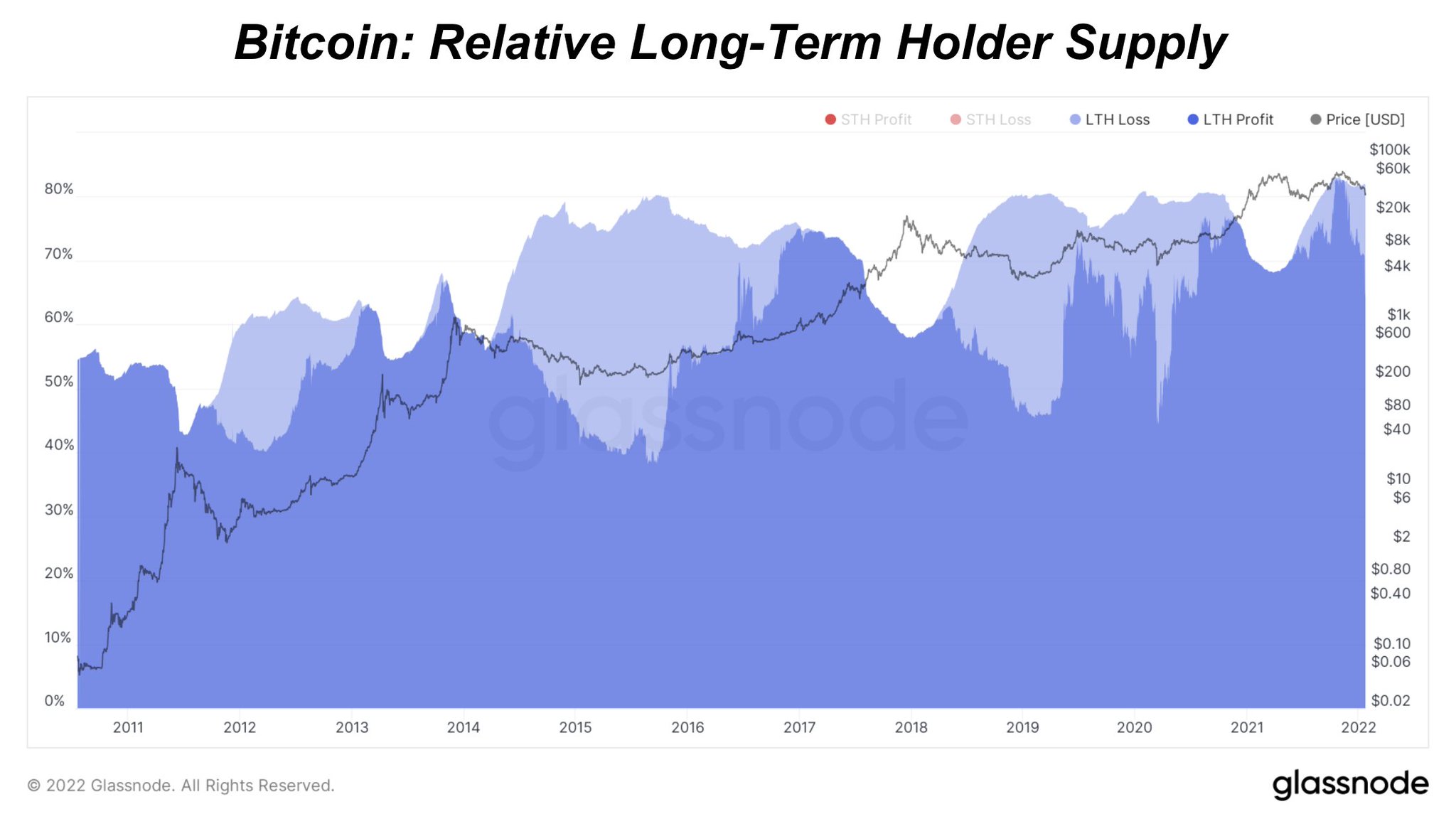

We also saw long-term holders distribute over the past couple months of downtrend, which historically is an oddity.

LTHs typically accumulate during bears & consolidation periods and distribute during uptrends; Macro fears played a role.

Accumulation is now starting again.

9/

LTHs typically accumulate during bears & consolidation periods and distribute during uptrends; Macro fears played a role.

Accumulation is now starting again.

9/

Coin days destroyed is calculated by taking the number of coins in a transaction & multiplying it by the number of days it has been since those coins were last spent.

A 90 day rolling aggregate of CDD shows relative accumulation/distribution. Currently strong accumulation.

10/

A 90 day rolling aggregate of CDD shows relative accumulation/distribution. Currently strong accumulation.

10/

How about $BTC derivatives?

There's a few things to pay attention to:

- Perpetual futures

- Quarterlies

- Collateral type used to enter deriv contracts

11/

There's a few things to pay attention to:

- Perpetual futures

- Quarterlies

- Collateral type used to enter deriv contracts

11/

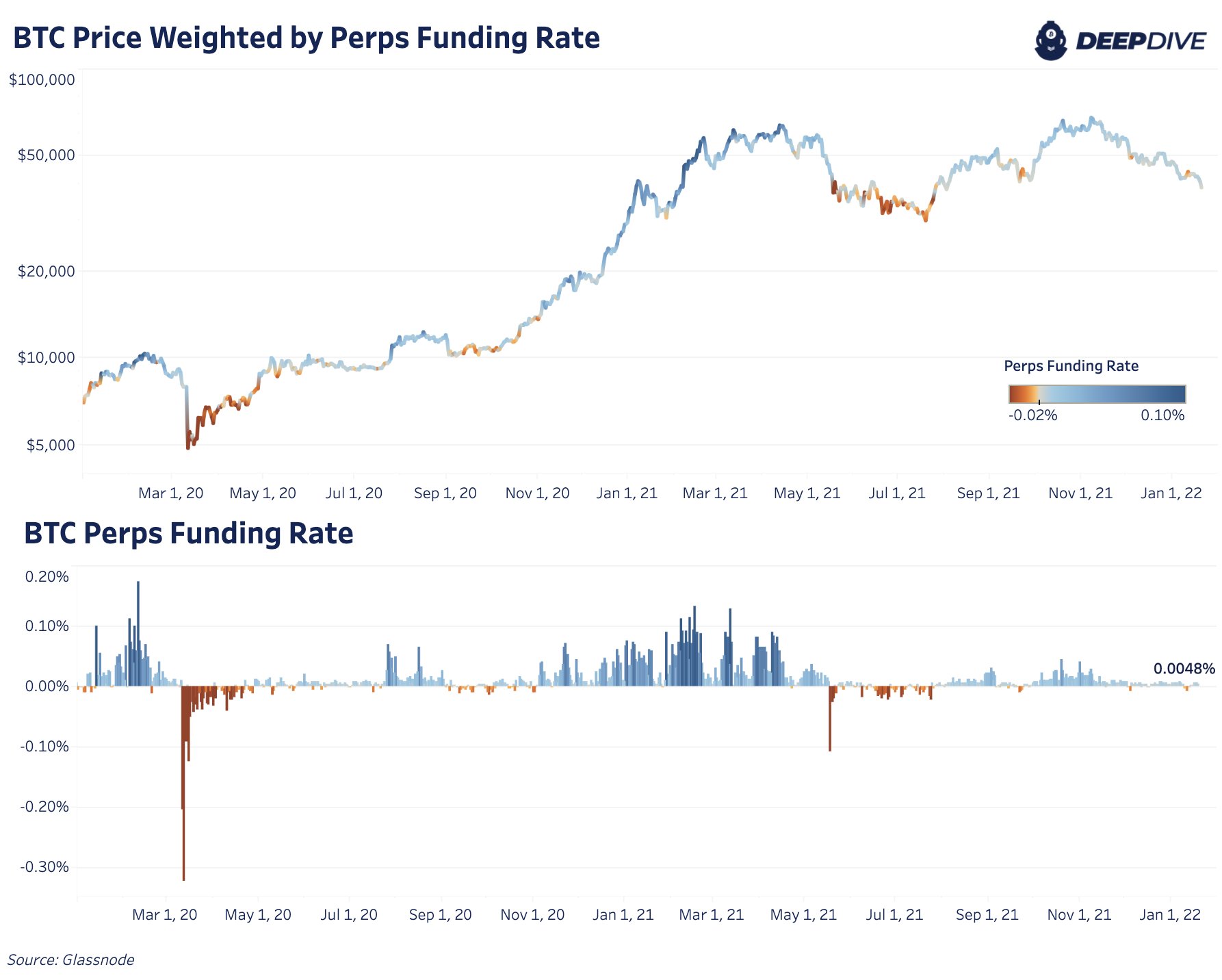

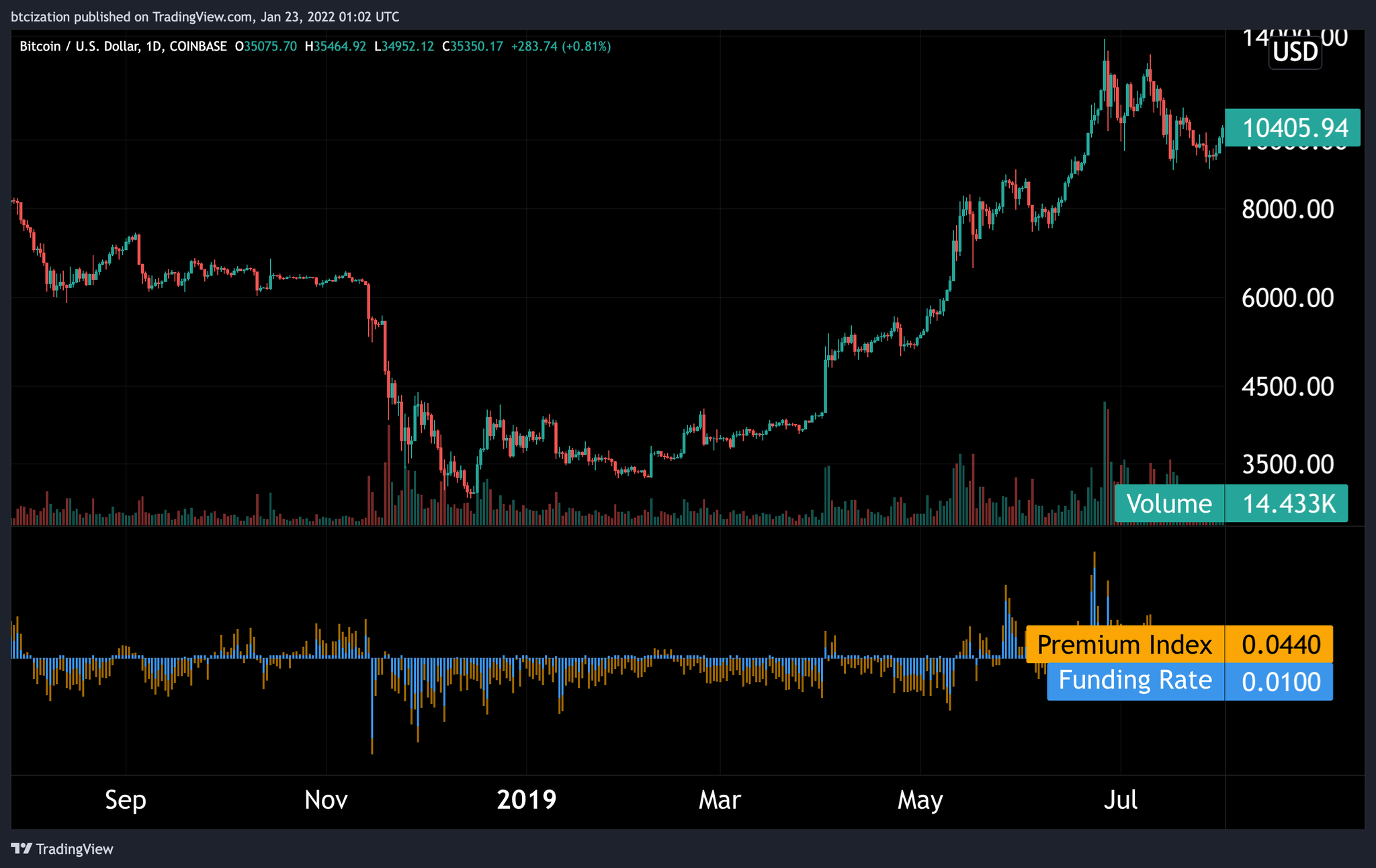

Perp futures funding displays whether derivatives are ahead/below the price of spot $BTC.

Speculative bulls no longer dominate, but bears aren't being over aggressive either.

Bottoms are often characterized by persistently negative funding; deriv bears get overly greedy.

12/

Speculative bulls no longer dominate, but bears aren't being over aggressive either.

Bottoms are often characterized by persistently negative funding; deriv bears get overly greedy.

12/

For instance, here is the bottom of the 2018-19 market, when bears found themselves aggressively shorting the 3k bottom following an 85% drawdown

This is data from BitMEX, which was the dominant deriv exchange at the time

Similar story after the COVID crash & this summer

13/

This is data from BitMEX, which was the dominant deriv exchange at the time

Similar story after the COVID crash & this summer

13/

In terms of quarterlies, the correlation between price & futures basis has been near 1:1 since this summer

The takeaway is that incumbents trading derivs have been driving the market.

0% or negative basis should signal market capitulation.

14/

The takeaway is that incumbents trading derivs have been driving the market.

0% or negative basis should signal market capitulation.

14/

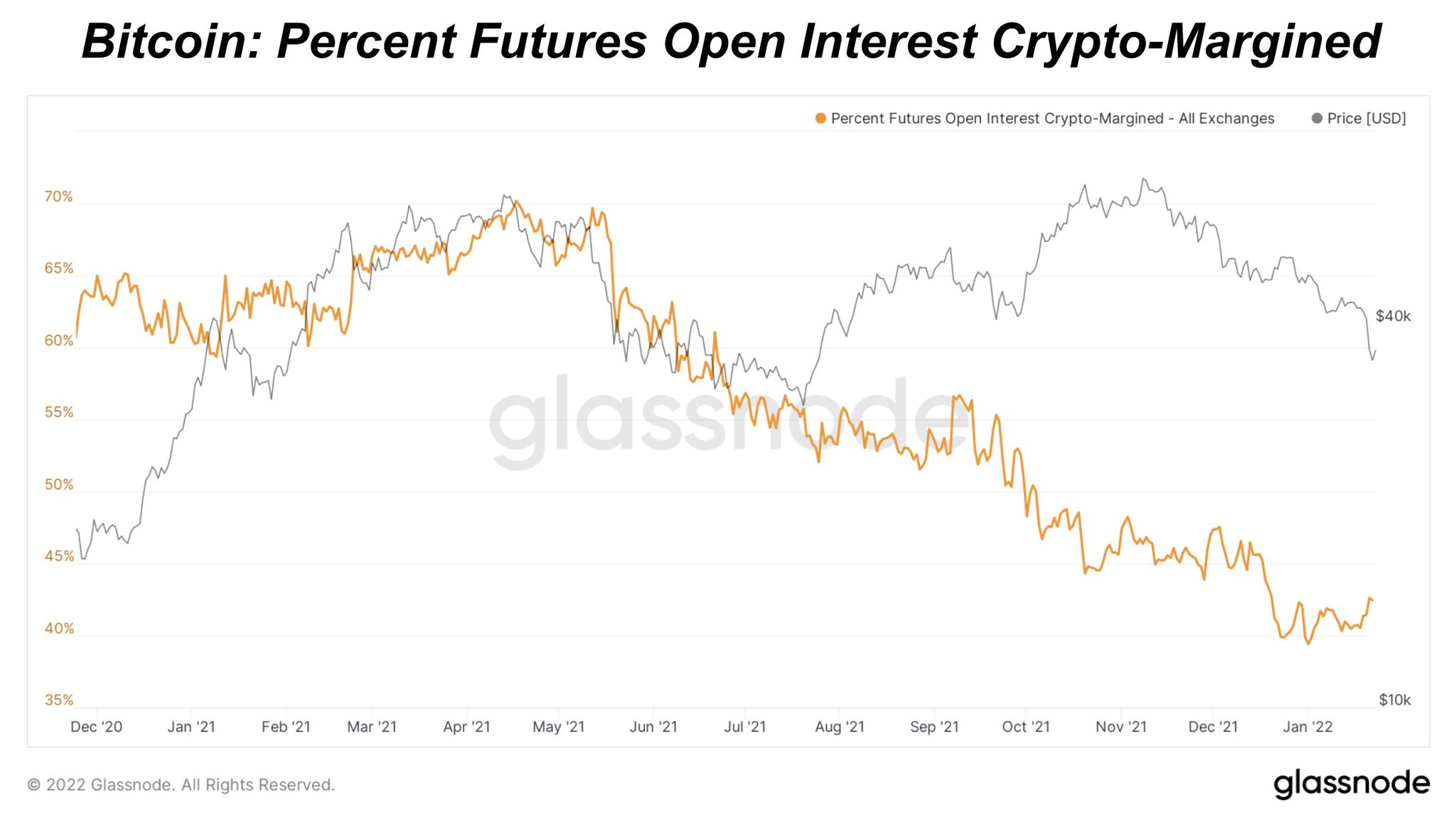

Crypto collateral use for $BTC futures continues its secular decline, a positive development as stablecoins don't have the convex relationship that BTC margined futures have during a market downturn.

15/

15/

The $DXY, a measure of dollar value against other fiat currencies has been in an uptrend since early 2021.

It'll be key to watch for dollar strength as the Fed *attempts* to tighten.

A rapidly strengthening dollar is a wrecking ball for all assets (see March 2020)

16/

It'll be key to watch for dollar strength as the Fed *attempts* to tighten.

A rapidly strengthening dollar is a wrecking ball for all assets (see March 2020)

16/

In terms of when the bull market returns, the conditions are still quite ripe, with ~81% of supply in the hands of long-term holders, but supply is only one side of the equation.

Strong spot demand (not derivative speculation) is needed for the bull market to resume.

17/

Strong spot demand (not derivative speculation) is needed for the bull market to resume.

17/

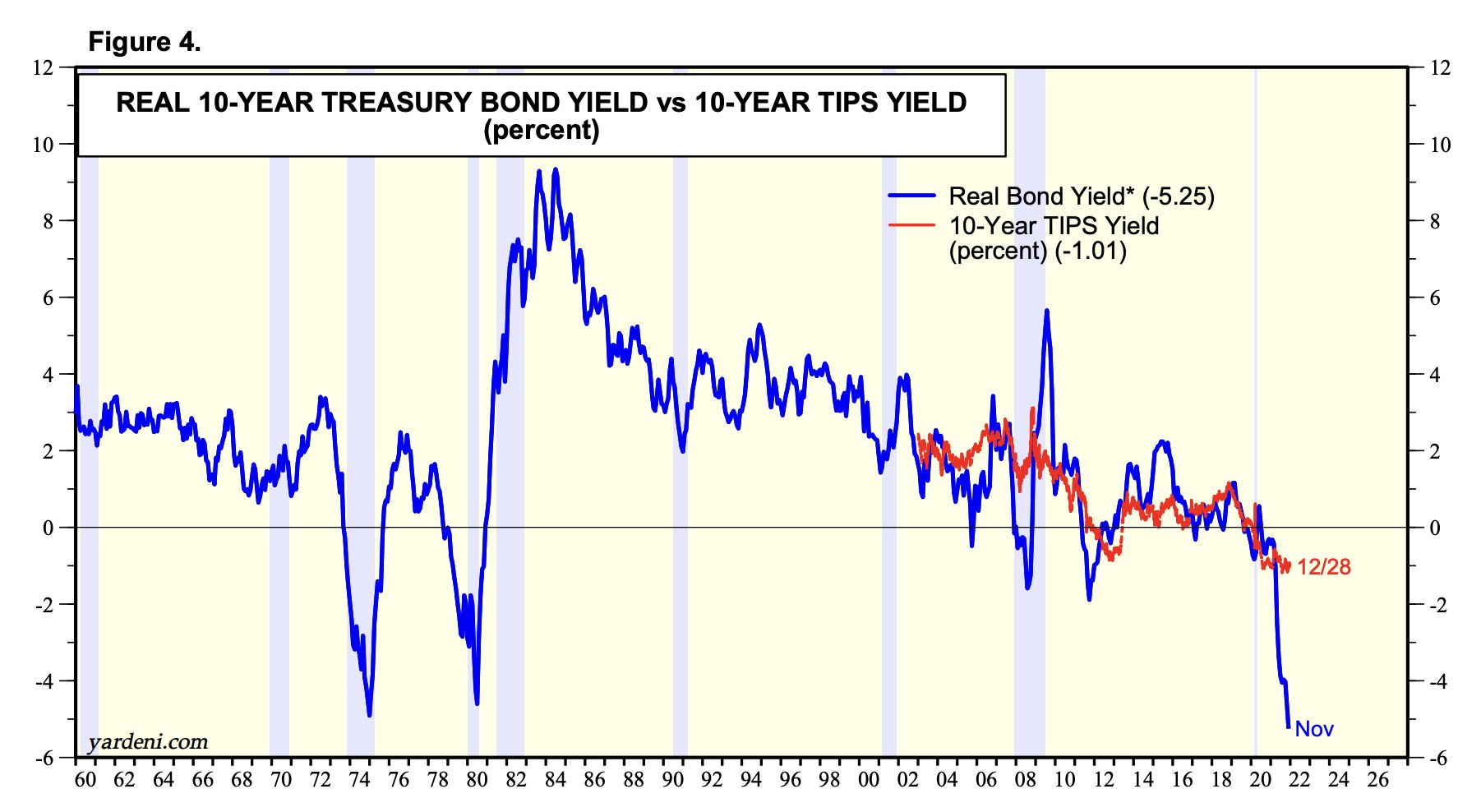

Question is, when does marginal selling by macro funds turn into marginal buying?

The reality is there are a few hundred trillion worth of bonds w/ negative real yields - contracts guaranteed to lose $

When, not if, the Fed reverses course on tightening, expect $BTC to fly

18/

The reality is there are a few hundred trillion worth of bonds w/ negative real yields - contracts guaranteed to lose $

When, not if, the Fed reverses course on tightening, expect $BTC to fly

18/

The economic endgame is binary this deep into the long-term debt cycle.

During a true deflationary scenario, infinite counter-party risk is present as fiat debt unwinds across the entire economic system.

19/

During a true deflationary scenario, infinite counter-party risk is present as fiat debt unwinds across the entire economic system.

19/

Is more downside to come? Maybe, especially if equities continue to tank & contagion hits credit markets

If you were a leveraged gold holder in Weimar you would've been wiped out multiple times over

Is the U.S. Weimar? No, but there's a lesson there

20/

If you were a leveraged gold holder in Weimar you would've been wiped out multiple times over

Is the U.S. Weimar? No, but there's a lesson there

20/

Your goal as a capital allocator is to maintain and grow your purchasing power across time.

The mechanics of $BTC make it all but a guarantee that the marginal production cost is going to continue to rise, forever.

21/

The mechanics of $BTC make it all but a guarantee that the marginal production cost is going to continue to rise, forever.

21/

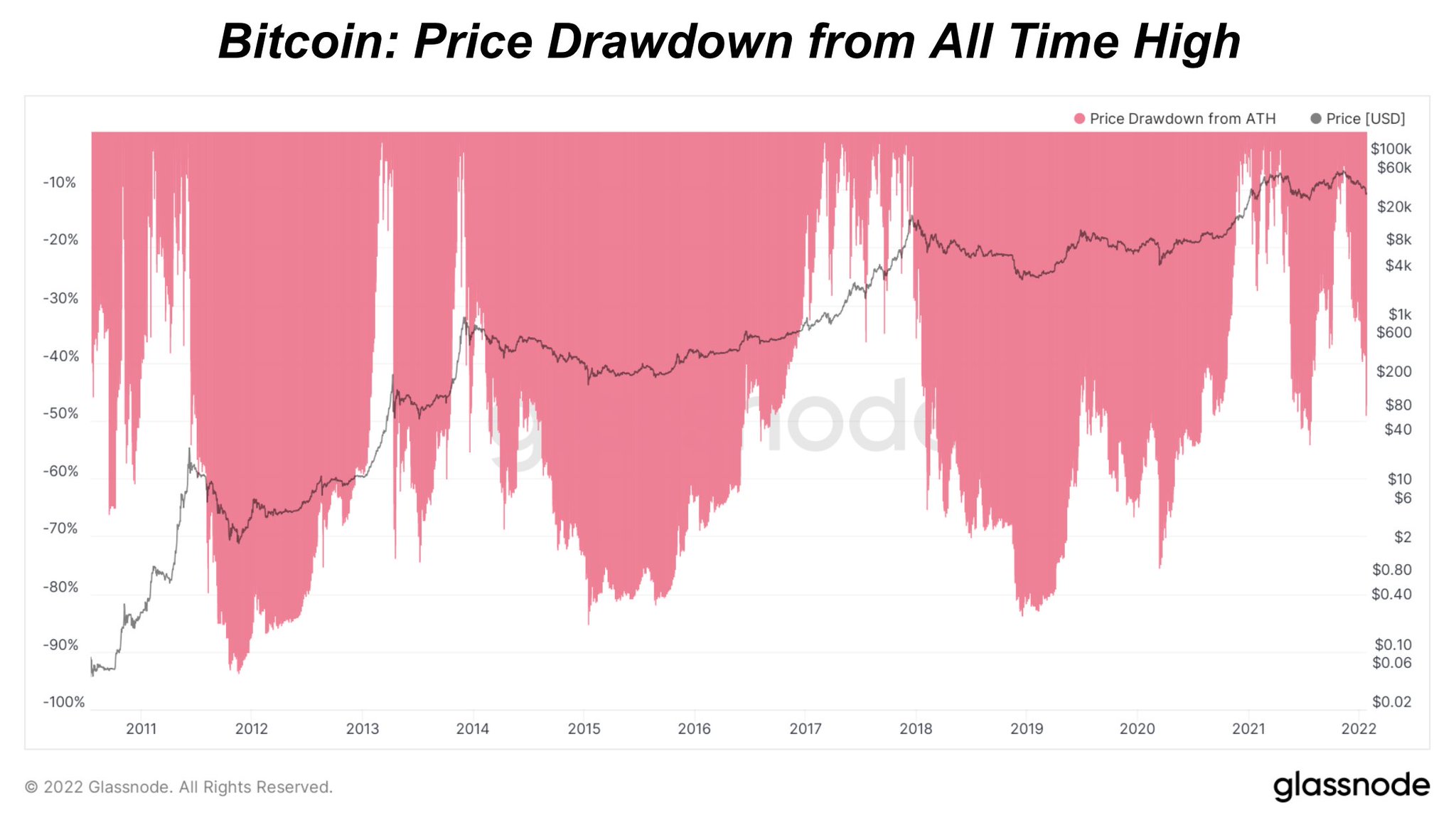

And lastly, the optimal strategy for 95%+ of people is to passively allocate to $BTC and simply sit on their hands.

Volatility is your opportunity, and thankfully it doesn't look like its going away anytime soon.

22/

Volatility is your opportunity, and thankfully it doesn't look like its going away anytime soon.

22/

If you found any of this insight valuable consider giving The Deep Dive and subscribing.

Try it out for free and see how it goes :)

END/ deepdivebtc.substack.com/welcome

Try it out for free and see how it goes :)

END/ deepdivebtc.substack.com/welcome

Mentions

See All

Anthony Pompliano @AnthonyPompliano

·

Jan 24, 2022

Take the time to read this 👇🏼