Thread

1/10 The USG response has likely stemmed contagion. However, $SIVB saga has effectively forced the mkt to price the entire Fed Funds rate into the funding cost of the regional banking system. An acceleration in lending contraction is here.

2/ $SIVB went to the market to raise capital on the heels of February deposits coming in below expectations. According to Barclays, deposits have fallen since the Fed started the hiking cycle in March 2022 — by about $860 billion across the banking sector.

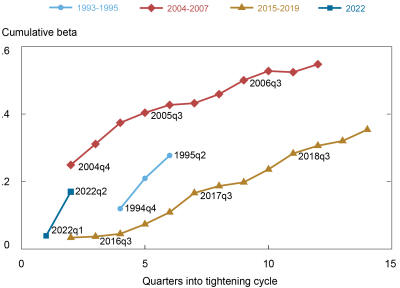

3/ The reason banks have been losing deposits has to do with a concept called “deposit beta”-> the relative increase/decrease in deposit rates vs. move in Fed Funds rate. Barclays estimates ~0.25x so far this cycle. Per NY Fed, this hiking cycle is off to a slow start:

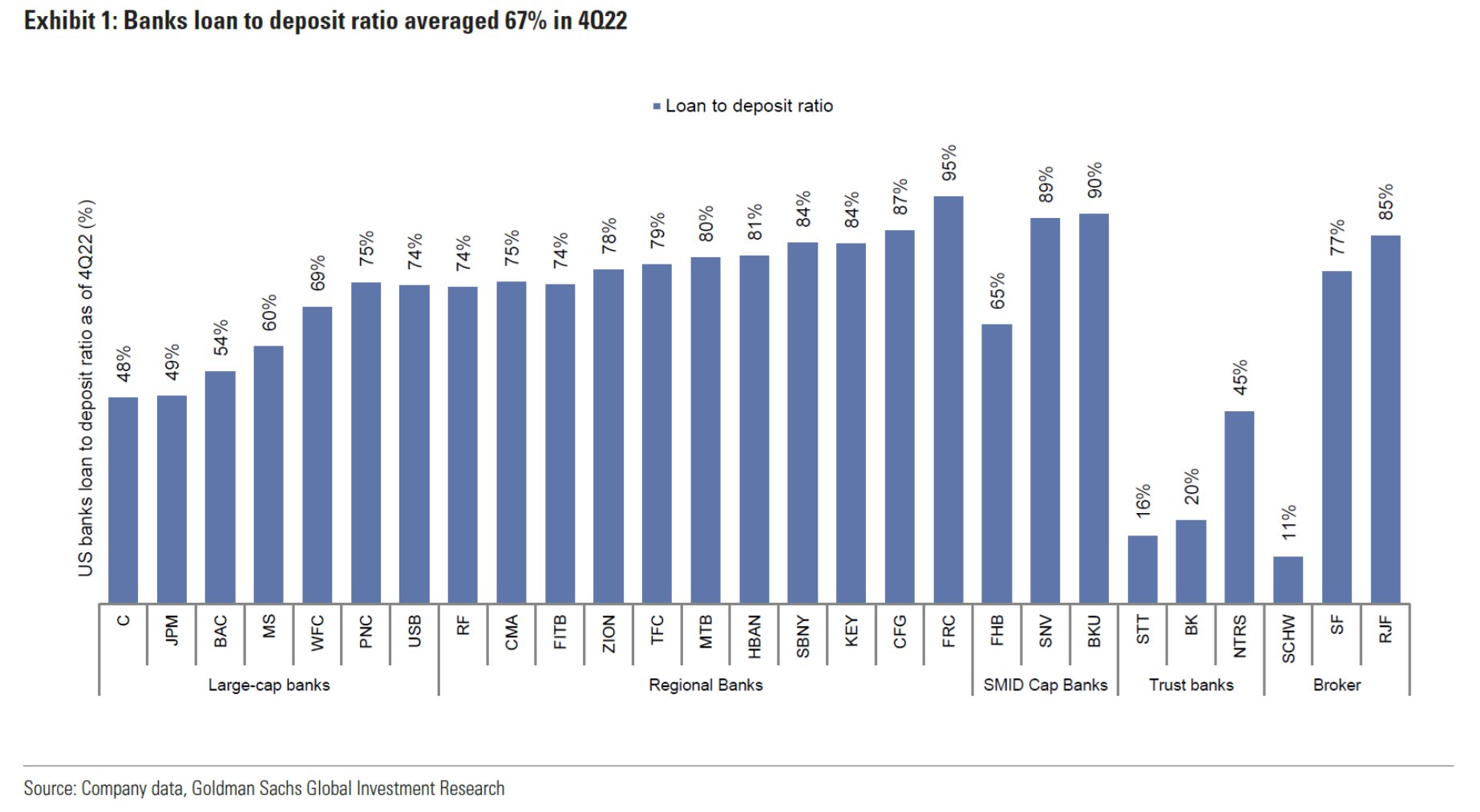

4/ Per S&P, loan to deposit ratios for the banks: 62% in Q3 2022; GS estimates ~67% in Q4 2022. Thus, the banks were refusing the raise deposit rates (because they didn’t really need the money). This in effect was stunting the ability of Fed policy to really slow the economy.

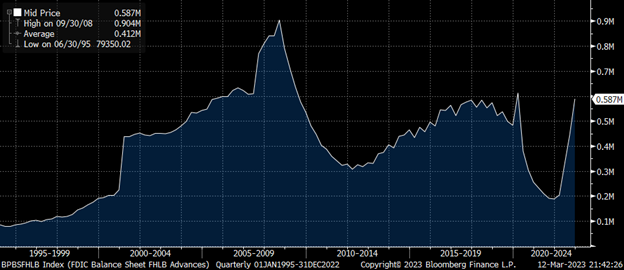

5/ Interestingly, in the background, banks have been accessing liquidity via the FHLB and doing so rather aggressively:

6/ The FHLB essentially allows banks to pledge mortgage collateral to receive shorter term funding. This is likely happening at the regional/community banks because those banks LTD ~80-100% range. The system level metrics are being brought down by the large money centers:

7/ The US Government is providing strong competition for savings via the UST market where the entire UST curve is effectively >4%. In effect, the UST mkt is “crowding out” the US banking system but it hadn't mattered till now.

8/The banking system starts borrowing as NIM is set to contract to help with liquidity in the shorter term. Banks can’t really afford to raise deposit rates and still make money lending long when the yield curve is flat/inverted.

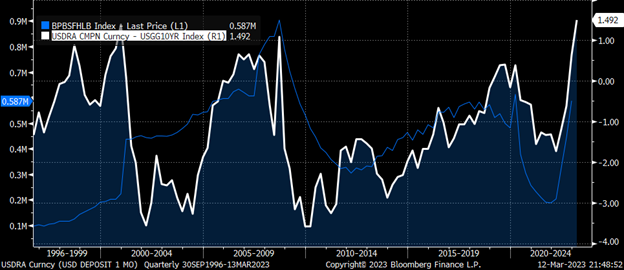

9/The chart below illustrates this point showing the correlation between FHLB borrowing and the spread between the US 10 year and 1m deposit rates at the banks. The borrowing from FHLB accelerates as the setup for NIM contracts and vice versa.

10/ It doesn’t matter if the Fed stops raising from here-> regionals really can’t make any money with these rate curves. This means they will be forced to curtail lending. SLOOS surveys already indicate this is underway.

If Fed start cutting, what happens to inflation outlook?

If Fed start cutting, what happens to inflation outlook?

Mentions

See All

Parik Patel @ParikPatelCFA

·

Mar 19, 2023

has good threads